When gathering competitive intelligence in a digital marketplace, website traffic is a key metric to prioritize. Knowledge about competitor and potential partners’ website traffic, digital marketing strategies driving traffic, and emerging trends can be game-changing assets for optimizing your digital performance and accelerating growth.

Semrush’s Traffic Analytics tool can offer a glimpse into any website’s desktop and mobile traffic numbers. In this article, we’ll explore the tool in depth and offer a number of use cases for conducting competitor analysis, identifying potential partners, and understanding your market as a whole.

Can I Really See Competitor Website Traffic with Semrush?

For your own traffic data, Google Analytics is the most comprehensive and accurate tool. But it can’t answer the question, “How much traffic does my competitor get?” For competitors, to compare website traffic, Google Analytics won’t do the trick.

For monitoring competitor website traffic, Traffic Analytics can get the job done. Unlike Google Analytics, which tracks web traffic internally, Semrush Traffic Analytics leverages clickstream data along with machine learning algorithms and Big Data technologies to estimate your rivals’ traffic.

It’s important to understand the difference between the two tools. For studying your own website’s traffic, Google Analytics is the way to go. To find competitor web traffic, however, Traffic Analytics is the best solution as it provides you high quality data regarding competitor traffic you can use for your competitive analysis.

Getting Started with Competitor Websites Traffic Analysis

When you look at data from the right angle, it begins to tell a story. A high bounce rate could suggest users aren’t finding what they’re looking for, or a competitor's referral traffic might speak to their success in forming partnerships.

Insights drawn from data about your competitors can help you outcompete them and earn more traffic. With the features highlighted below, you can:

Estimate audience size and growth Spot unusual traffic spikes and speculate causes Monitor competitor traffic and differentiate spikes from trends Understand the visitor’s experience on competitor websitesMeasure Competitor Website Traffic

Starting broad with your traffic intelligence gathering lays the foundation for more in depth research. Begin with the Traffic Analytics Overview Report to study traffic to competitor websites, and examine how those numbers have increased or decreased over time.

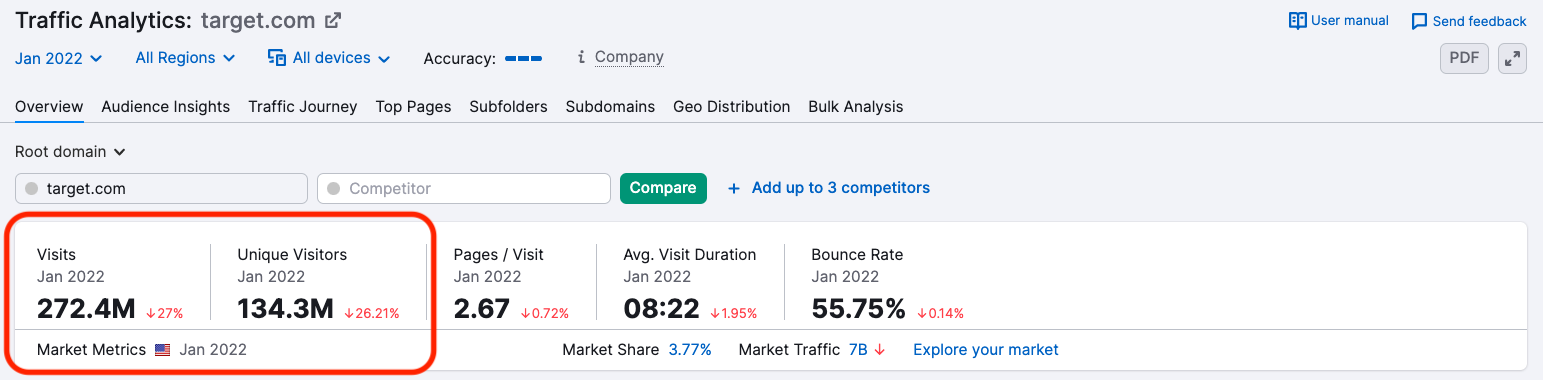

The two sections highlighted above show general traffic trends for Target.com during the month of January, 2022.

The first metric allows you to track competitor website visits and estimate the size of your competitor’s audience. The number of unique visitors for the month points to their growth. The percentages (in green or red) beside the figures show the percentage of growth month over month.

Examine Traffic Trends Across Time

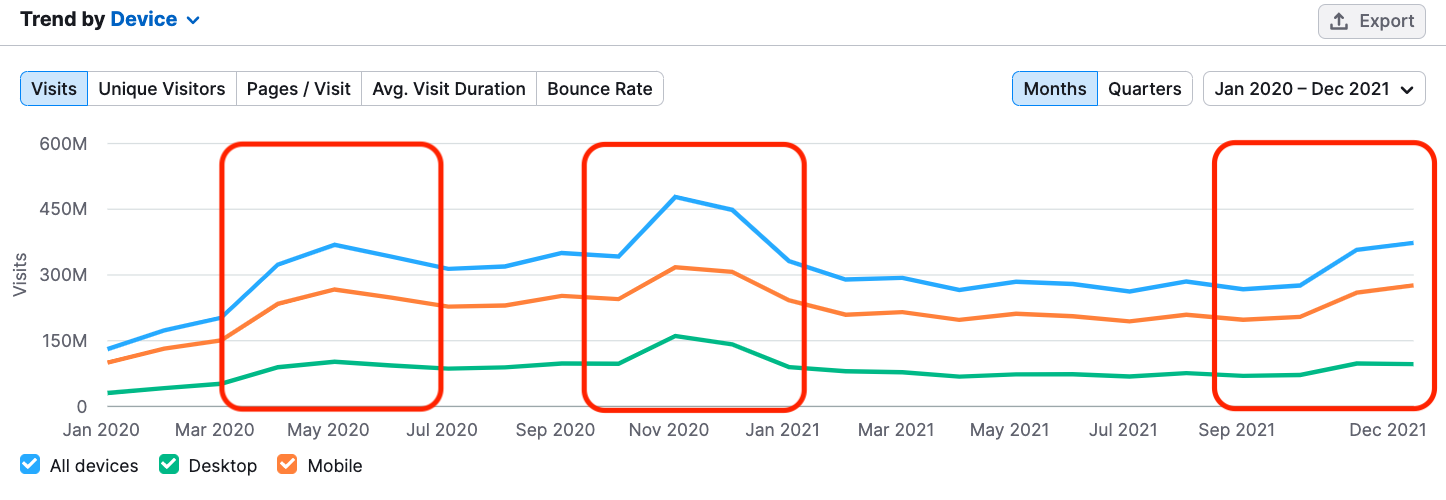

The Trend Graph depicts traffic data over time. With the graph below, we’re looking at visits from all devices to Target.Com over the last two years.

Each highlighted section shows an uptick in traffic. In thinking about these increases for the purposes of improving our own strategy, we might ask, “What caused them?”

For Target, the yearly spikes between October and December are likely due to holiday shopping. A seasonal trend, as opposed to an unusual circumstance.

The increase in February 2020, however, was likely due to the start of the Coronavirus pandemic. Interestingly, this seems to have caused a permanent shift in shopping behavior as the numbers have remained elevated.

