Entering new markets is always an adventure, and adventures always involve some risk. Moving beyond your current market is challenging, but a well-informed go-to-market strategy ensures you’ll thrive in your new market environment.

This guide aims to help businesses build a data-driven go-to-market strategy. First, we’ll explore exactly what a go-to-market strategy is and why it’s important. Then, we’ll offer a step-by-step process for developing your own.

What Is a Go-to-Market Strategy?

In a nut-shell, a go-to-market (GTM) market strategy is a planned system for distributing and delivering goods or services to a new target market.

When building your GTM, you’ll consider a variety of items, such as:

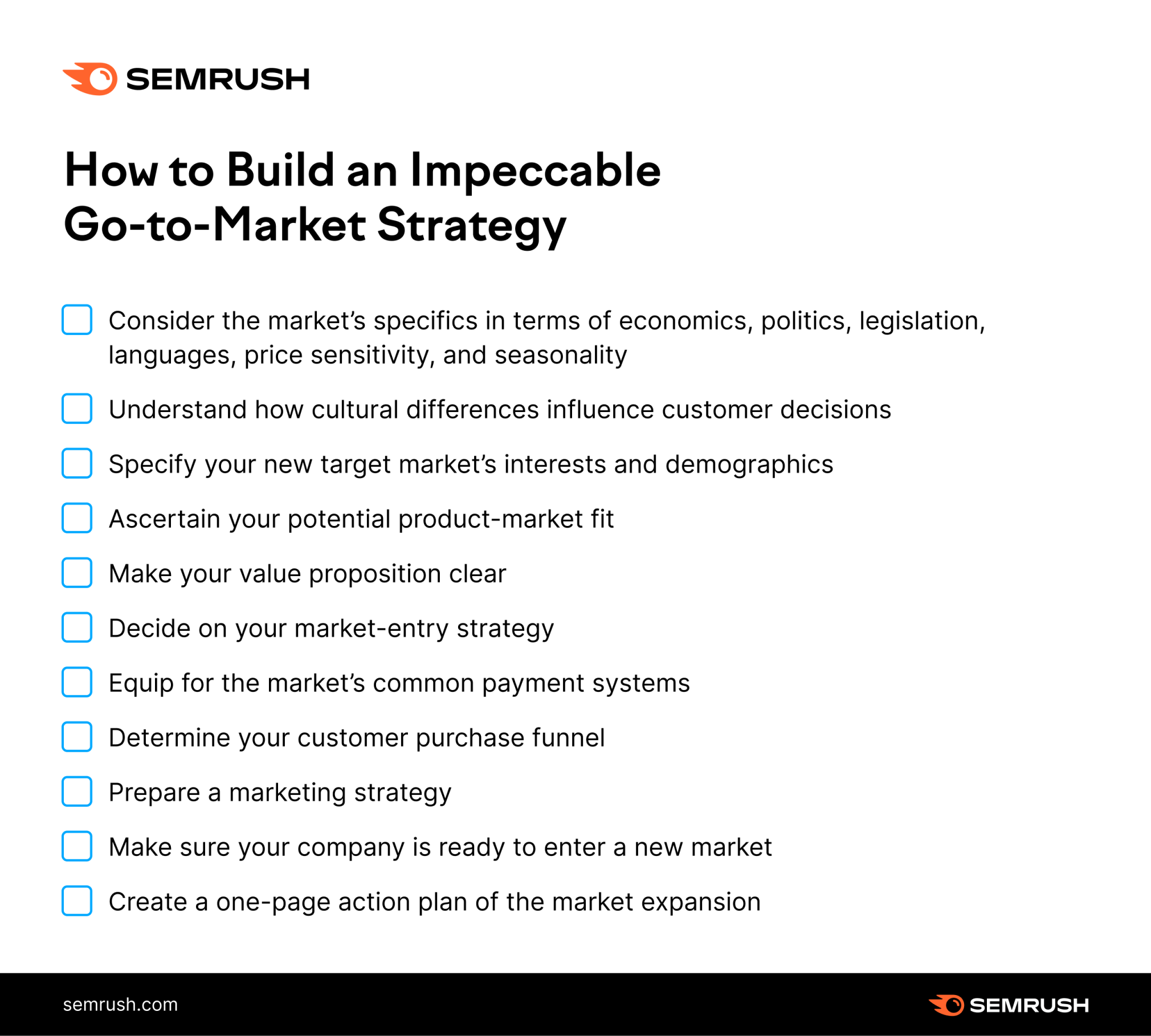

Market size and competition Customer pain points and the buyer journey Product-market fit Audience demographics Local and international market variations Marketing approaches, sales funnels, and pricing strategiesTaken together, these various focus areas form a strategy that ensures a good product-market fit in your specific target region or niche. In other words, it’s your course for success! The checklist below will help you lay out a comprehensive GTM strategy for your next endeavor.

Your Complete Go-to-Market Checklist for a Powerhouse Strategy

Expanding into new markets involves many of the same risks as opening a new business, and it can be just as involved and overwhelming. Using the action steps below, you’ll gain a competitive advantage with new market entry, product launches, and building brand awareness.

Make Sure Your Company Is Ready to Enter a New Market

Before taking action to expand your business, get everyone involved on the same page. This step is especially important if you are moving to a national stage. To set off the process, address the following items:

Goals and alignment. Before making strategic decisions, ask yourself this question: what do I want to achieve with this expansion? Be specific about your ultimate objective and ensure they’re measurable. Internal capabilities. Consider what capabilities you need in-house to make your expansion successful. Do you need to invest in infrastructure? How much will it cost and can you afford to allocate additional resources to expansion? Human Resources. Think carefully about the current state of your Human Resources and the talent gaps you may have. Ask yourself: do I have the talent I need to manage the expansion? Can my existing teams allocate time for new projects, especially on a global scale? Do I have to employ new marketers, sales teams, or hire an external agency? Optimal timing. Last but not least, determine the best time to act. This factor will involve a careful analysis of the target market, its current political climate, global economics, and more.Gauge Your Potential Product-Market Fit

You have to confirm your product-market fit in the current region before you even start assessing a new market for expansion. At the point of building a go-to-market strategy, though, your task is to research your ideal future customers in every detail and estimate the potential demand.

You can analyze any potential market with the help of Semrush’s Market Explorer. Start by measuring the level of demand in the region to decide whether it’s worth studying the field further.

To begin, enter your domain or one of your potential competitors’ domains into the Market Explorer tool. You can also build a custom market by entering several domains manually. Don’t forget to choose a specific country.

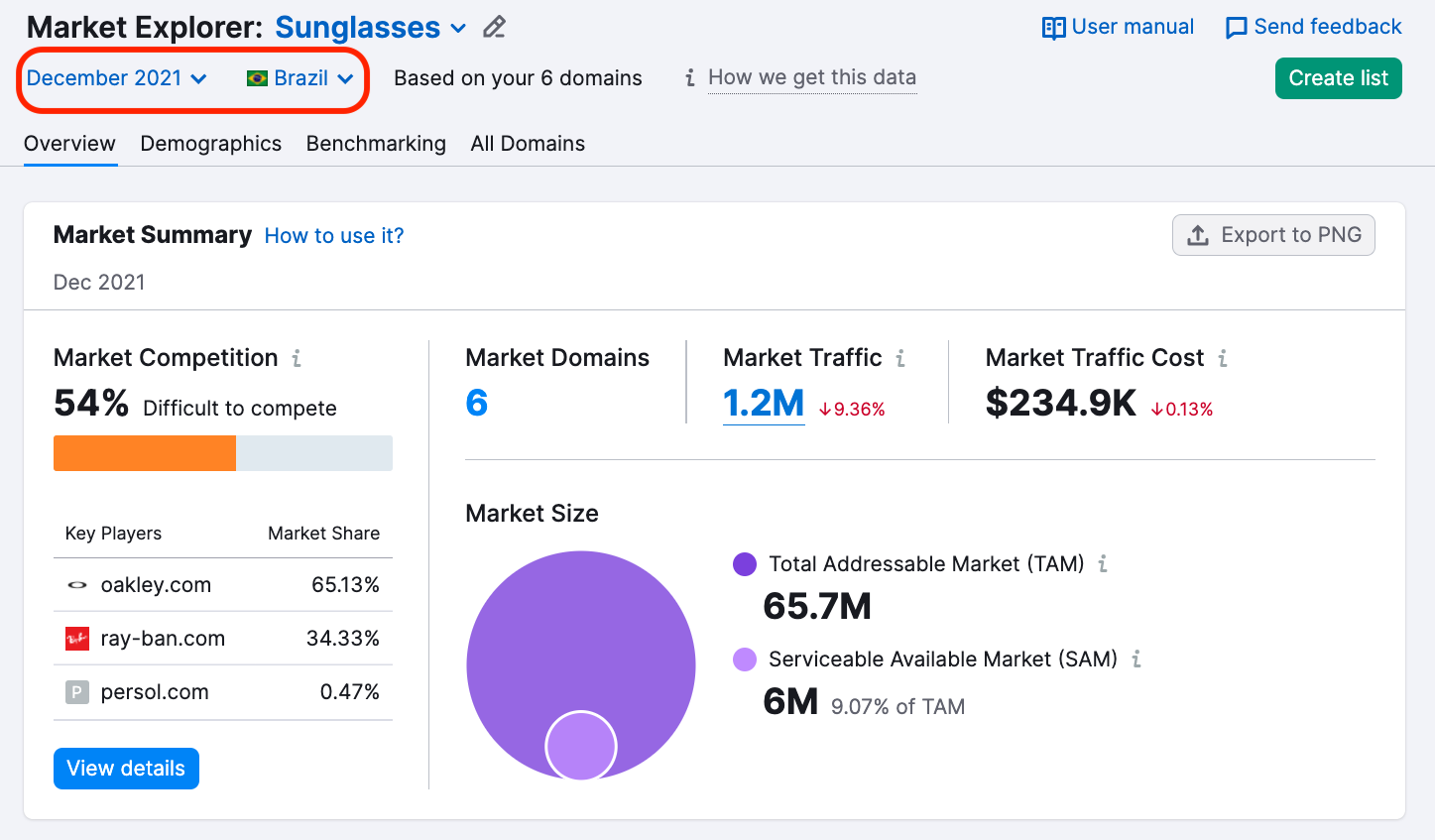

For this example, let’s say we work for a US eyewear company that specializes in sunglasses and is trying to enter the Brazilian market. We’ve built a custom market that includes some recognizable eyewear companies and selected Brazil as our location.

The Market Summary section of the Market Explorer Overview Report provides a wealth of information about your prospective market. We entered six competitors and selected Brazil as our geographic target.

Pay attention to the Market Competition and Market Size sections of the Market Summary. In Brazil, the Market Competition is quite stiff. Oakley and Ray-Ban own most of the market share, leaving little room for new entrants.

In terms of market size, about 10% of the total addressable market (TAM) demand comes from people who are ready and willing to buy a pair of sunglasses, indicated by the Serviceable Available Market, or SAM.

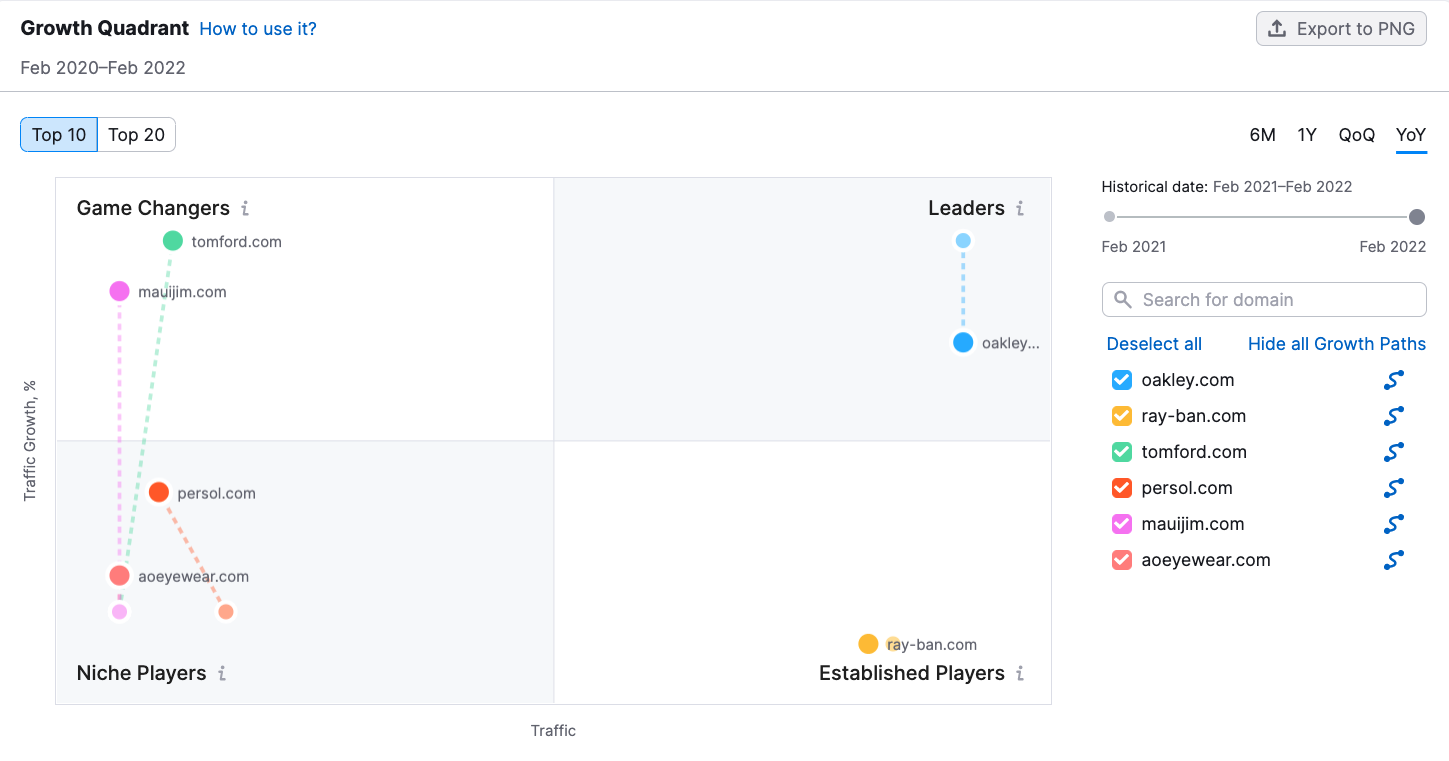

Next, scroll down to view the Growth Quadrant, which shows an overview of the competitive landscape.

This graph shows growth year-over-year from December 2020 to December 2021. On the graph’s left side, notice Tomford.com and mauijim.com’s growth. They moved from the Niche Players quadrant to the Game Changers quadrant.

So while Oakley and Ray-Ban are still the big players in Brazil, the Growth Quadrant uncovers new information about smaller players making big moves in the market.

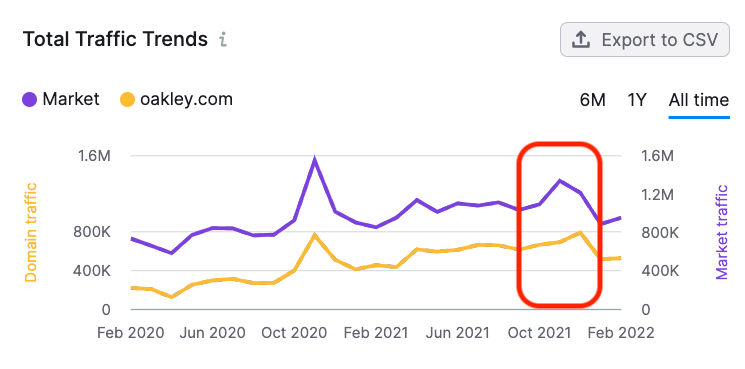

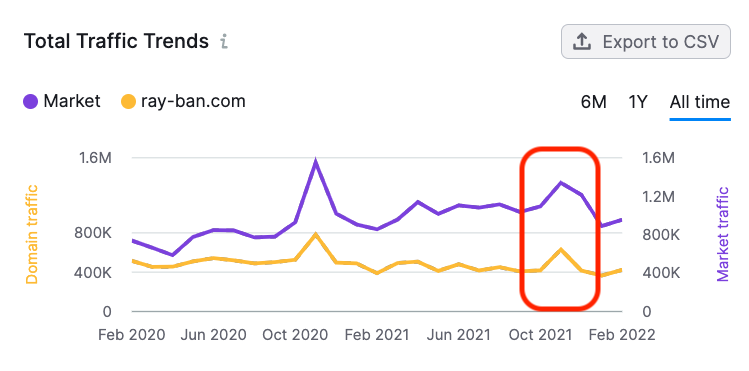

Finally, check the traffic trend for the entire market to understand whether the market is expanding or contracting.

These graphs show the market growing steadily over the past year with a major spike in October 2020. Market growth is a good sign when entering a new market.

Also, notice the spike in market traffic in December 2021. Oakley’s traffic remained steady during this spike, while Ray-Ban’s spiked with the market traffic trend. In December, Ray-Ban was the real winner, despite their smaller traffic share. Considering their marketing and sales strategy during this month might reveal interesting insights about the Brazilian market.