Compare Customer Experience Between Websites

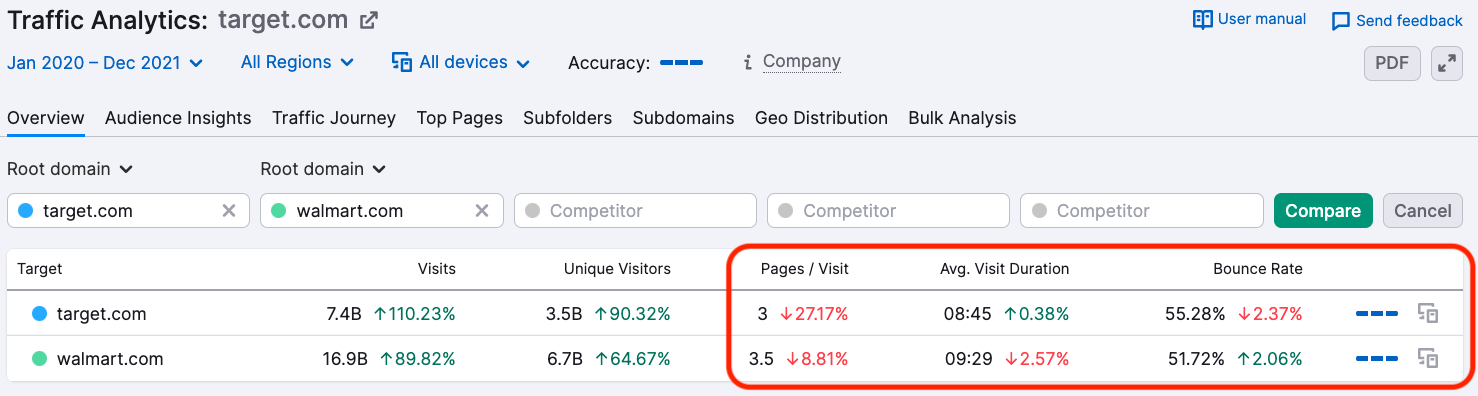

Wondering how to compare website traffic across organic competitors? Traffic Analytics allows you to view data for up to five websites side by side.

Though Walmart is the clear leader for visits over Target, the other metrics tell a slightly different story. In the last six months, Target bounce rate, suggesting customers are finding what they need.

Walmart, to the contrary, moved in the opposite direction. While their visits are rising, their bounce rates are getting worse. This could mean:

Users aren’t find the content interesting or helpful A promoted offer isn’t as good is it seems Traffic is coming from countries where the product or service isn’t availableBusinesses need to compete for website traffic, and metrics like bounce rate and visit duration can reveal who is winning when it comes to serving customers what they want. Using Semrush for bounce rate, page visit, and visit duration data and tracking their results over time could lead to interesting insights into the customer experience.

Find Competitor Traffic Sources and Marketing Strategies

To understand how competitors set their priorities and interact with audiences in terms of SEO, PPC, SMM, and Content and PR, you’ll need to dive deeper into the Traffic Analytics reports.

With the features highlighted below, you can:

Expand your analysis by unpacking competitor traffic generation strategies Track user journeys for a clearer picture of related sites and user needs Understand what sites send the most traffic to your competitors Pinpoint potential advertising venues based on user journeys Discover competitor paid and social media promo landing pages Analyze competitor sites and market trends with subdomains and subfoldersTrack User Journeys

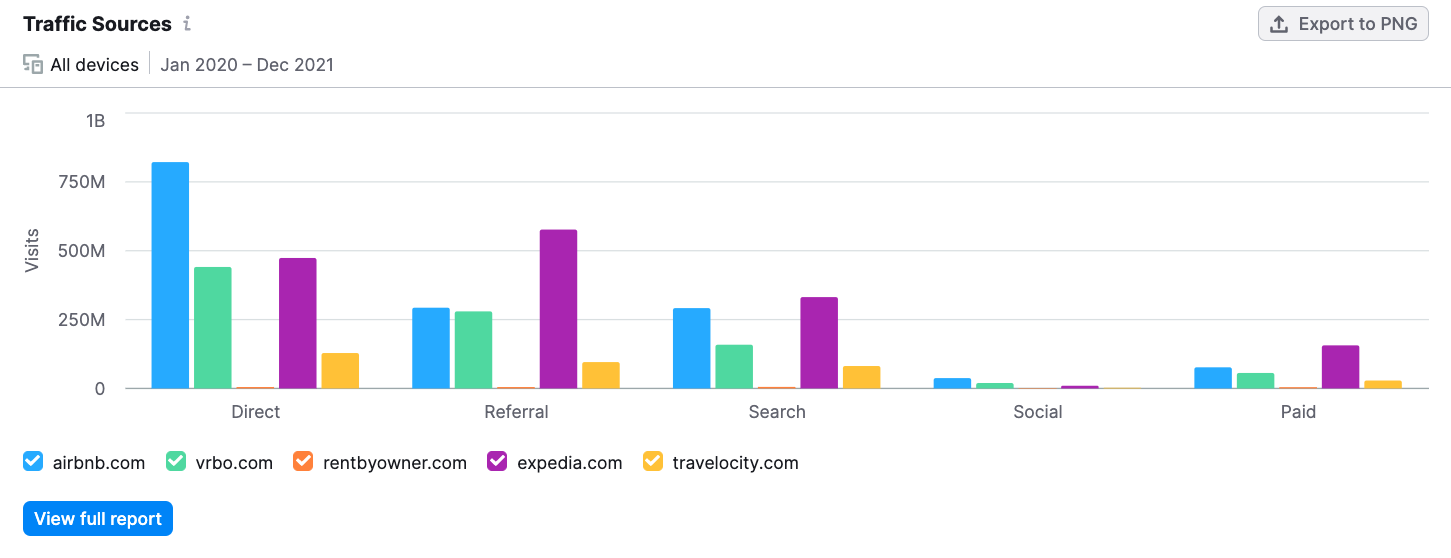

The Traffic Journey report reveals competitor traffic channels, what sites bring users to a rival’s site, and what sites users visit after leaving. This graph shows Airbnb and a number of competitor sites.

While Airbnb comes out on top for direct traffic, Expedia outpaces Airbnb by over 250M visitors for referral traffic and 50M when it comes to traffic from search engines. While these numbers suggest that the Airbnb brand is better known, Expedia is out marketing Airbnb when it comes to backlinks and organic search.

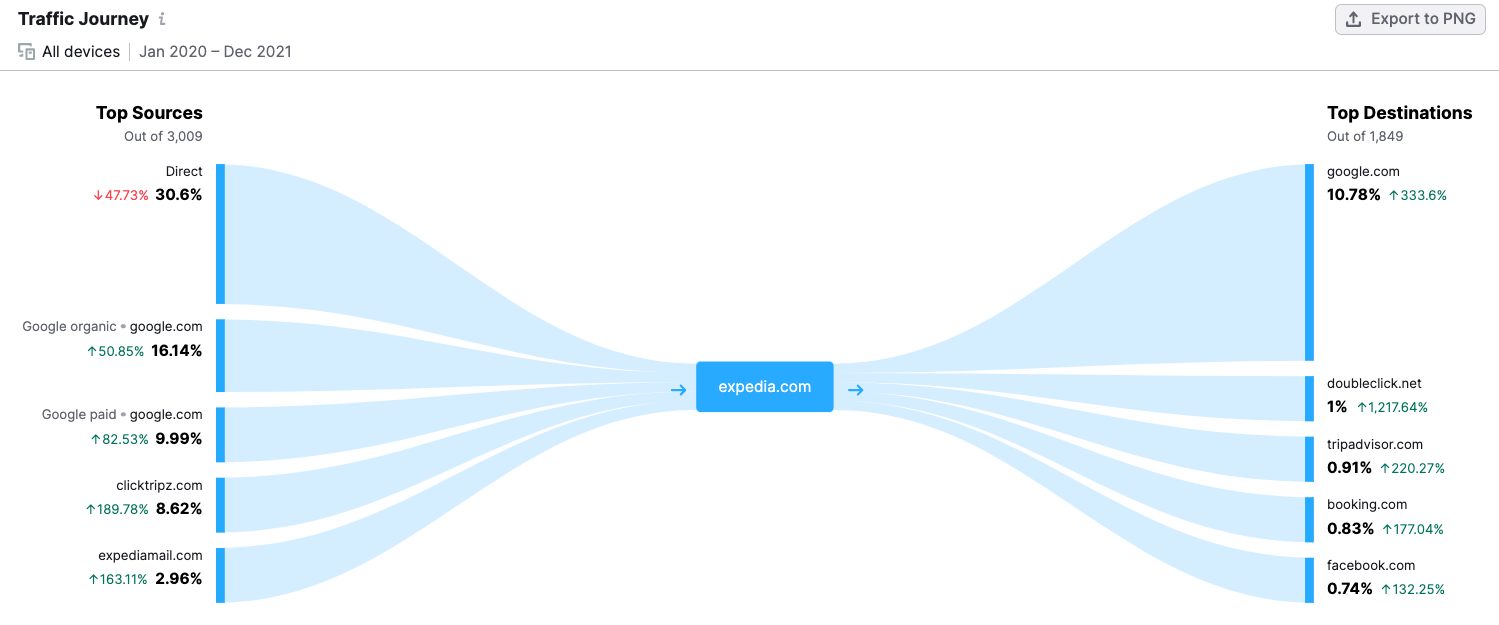

To understand the user journey, the Traffic Journey graph depicts where users come from and where they go after visiting our chosen websites.

While you can view 5 competitors on a single Traffic Journey chart, we simply looked to Expedia. We were curious after seeing their referral traffic and traffic from search results was so high.

As mentioned, their search volume and keyword rankings are strong, so it makes sense that traffic from Google would show up as a top source.

Almost 9% of their website traffic came from clicktripz.com, and that number doubled between October and November 2021. Downstream, Tripadvisor.com and Booking.com capture the most traffic, though this number remains below 1%, which is likely due to visitors comparing offers as opposed to a problem with Expedia’s platform.

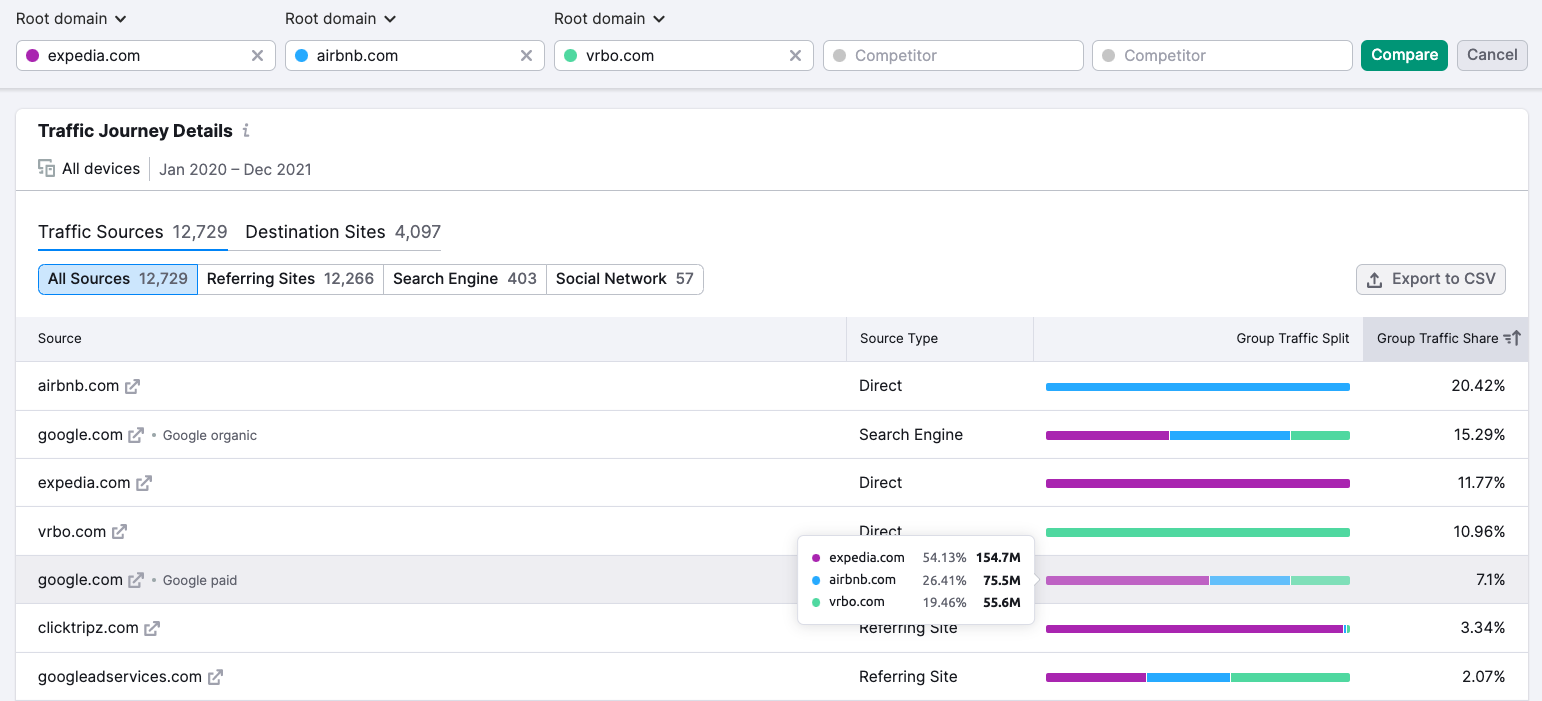

The traffic Journey Details portion of the report offers an even deeper look at traffic sources and destination sites.

The Group Traffic Split column uses Semrush website traffic data to depict a visual breakdown of the traffic share. Hovering over the colored bar allows you to see the exact visitor numbers and percentages sent to each site.

Explore Top Pages, Subdomains, and Subfolders

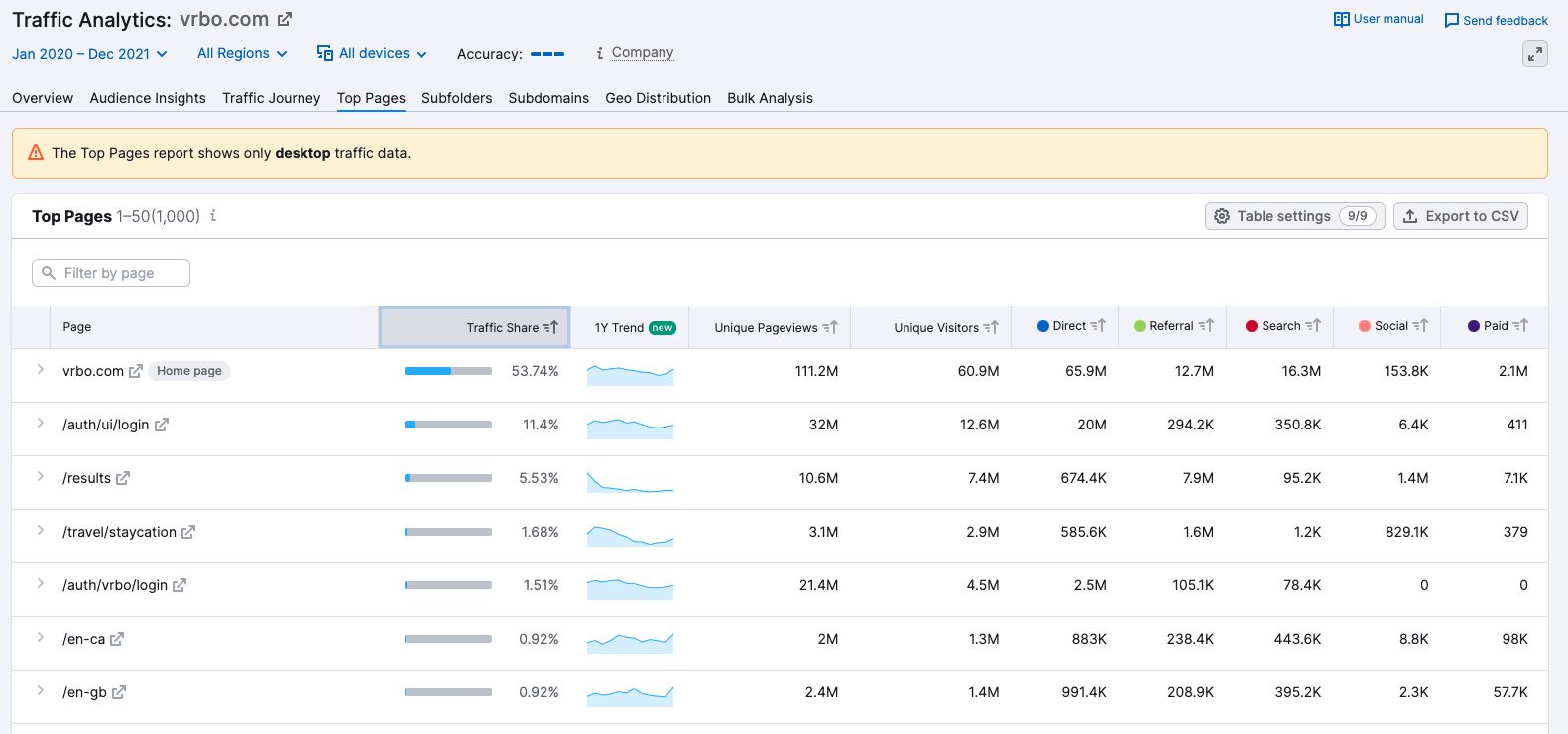

For detailed data focused on a rival website’s individual pages, subdomains, and subfolders, check out the Top Pages report. This report provides data for pageviews and unique visitors, metrics for traffic sources for each page, and a variety of sorting options.