Consider Local Market Peculiarities

When doing our initial market research, we gained insight on a number of the Brazilian market’s features. Now, it’s time to get a closer look at the peculiarities, so we can avoid any unpleasant surprises down the road.

1. Scrutinize the economic situation

Thoroughly assess the state of the economy in your chosen region to see if it’s a good fit and the time is right.

Skipping this step could leave you unable to get your footing in your new market. Best Buy confronted this problem in the UK in 2010. Ignoring the already unfolding global recession, they decided to try to set up shop in the UK with an eye toward strategic acquisitions. The state of the economy globally, and specifically in the UK, lead to a serious failure.

2. Analyze local laws and regulations

Even big-name brands struggle when with local laws and regulations. When Uber attempted to expand into South Korea, many assumed they were a shoo-in. After all, the company boasted well-established markets in many nations around the world. However, Uber failed to understand their target market, and this came with dire consequences.

The taxi industry in Seoul is bearish because of too many taxis and a slowdown of the population growth rate. Seoul alone has more than 70,000 taxi drivers (versus New York City’s 13,000). The government started to reduce the number of taxis, and offices no longer issue taxi licenses. As a result, the price of taxi licenses bought and sold has significantly increased.

If Uber began operating in the market, the taxi industry would have seen a considerable decrease. The government was afraid of an adverse reaction from industry representatives, and Uber’s development in South Korea has been hindered as a result of these regulatory issues.

The takeaway? Without proper preparation, any market expansion plan is foolhardy.

3. Understand Local Politics

To gain a handle on the business climate of a location, a thorough understanding of local politics is necessary. Some markets may not prove as suitable because of an investment-unfriendly political climate or overall political instability.

In the business world, this is reflected in the PEST(ELI) test the global business community often refers to when considering market expansion.

4. Consider Language Barriers

Consider the WhatsApp expansion in Germany. By 2016, WhatsApp had acquired 1.2 billion users by successfully scaling up worldwide. However, before expanding into Germany, they failed to translate their terms of use into German.

As a result, the Federation of German Consumer Organizations filed a lawsuit against the company charging that the technical language was “largely incomprehensible” to German users. A small oversight cost the company more than a quarter of a million euros.

A smaller brand likely wouldn’t have weathered this challenge successfully.

5. Study Price Sensitivity

Along with studying the economy, look at factors such as the average resident’s average amount of disposable income. If the margin is too low, people may not be able to afford your products.

6. Be Alert for Seasonality

Last but not least, geographic realities such as reversed seasons between the Northern and Southern Hemispheres may have a huge impact on consumer demand.

Are you Building an International Go-to-Market Strategy?

Entering a market in a different country comes with a few important stumbling blocks to consider. Communication, acquisition, and decision-making vary from country to country. So, as you do your research, consider questions like:

Do your potential customers normally make group decisions? Or do they buy products individually by quickly entering their credit card info? How do potential customers prefer to communicate? Countries like Brazil and Japan value face-to-face meetings over phone or video calls. What cultural norms influence decisions? What should our communication, customer service, and marketing strategy include or avoid?Consider DoorMint’s failed expansion into India. DoorMint started as an on-demand, online services marketplace connecting service providers (e.g., plumbing, pest control) with customers.

As the company expanded, they decided to specialize in online laundry and dry-cleaning. This choice proved fatal in India, where traditional launderers or dhobi have long satisfied this need. DoorMint was unable to compete with tradition.

As a rule of thumb, approach your new target audience with an open mind and awareness of your own cultural assumptions. This way, you’ll be better able to empathize across cultures and make better decisions for your strategy.

Specify Your Target Market’s Interests and Demographics

Along with a firm cultural footing, pay attention to your target market’s demographics and interests. They may differ drastically from your current market.

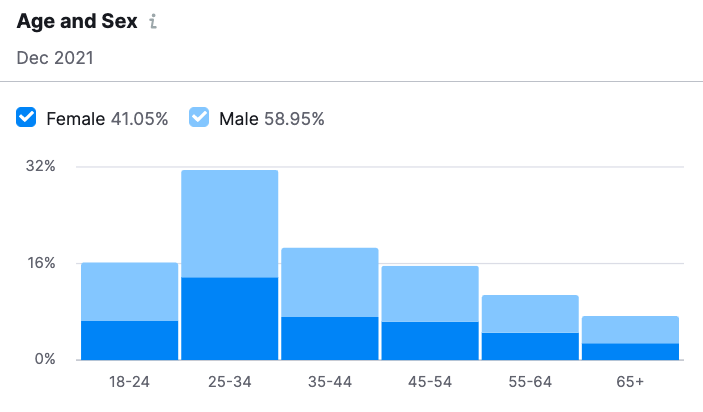

With Semrush’s Market Explorer tool, you can study your prospective audience in the Demographics report.

The breakdown of age and gender helps you better understand your target market. When it comes to sunglasses in Brazil, it looks like the largest portion of the market is between the ages of 25-34 with a 60-40% split between men and women. With this information, our marketing should target this age and gender break down in terms of tone and voice, for example.

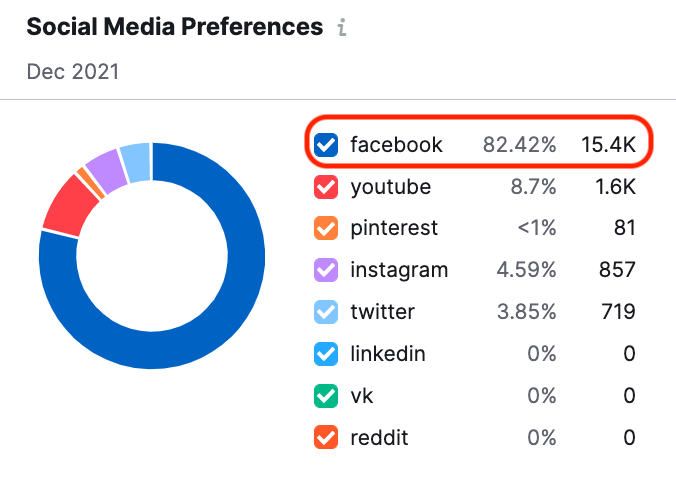

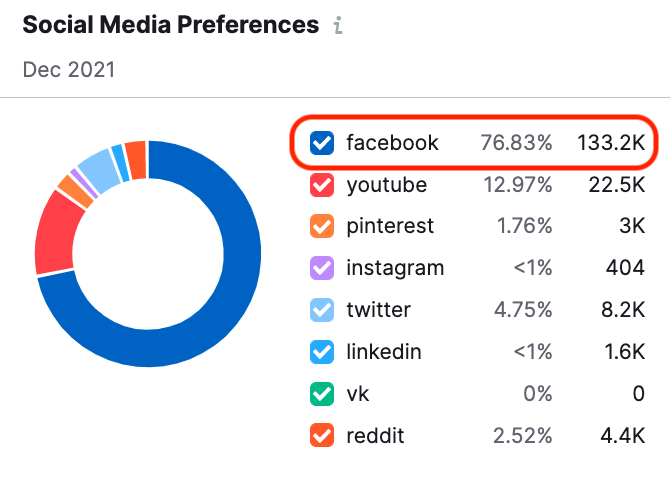

The social media preferences graph helps you discover what social media platforms your audience uses most often.

Comparing charts between the US and Brazil, we see that the US has a wider variety of social media platforms frequented by those interested in sunglasses. In Brazil, however, Facebook is by far the top, while alternative social media platforms are less popular. This may impact marketing decisions down the line.