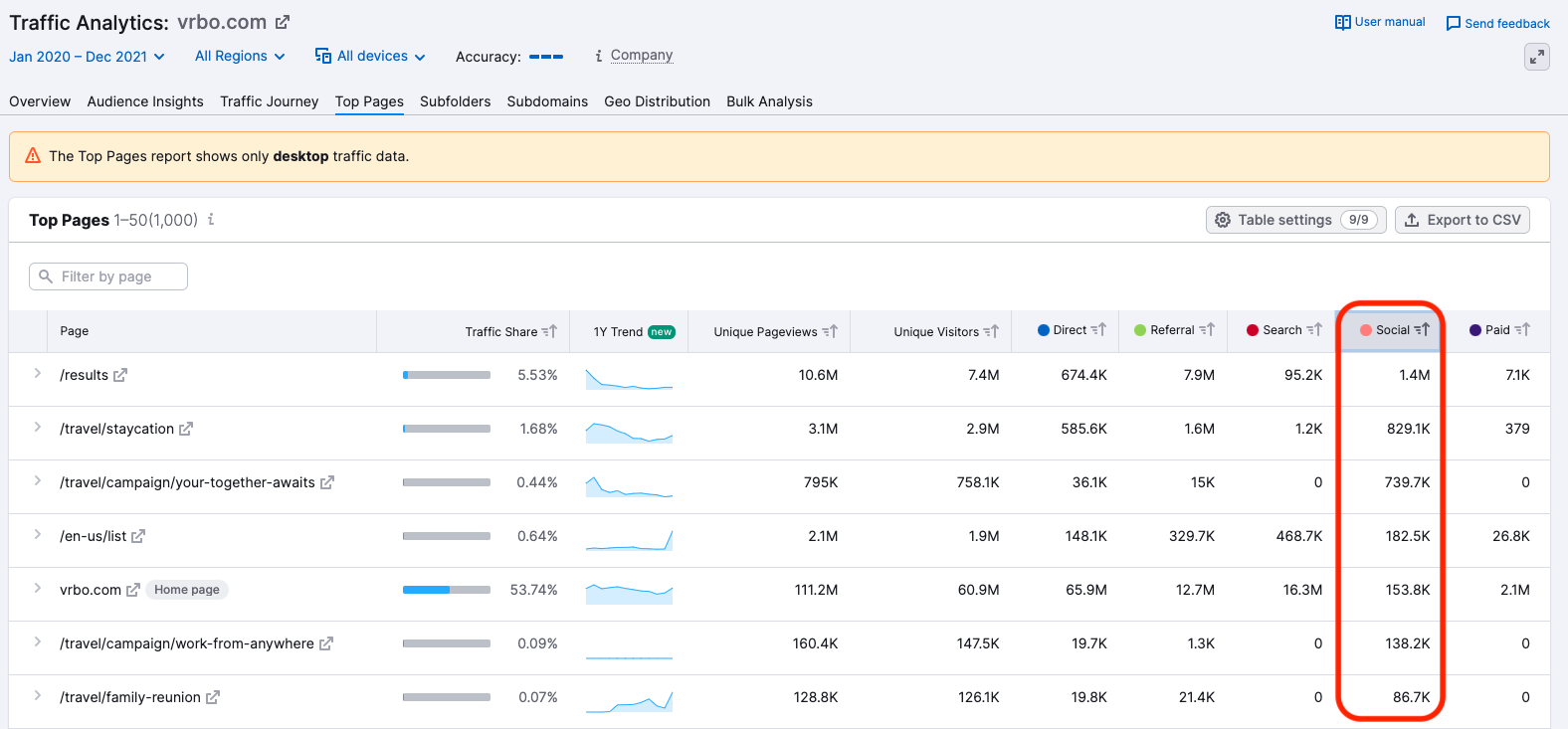

To search for specific pages, such as those being promoted on social media or with paid ads, filter according to the traffic source to bring those pages to the top.

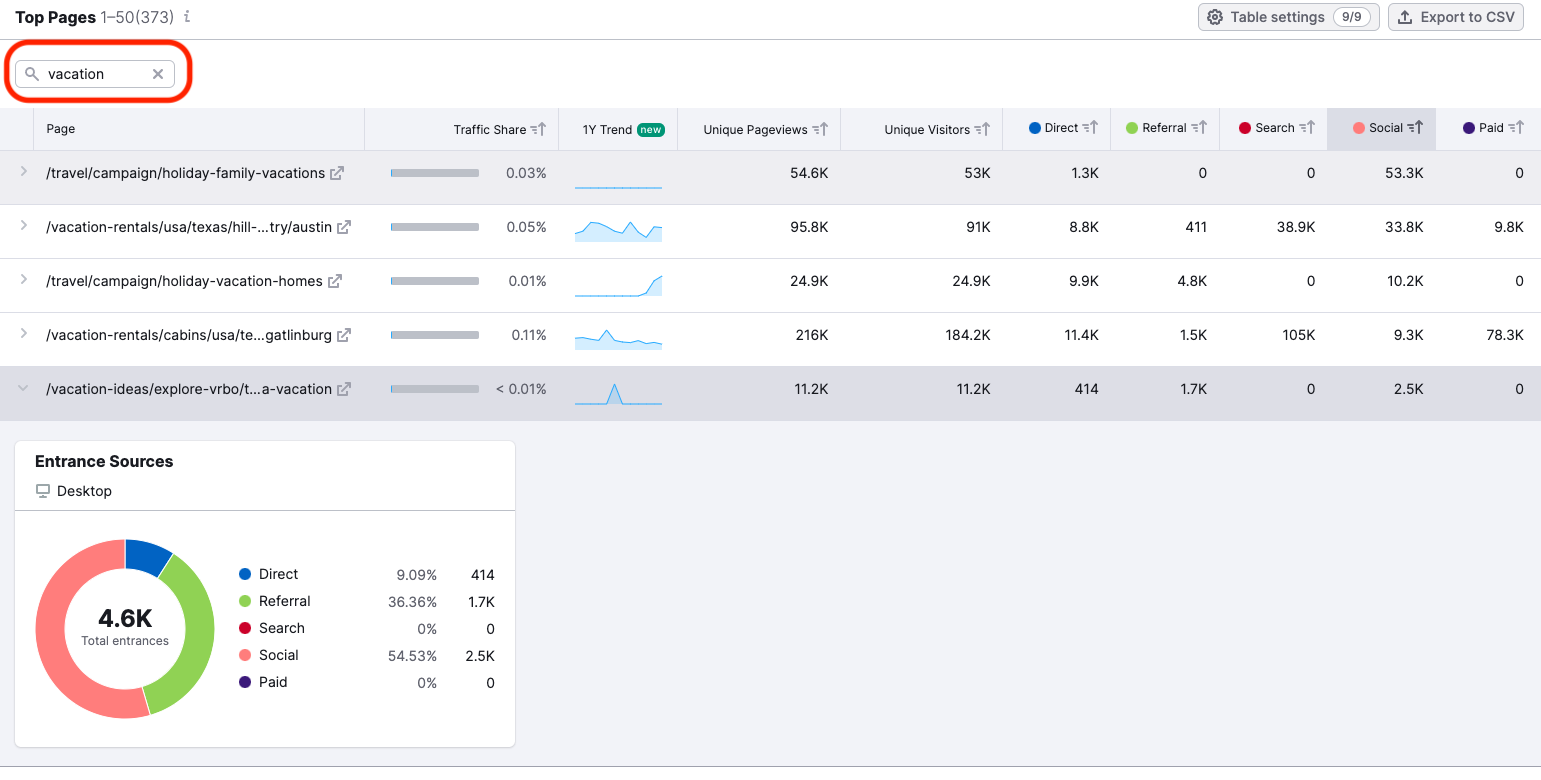

You can also filter by page and view the pages by clicking on the item. For example, we sorted by the word “vacation”.

As the graph shows, the selected page focused on “vacation ideas” receives a lot of traffic from social media and referrals. This information reveals insights about VRBO’s social media marketing strategy and can serve as a starting place for beginning to unpack their backlink profile.

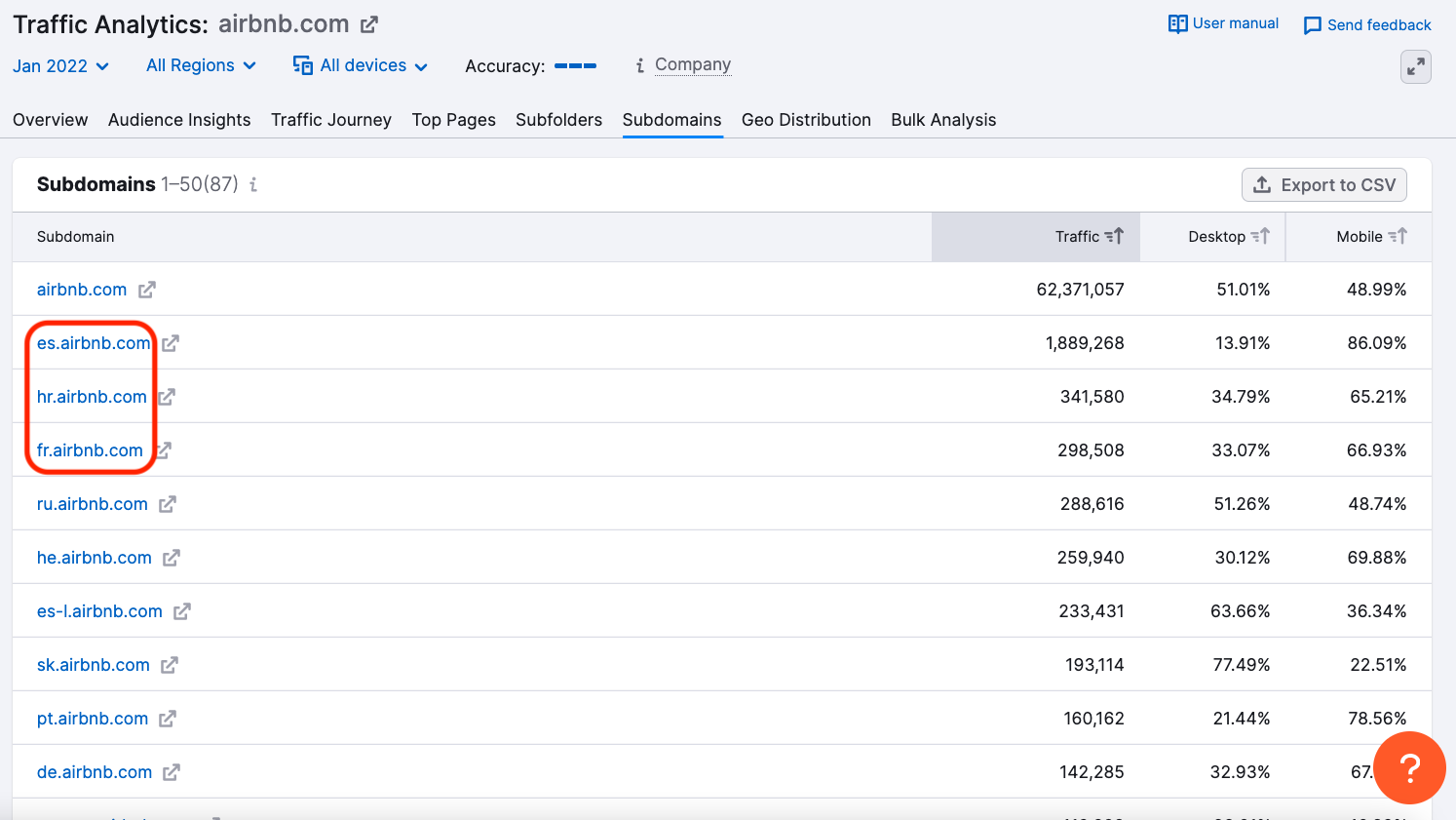

Finally, the Traffic Analytics tools allow you to understand the structure of competitor sites using subdomains and subfolders and track traffic trends across different sections.

With this table, Airbnb’s traffic numbers for specific subdomains reveal their popularity. For example, the Spanish, Croatian, and French subdomains are at the top when it comes to traffic.

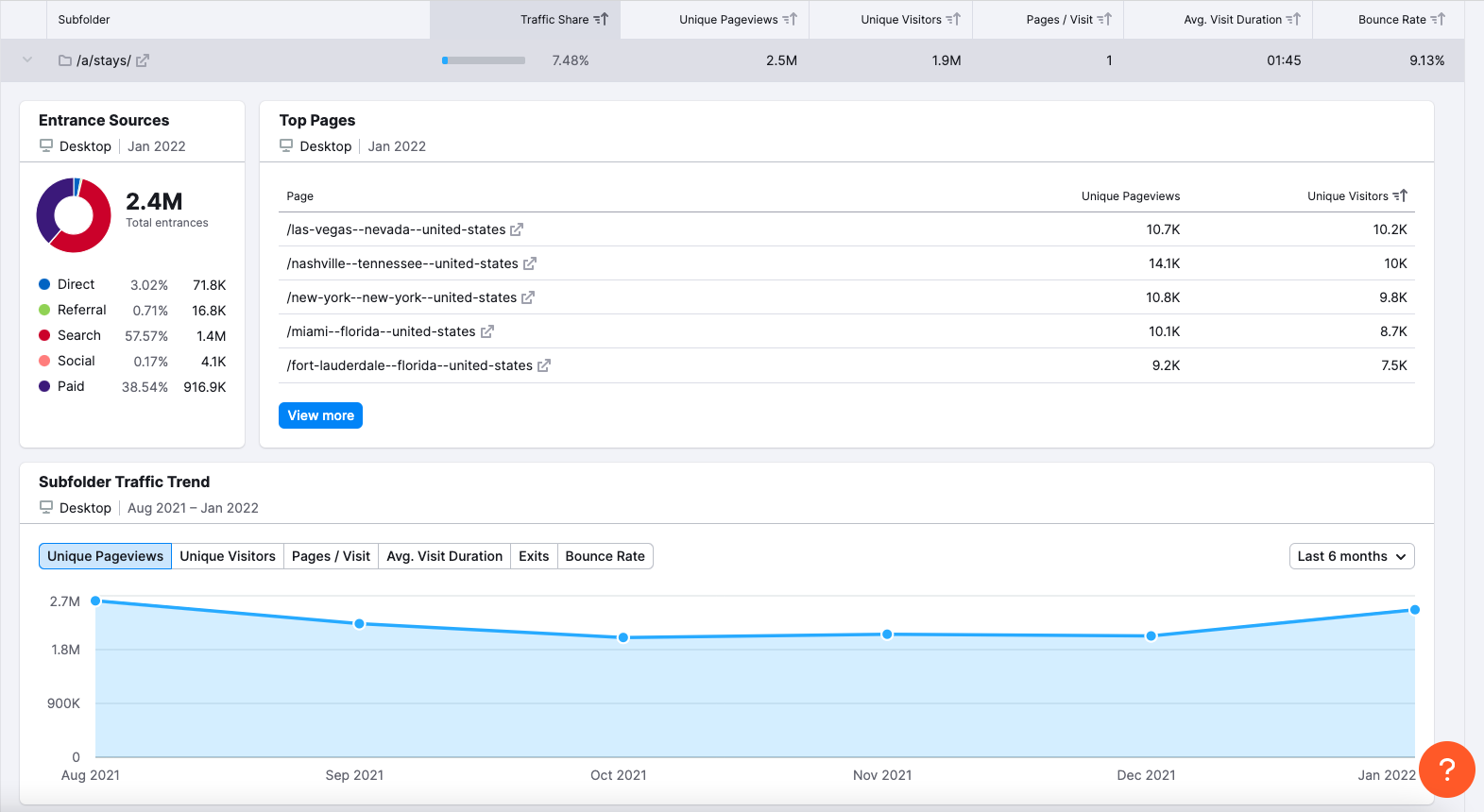

Subfolders work in a similar fashion, though they allow for a deeper dive when it comes to traffic metrics, entrance sources, and trends.