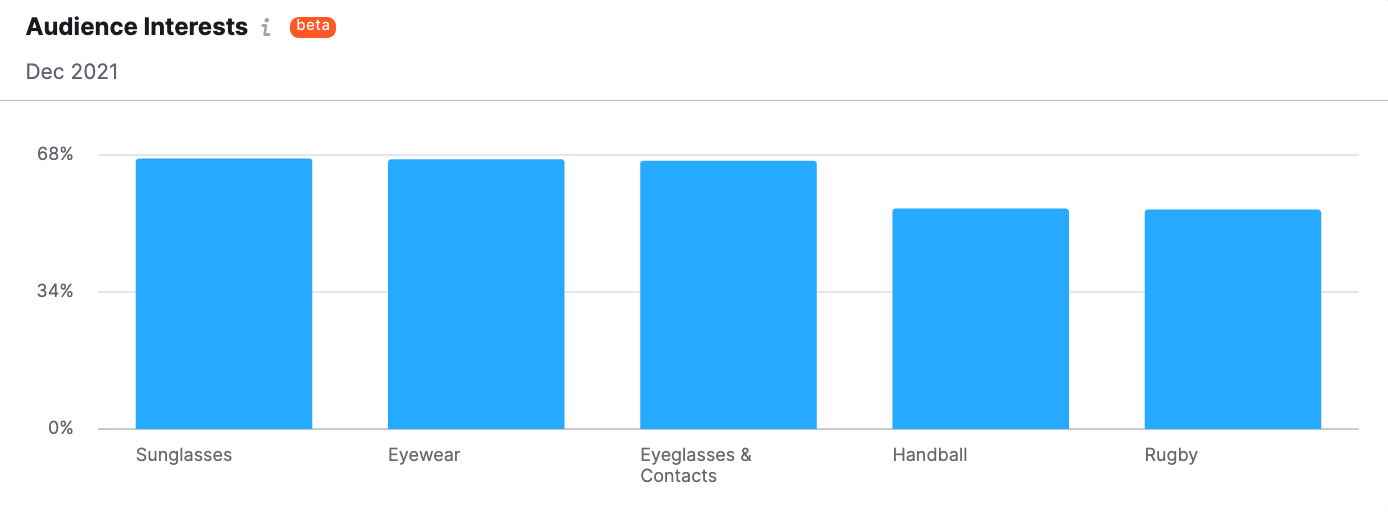

Finally, the Demographics report shows a breakdown of audience interests.

In Brazil, customers who are interested in sunglasses and eyewear are also interested in handball and rugby. This information may also be useful for developing customer personas or considering potential partners or locations for ads.

Make Your Value Proposition Clear

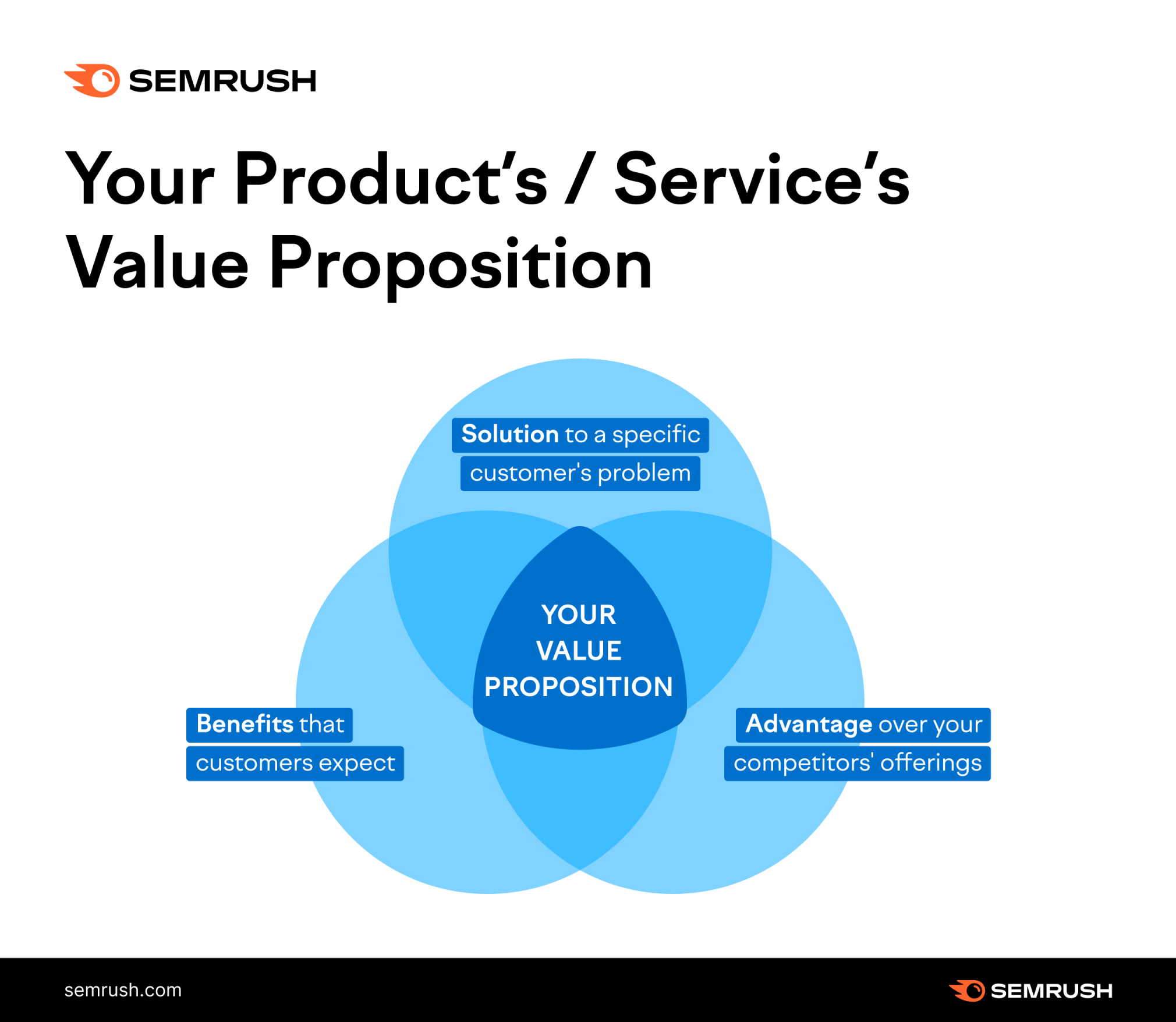

Consider what benefits customers can expect and define your key differentiators. Answer these questions:

How does your product or service solve/improve problems? What benefits can customers expect? Why should customers buy from you instead of your competitors? In other words, how are you better than your competitors?Then, articulate a value proposition that will be an intersection of all three.

Be careful to research your specific market. What works in one region or niche may fail in another. Your offering may be too complex or irrelevant, the price may be too high, or you may face any number of other obstacles. Even successful brands find there are some markets where their products and services aren’t in high demand.

Coke, for example, attempted to market two-liter bottles in Spain. Despite the brand’s popularity, their venture failed because Spanish refrigerators typically couldn’t hold such big bottles. Or consider the lesson learned by General Foods in Japan. The company spent millions of dollars marketing cake mixes, yet sales remained abysmal because only three percent of Japanese homes had ovens!

Define your value proposition properly. Supported by the specified customer persona and underserved needs, a good value proposition can help you achieve product-market fit in the target region.

Decide on Your Market-Entry Strategy

Globalization has changed the way companies approach their distribution strategies.

If we think about physical production, manufacturing can now be spread across the world, and products can be delivered to the markets on a just-in-time basis. And for software companies, geographic borders often only matter in terms of legislation, talent hiring, and language barriers.