Most of the traffic to the “stays” subfolder comes through paid and search traffic. Las Vegas, Nashville, New York are the top pages within this subfolder, which shines a light on popular destinations in this market. And the upticks on the trends graph suggests there’s higher travel after the new year and in the summer.

If you were a competitor to Airbnb, you might use this information to look for potential places for growth or opportunities for increased targeted marketing efforts.

Evaluate Partnerships and Cultivate Growth with Traffic Data

Beyond using Semrush for competitor research, Traffic Analytics data can become a source of useful insights for expanding your business, persuading prospects to close deals, or establishing strong and fruitful partnerships.

With the features highlighted below, you can:

Compare shared audiences among your business and your competitors Discover what other websites shared audiences frequent Filter by industry to pinpoint the best partnership opportunities View traffic numbers by country to identify emerging markets and growth opportunities Track traffic trends in various countries over time Explore pages on competitors sites that appeal most to audiences in various countriesCompetitor Traffic Analysis Tools for Generating Audience Insights

The Audience Insights report is a great starting place for understanding how your market’s audience interacts with you and your competitors.

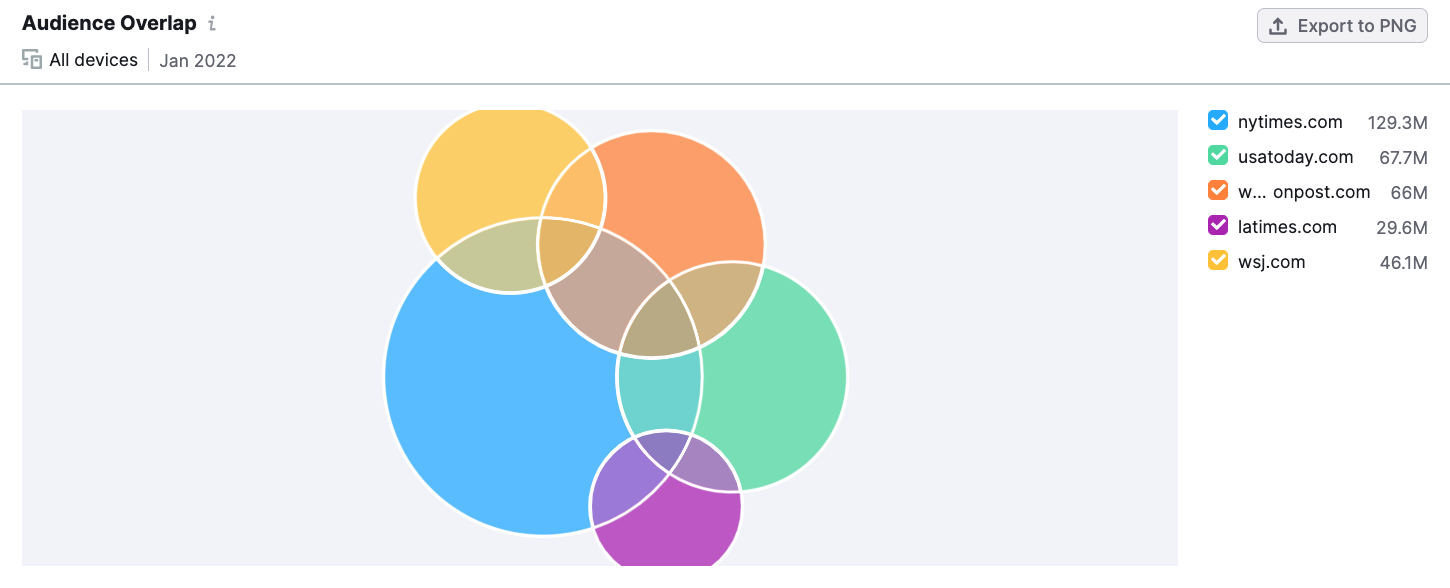

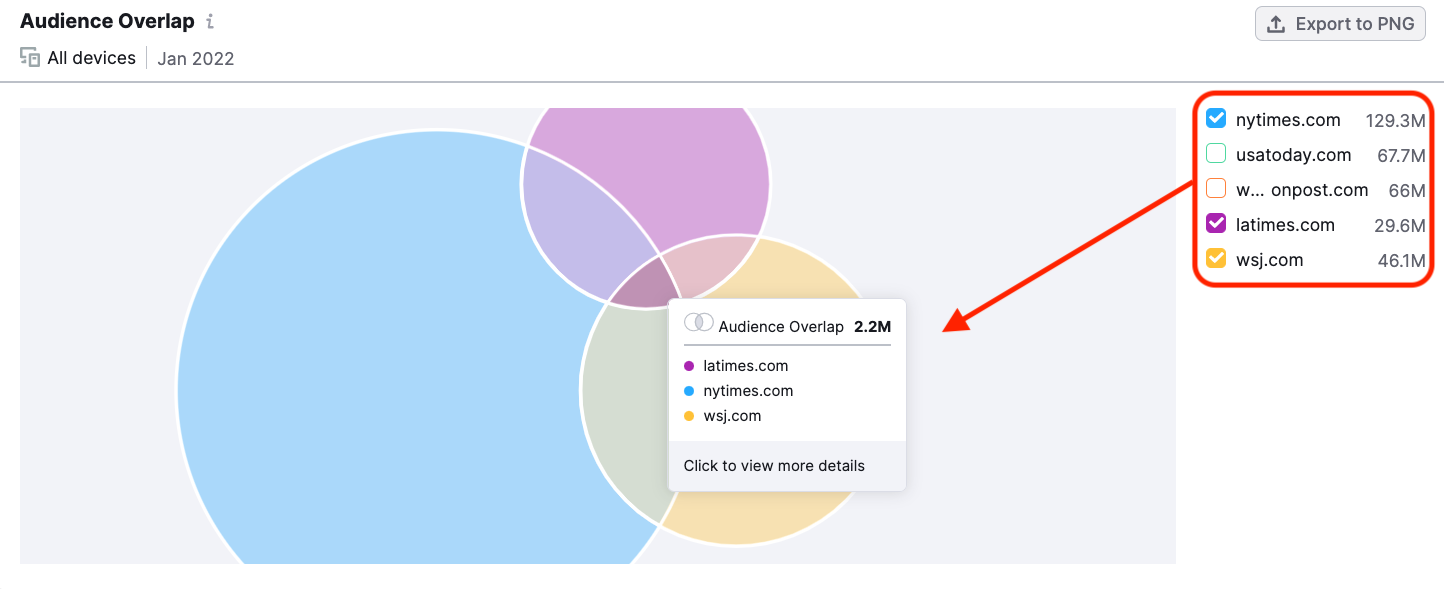

The Audience Overlap Graph shows the size of competitors' audience and the extent to which their audience and their competitors’ overlap. The graph below depicts the audiences for 5 major U.S. newspapers.

The New York Times is the largest circle, indicating they have the largest audience with 129.3M monthly visitors. They share the largest overlap with the Washington Post, meaning 22M people who visited the New York Times website also visited the Washington Post.

To consider a few smaller newspapers in relation to the New York Times, make a selection with the checkboxes to the right of the graph.

Considering the two smallest newspapers alongside the largest. The graph shows the Wallstreet Journal shares a larger audience with the New York Times than the LA Times does. And the shared audience between the Wallstreet Journal and the LA Times is also quite small.

By considering these shared audiences in different ways, we might gain insights into how to partner with competitors or target certain audiences to grow our own traffic.

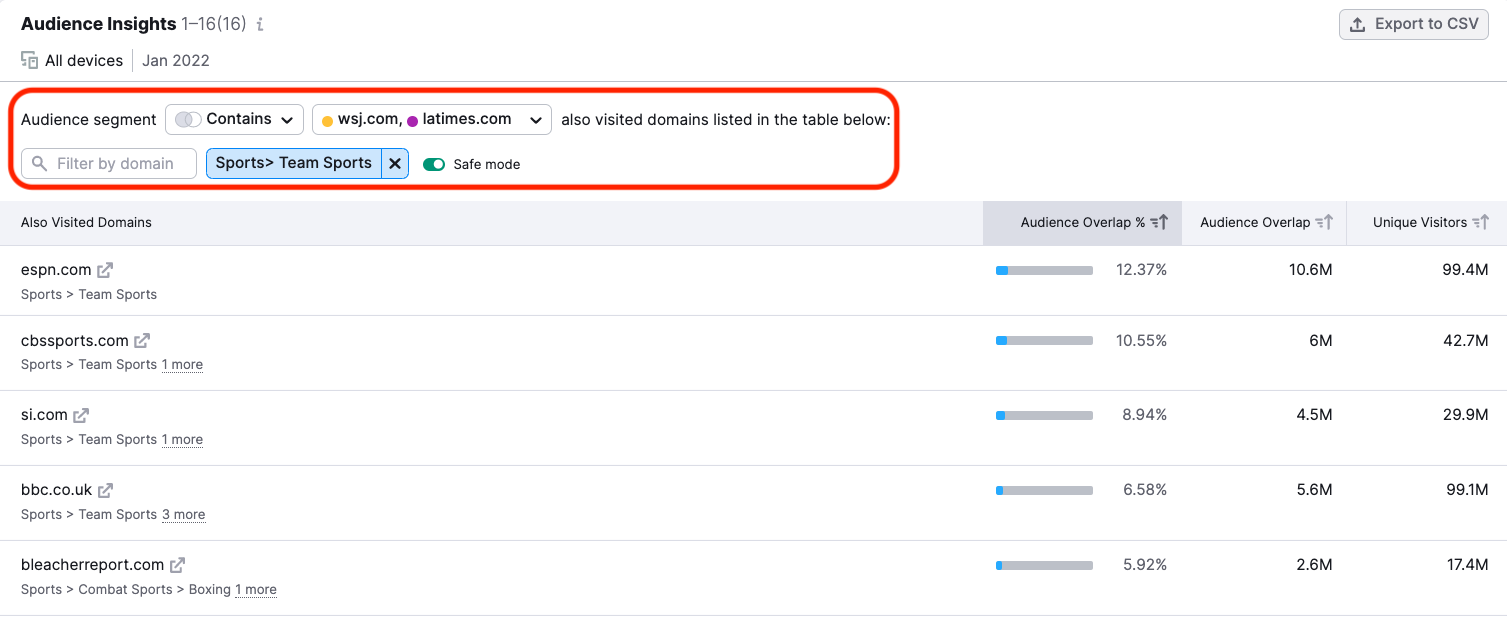

The Audience Insights portion of the report provides additional information about where audiences spend their time online. Again, we looked at the two smallest newspapers and filtered the chart to where these two papers audiences go to read about sports.

According to the Audience Insights report, of all of the people who visit the Wallstreet Journal and the LA Times websites, 12.37% also go to espn.com and 10.55% go to cbssports.com.

This insight might help inform a partnership strategy. For example, the marketing team for a sports section of a paper might look to ESPN or CBS Sports for advertising or partnership opportunities to capture some of this audience.

Track Competitor Web Traffic Globally

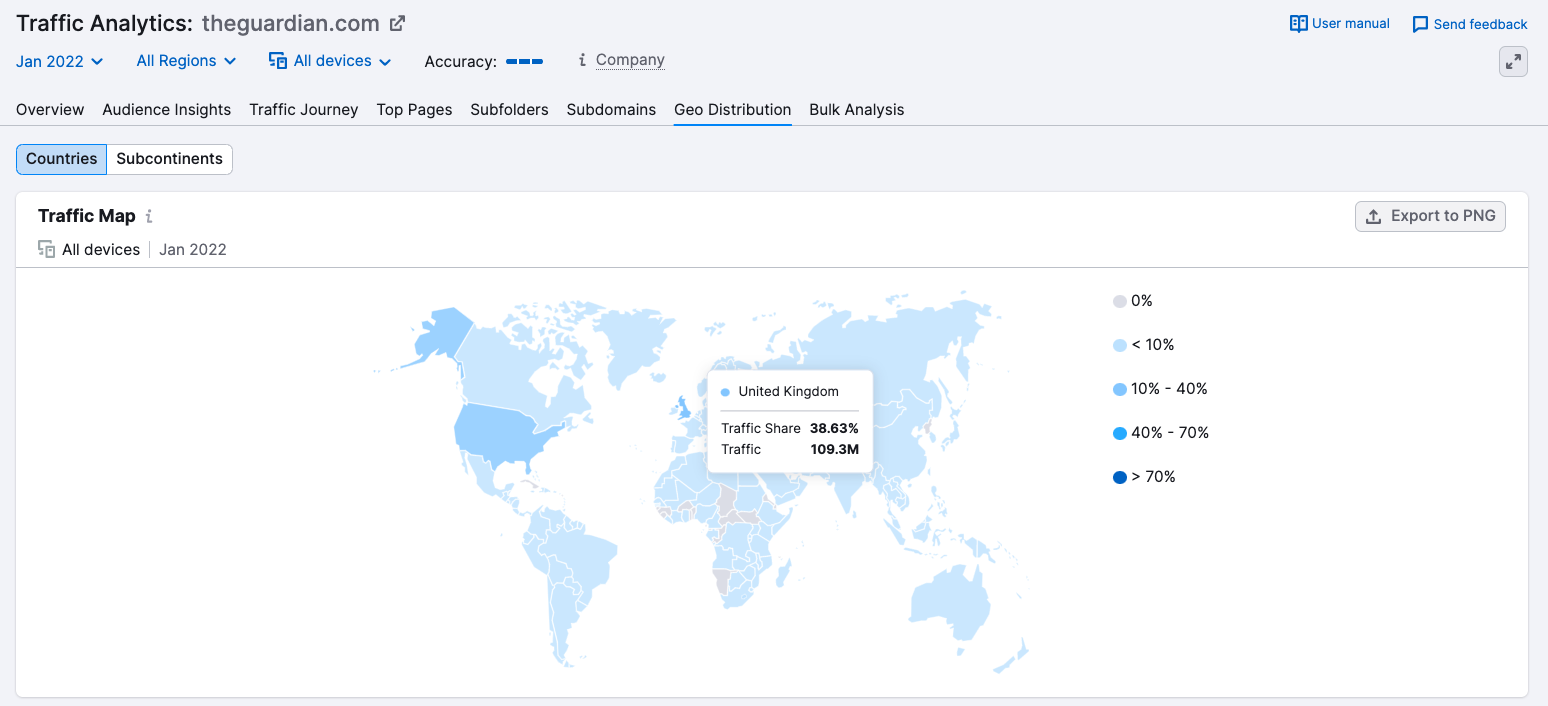

The Geo Distribution report offers insights into audiences across the globe. For a general picture of a competitor’s global web traffic, start with the Traffic Map. For this map, we check global traffic for the Guardian.