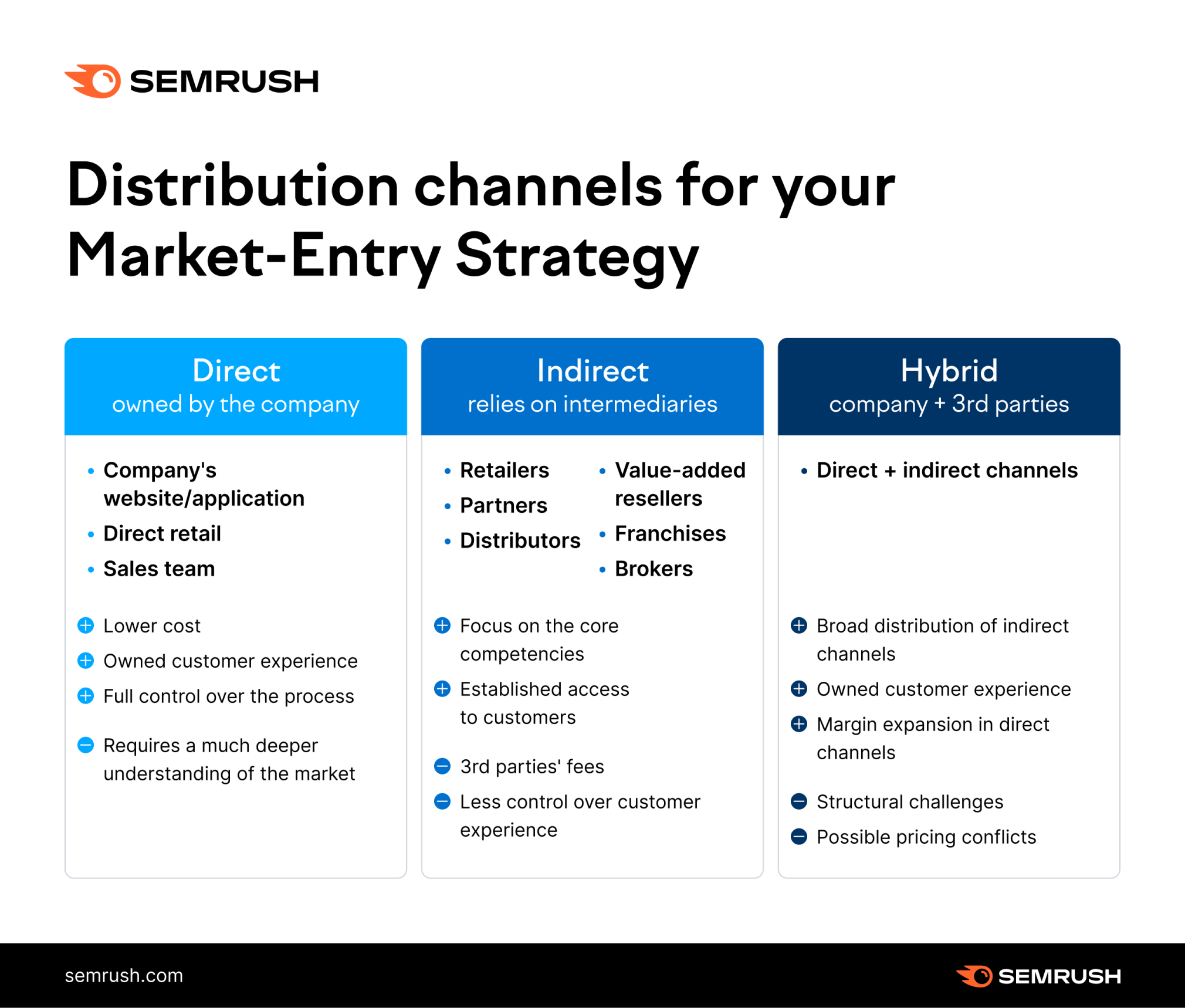

However, economic uncertainties can influence even those “globalized” businesses. Think carefully before choosing your distribution channels in a new market. Consider the variety of channels:

Direct distribution occurs through company-owned channels, and more businesses are moving in this direction. Direct distribution permits companies to cut out the middleman and own every part of their operation, resulting in higher customer satisfaction. Indirect distribution involves partnering with third parties to sell and fulfill your company’s value proposition. Many big-name companies use this approach to leverage relationships through third-party partners.This is exactly how Semrush entered the Japanese market, with the help of partnering with a digital marketing agency, oRo. This strategic partnership helped to double the performance results on the market.

Hybrid distribution systems are another option, involving both company-owned and third-party mechanisms. Many companies today (for example, Nike) rely on this model, giving them the best of both worlds.

Be Equipped for the Common Payment Systems in Your New Market

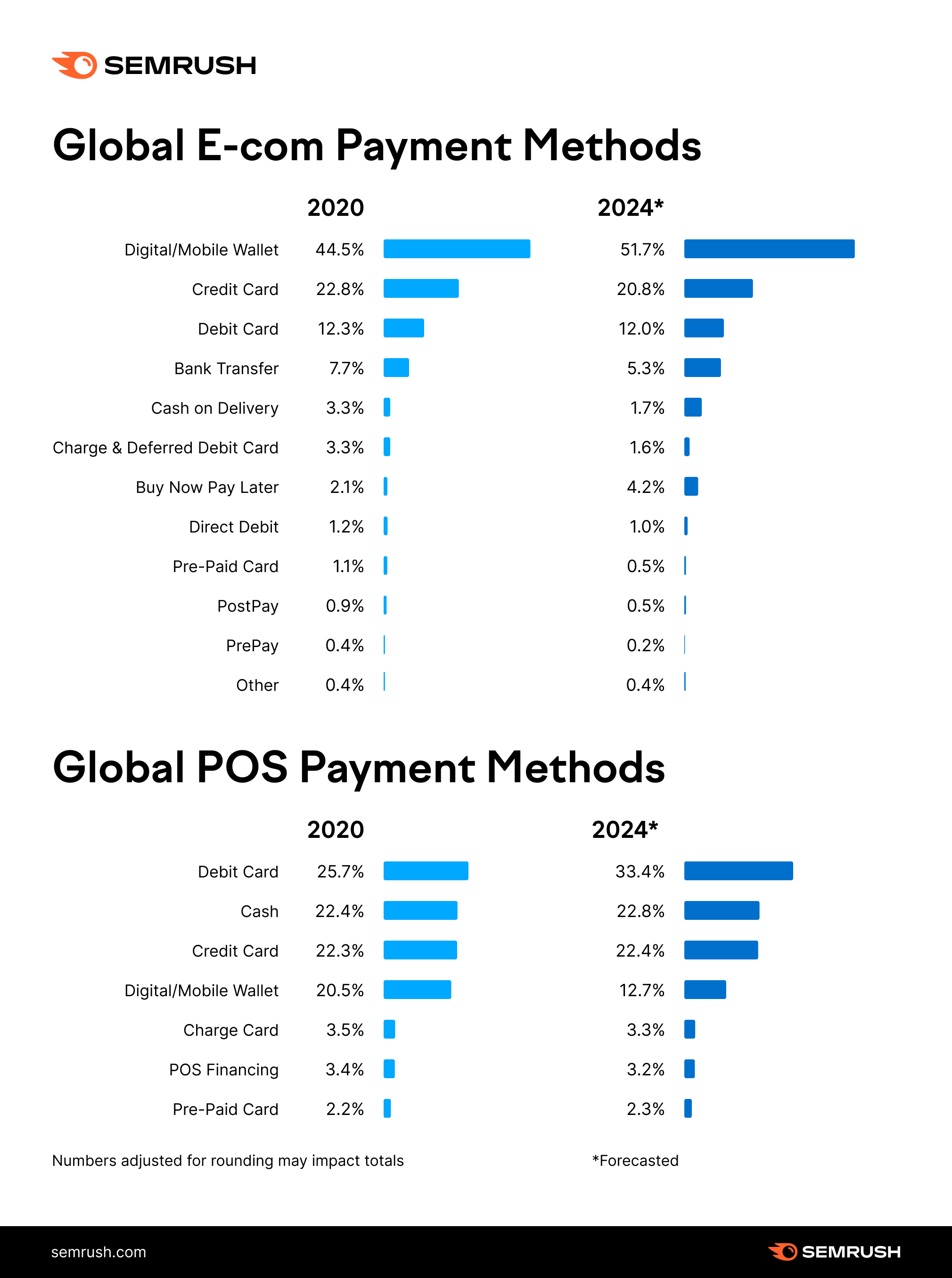

Making sure consumers have the right options for payment can be the difference between closing and losing the sale. Let’s consider Ecom (Ecommerce) and CNP (card-not-present transaction) payment methods globally and regionally to compare.

Globally, 44.5% of people prefer paying for items with a digital or mobile wallet, while debit cards are the most common CNP method at 25.7%. These numbers are projected to grow to 51.7% and 33.4% respectively by 2024.

https://worldpay.globalpaymentsreport.com/en/

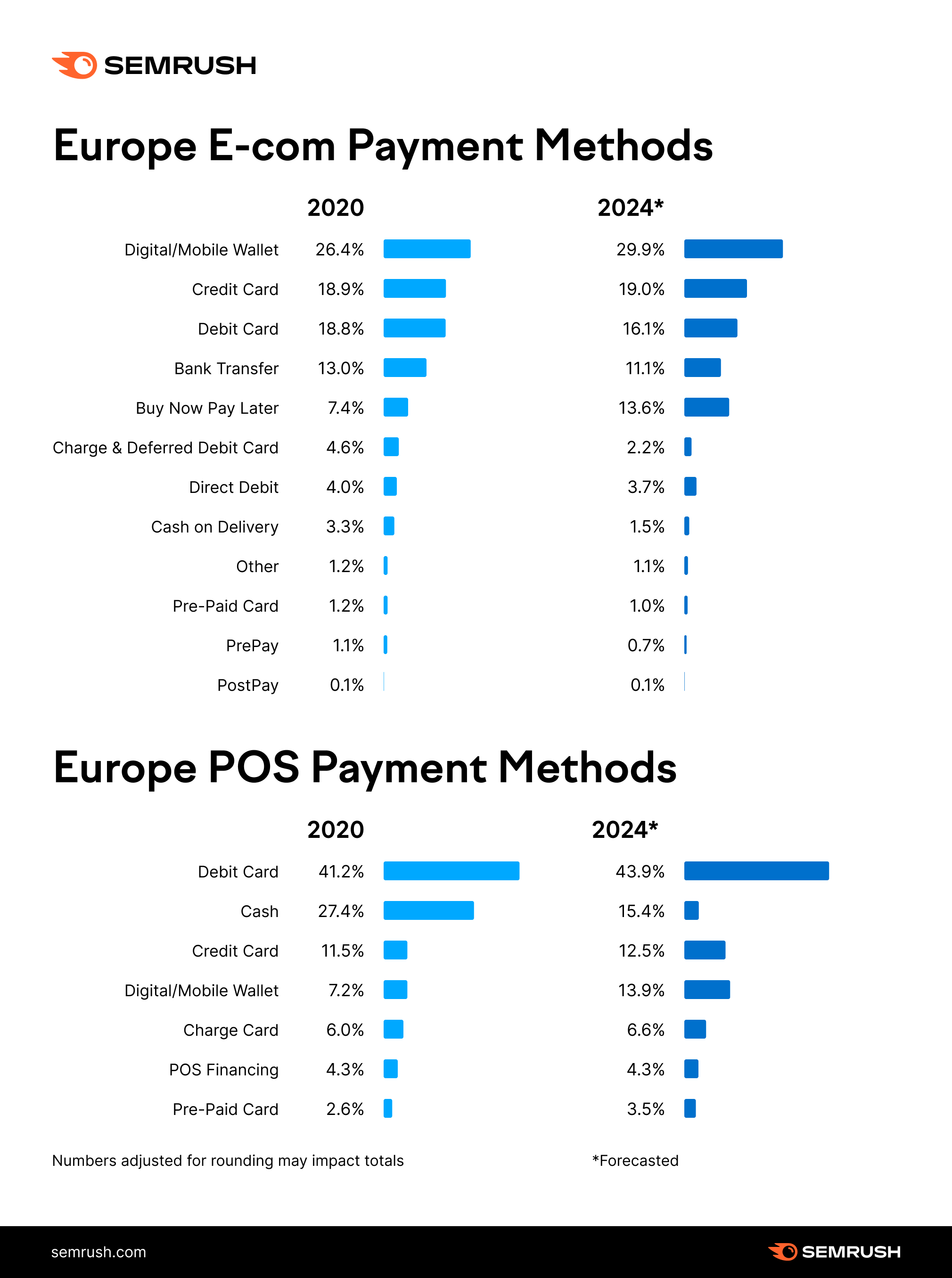

https://worldpay.globalpaymentsreport.com/en/In Europe, bank transfers account for 13% of payments, which is much higher than the global average. While this number is comparatively high, it’s projected to dwindle to 11% by 2024. Even so, at 11% it’s an important method to consider when thinking about payments in European markets.

https://worldpay.globalpaymentsreport.com/en/

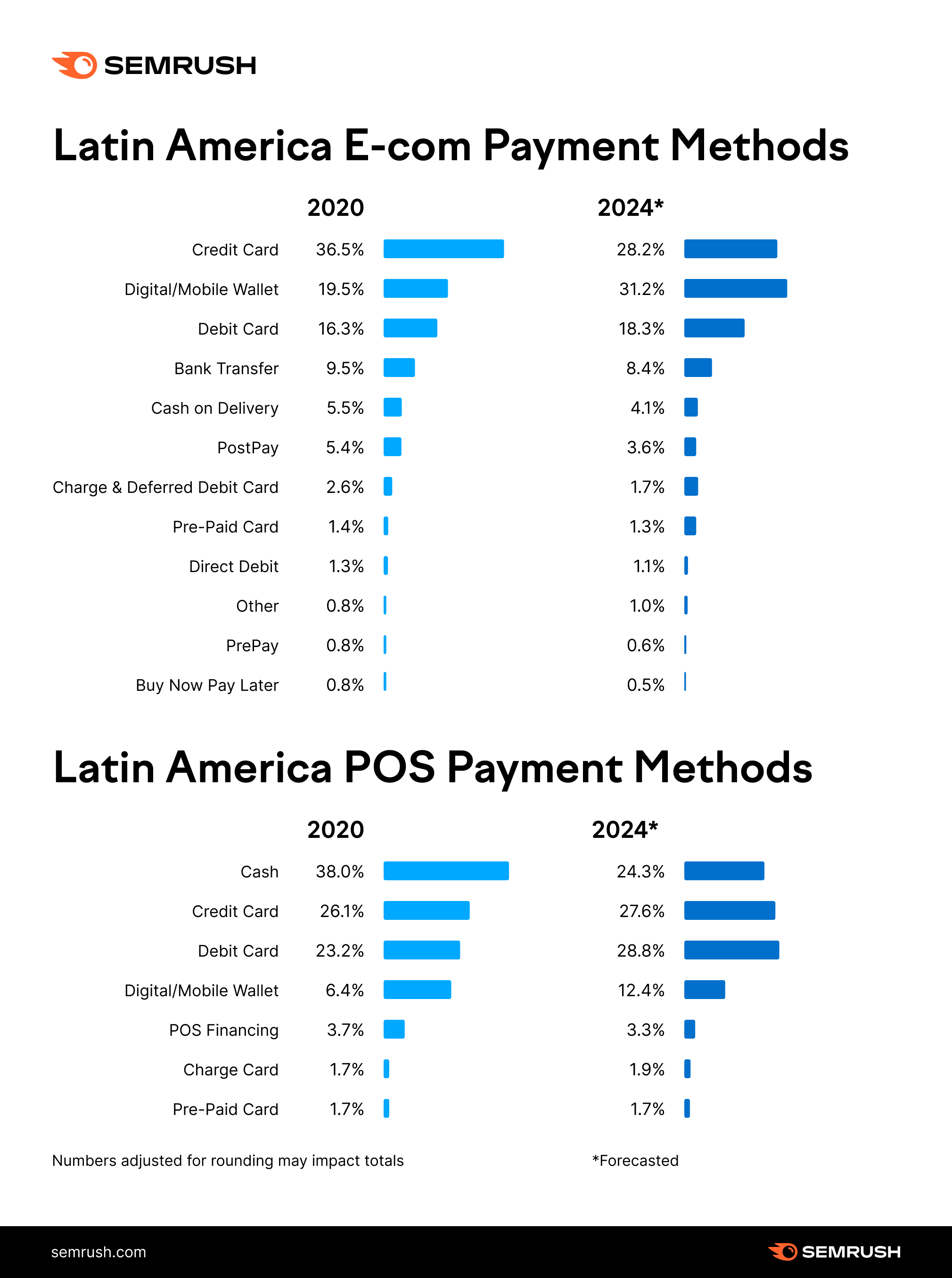

https://worldpay.globalpaymentsreport.com/en/In Latin America, cash is still king when it comes to CNP transactions. With 38% of transactions happening in cash, Latin America stands apart from most other regions, with debit cards being the preferred method. While this figure is expected to fall by 2024, it’s still an important thing to keep in mind when expanding into this market.

https://worldpay.globalpaymentsreport.com/en/

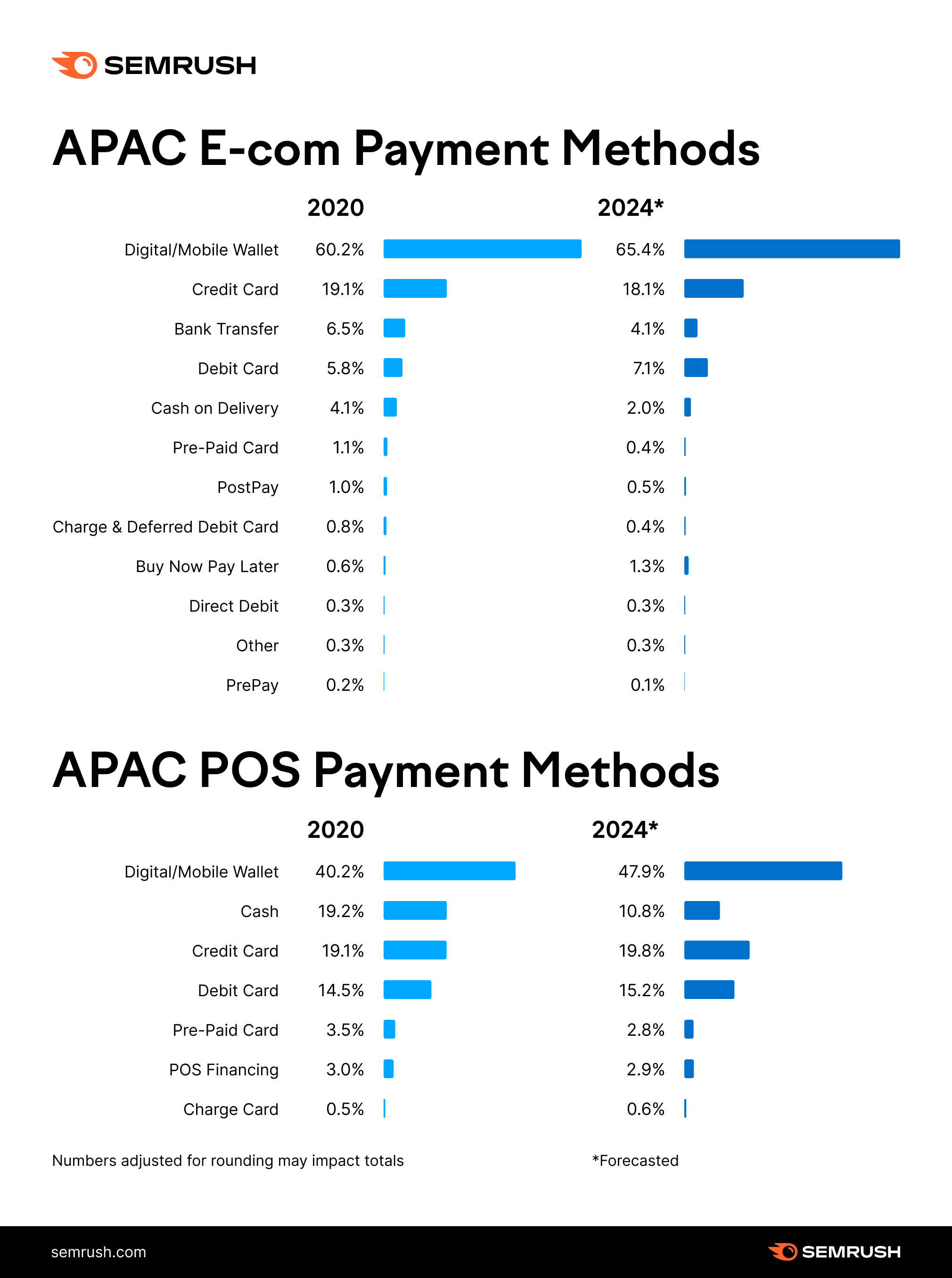

https://worldpay.globalpaymentsreport.com/en/Asia-Pacific markets are by far the most accustomed to digital and mobile wallets. Compared to the 44.5% of purchases made this way globally, Asia-Pacific markets stood at 60.2% and are projected to rise to 65.4% by 2024.

https://worldpay.globalpaymentsreport.com/en/

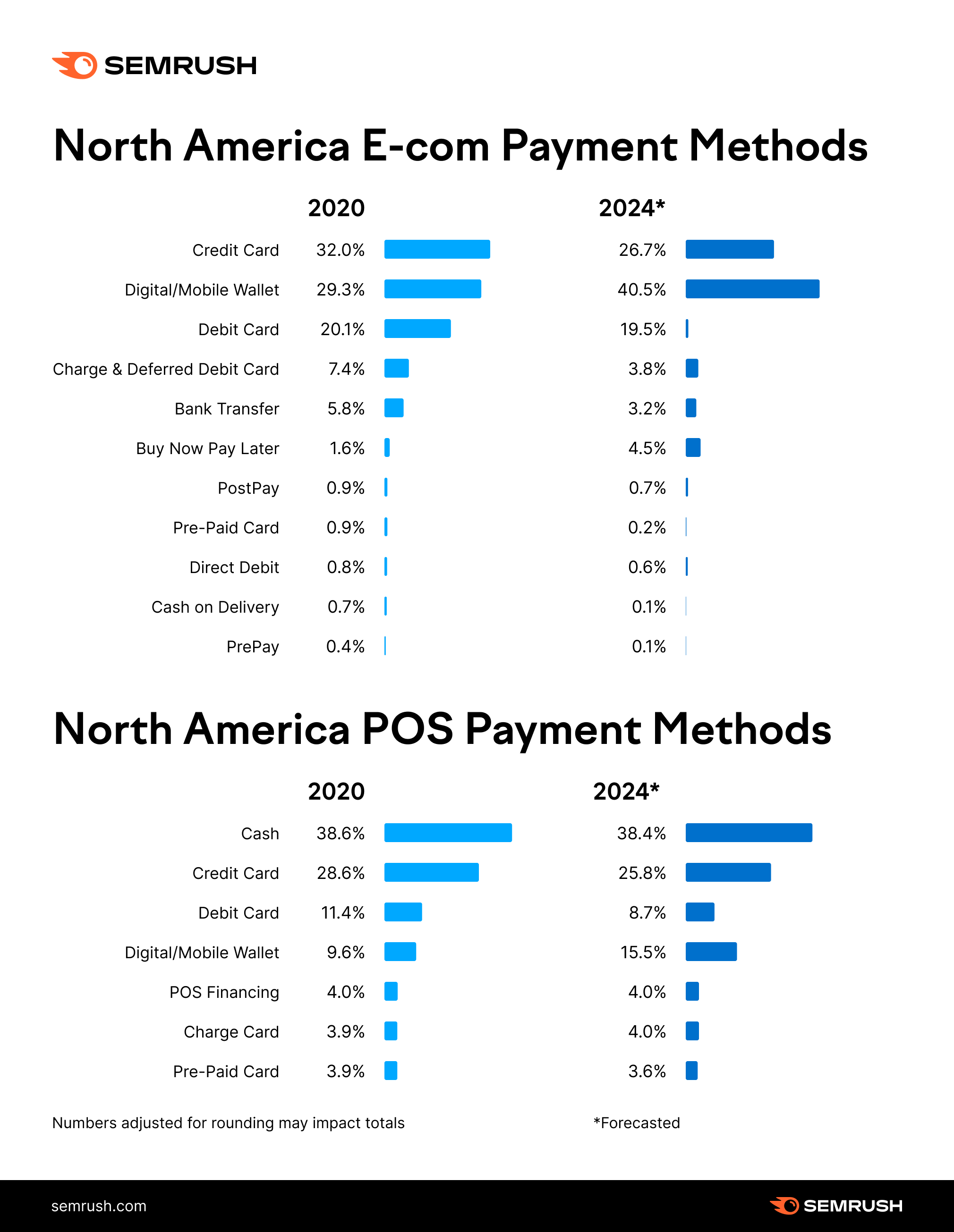

https://worldpay.globalpaymentsreport.com/en/And finally, North Americans still prefer their credit cards for payments, though this top payment method is projected to be taken over by digital and mobile wallets by 2024.

https://worldpay.globalpaymentsreport.com/en/

https://worldpay.globalpaymentsreport.com/en/Attempting to break into a new market without the proper research on payment methods can leave your audience without their preferred options. And when it comes to spending money, people like familiarity, so you definitely want to match your offerings to their accustomed methods of payment.

Determine Your Go-to-Market Funnel

With knowledge about the market and audience, you can start developing a marketing strategy that begins with the top funnel, and continues all the way to conversion.

As you do so, ask yourself the following questions:

How are consumers going to find you? How are they going to convert? How are you going to turn them into loyal customers?The best sales funnels attract new customers while fostering repeat business. Retaining customers remains far more lucrative than acquiring new ones.

As for awareness, consider a wide-ranging campaign to attract new people to your brand. This could include everything from digital and print materials to events.

Prepare a Marketing Strategy

What is a tried and tested method for preparing a marketing strategy? It begins with analyzing your competitors’ strategies. With the right tools, competitor analysis is not as overwhelming as it might seem.

Use Semrush Traffic Analytics to gain access to valuable insights about your competitors’ successes and failures.

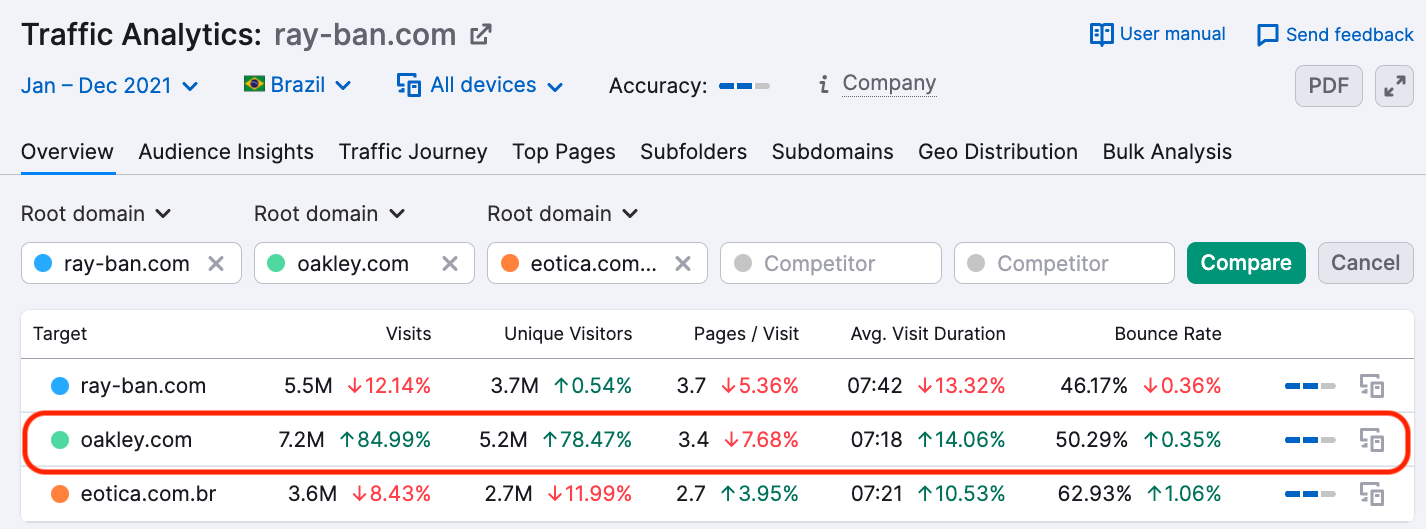

Let’s return to some top brands for sunglasses. We picked the top three eyewear brands in the Brazilian market.

Of the three selected brands, Oakley.com has seen the most significant growth in Brazil. Whatever they’re doing with their marketing, it’s working.

Over the last year, they saw a 78.47% increase in unique visitors. They’ve also limited the number of page views and lowered their bounce rate, meaning visitors are having an easier time finding what they want on the Oakley.com website.

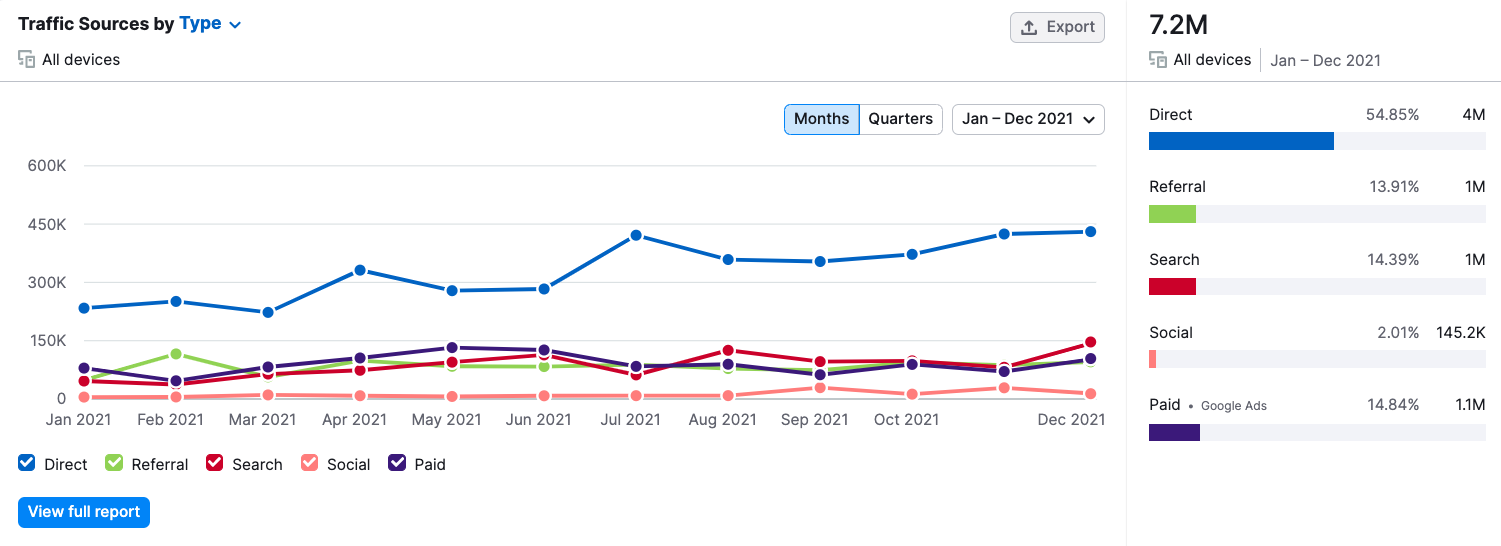

The Traffic Sources by Type graph can shed light on where Oakley is placing their marketing efforts. This graph reflects traffic sources to the Oakley website alone.

Oakley’s direct traffic is high, indicating a strong brand presence in Brazil. Perhaps more interesting from a marketing perspective, however, are their referral, social, search, and paid numbers.

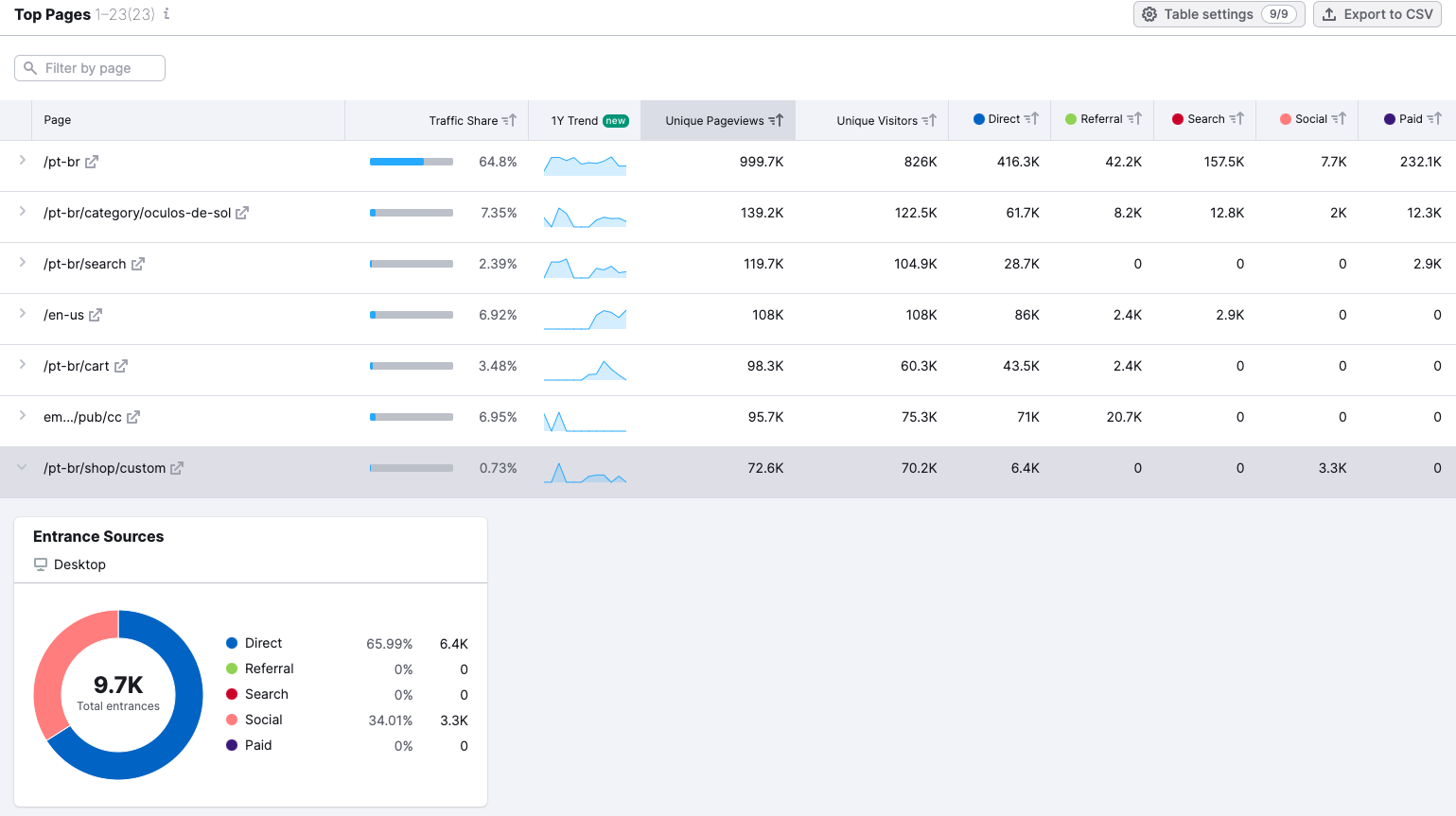

With the Top Pages report, you can drill down on your findings for more specific insights into Oakley’s winning marketing strategies.

For example, this page allowing customers to customize their sunglasses has done well in bringing in traffic from Social Media. From here you can look at the specific page to analyze your competitor’s marketing efforts.

This easy workflow is just one example of how .Trends traffic data can inform your marketing strategy. As you think about your purchase funnel and how you’re going to impact the market, you can leverage insights from competitors’ strategies and the current market to your advantage.