The majority of the Guardian’s traffic is split between the United States and the United Kingdom, with the UK taking the prize when it comes to total traffic numbers. On the map, countries that account for less than 10% of the website traffic are light blue, suggesting there is some audience in these countries, even if those markets are small.

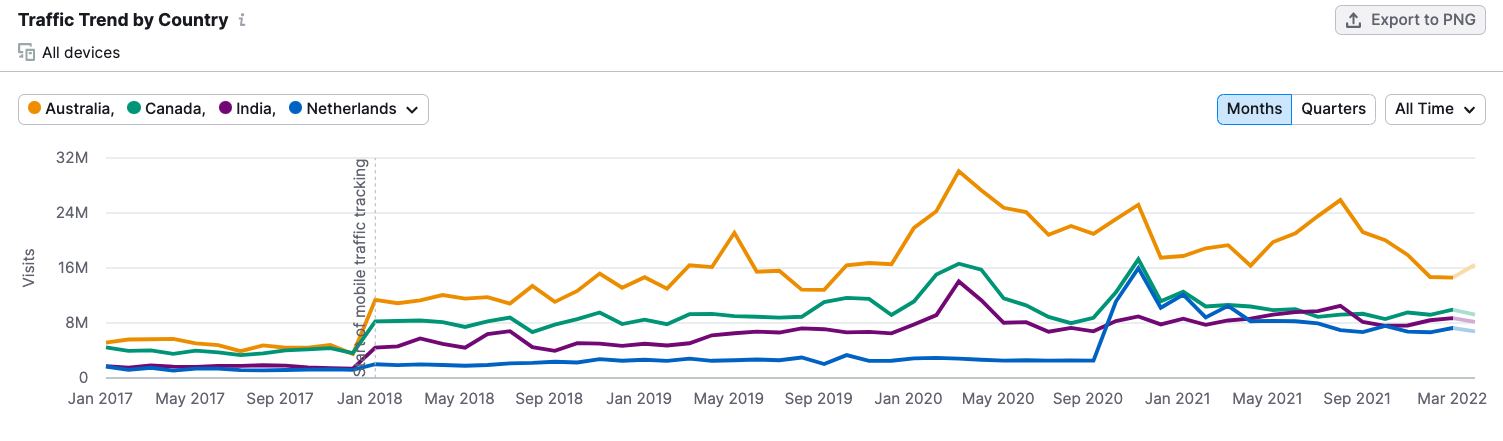

For a closer look at traffic trends over time, scroll down to the Traffic Trend by Country graph. For this example, we looked at several smaller markets that show the highest traffic numbers and growth over the past five years.

With this graph, growth trends in various countries become clear. For example, notice the spike in traffic from the Netherlands in September of 2020. This data point might lead to deeper research about this specific market.

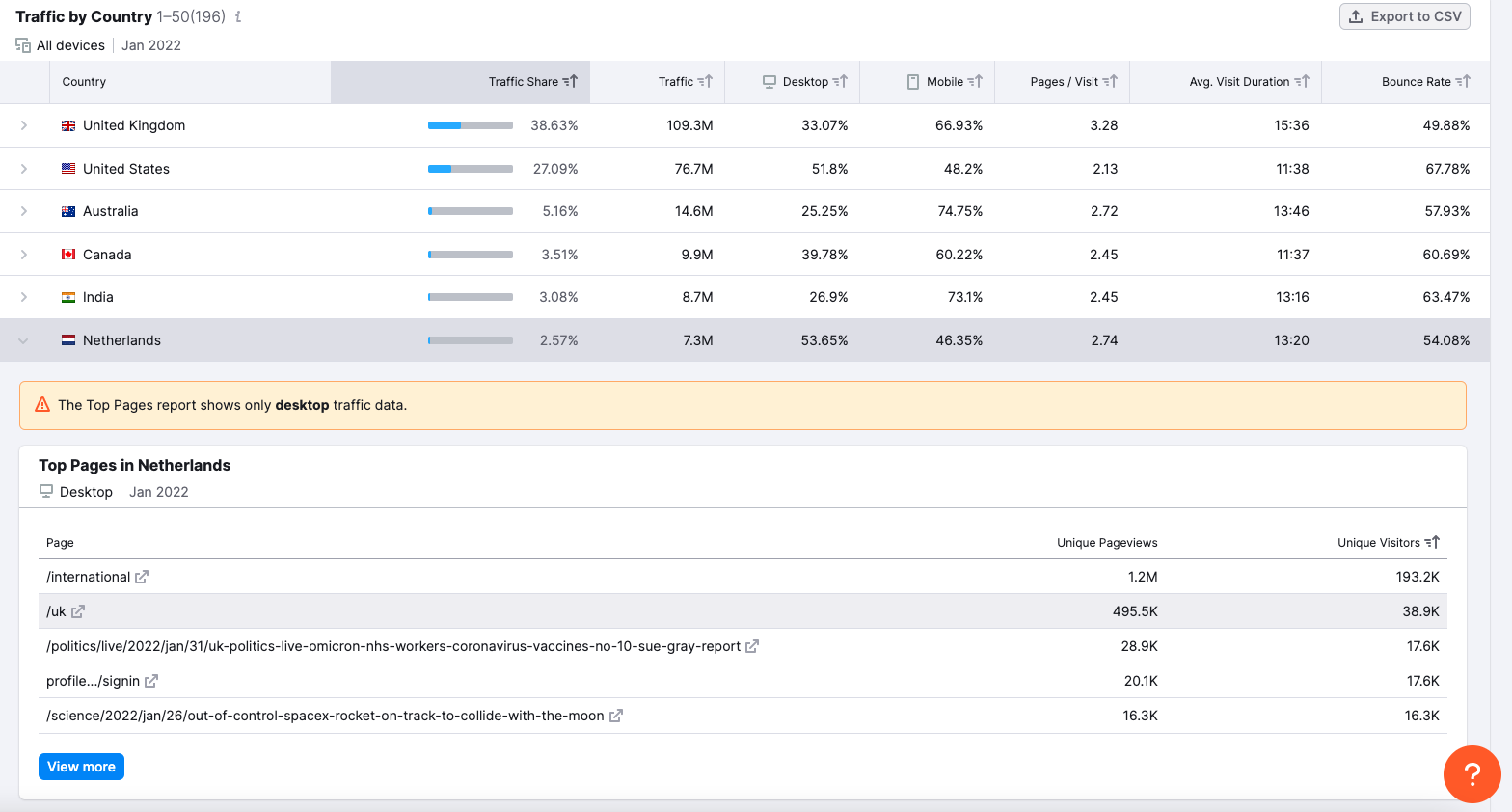

Finally, the Traffic by Country chart shows data for specific locations. Each entry has a drop down tab that shows top website pages in that country.

Considering the Dutch market again, the market seems to be growing and may be a good target for future growth. And examining the country’s top pages–international news, sports in the UK, and politics in the US–any newspaper expanding into this market may want to consider offering similar content.

More Than Simply Checking Traffic to Competitors’ Websites

If you arrived at this article wondering how to find competitors’ website traffic, we hope you’ve discovered that and more. Ultimately, learning how to use Semrush for website data is only the beginning. Once you know how to check other website’s traffic, you can go one step further with the numbers and generate deep insights.

High quality traffic insights help you understand your market, outcompete your rivals, and give your audience what they want. While it helps to start with the numbers, the Traffic Analytics tool from Semrush goes beyond simply showing unique visits and bounce rates. Semrush’s competitor analysis capabilities are far reaching. With Traffic Analytics, and the expanded .Trends suite, you’ll find a complete solution for all of your market research needs at your fingertips.

Innovative SEO services

SEO is a patience game; no secret there. We`ll work with you to develop a Search strategy focused on producing increased traffic rankings in as early as 3-months.

A proven Allinclusive. SEO services for measuring, executing, and optimizing for Search Engine success. We say what we do and do what we say.

Our company as Semrush Agency Partner has designed a search engine optimization service that is both ethical and result-driven. We use the latest tools, strategies, and trends to help you move up in the search engines for the right keywords to get noticed by the right audience.

Today, you can schedule a Discovery call with us about your company needs.

Source: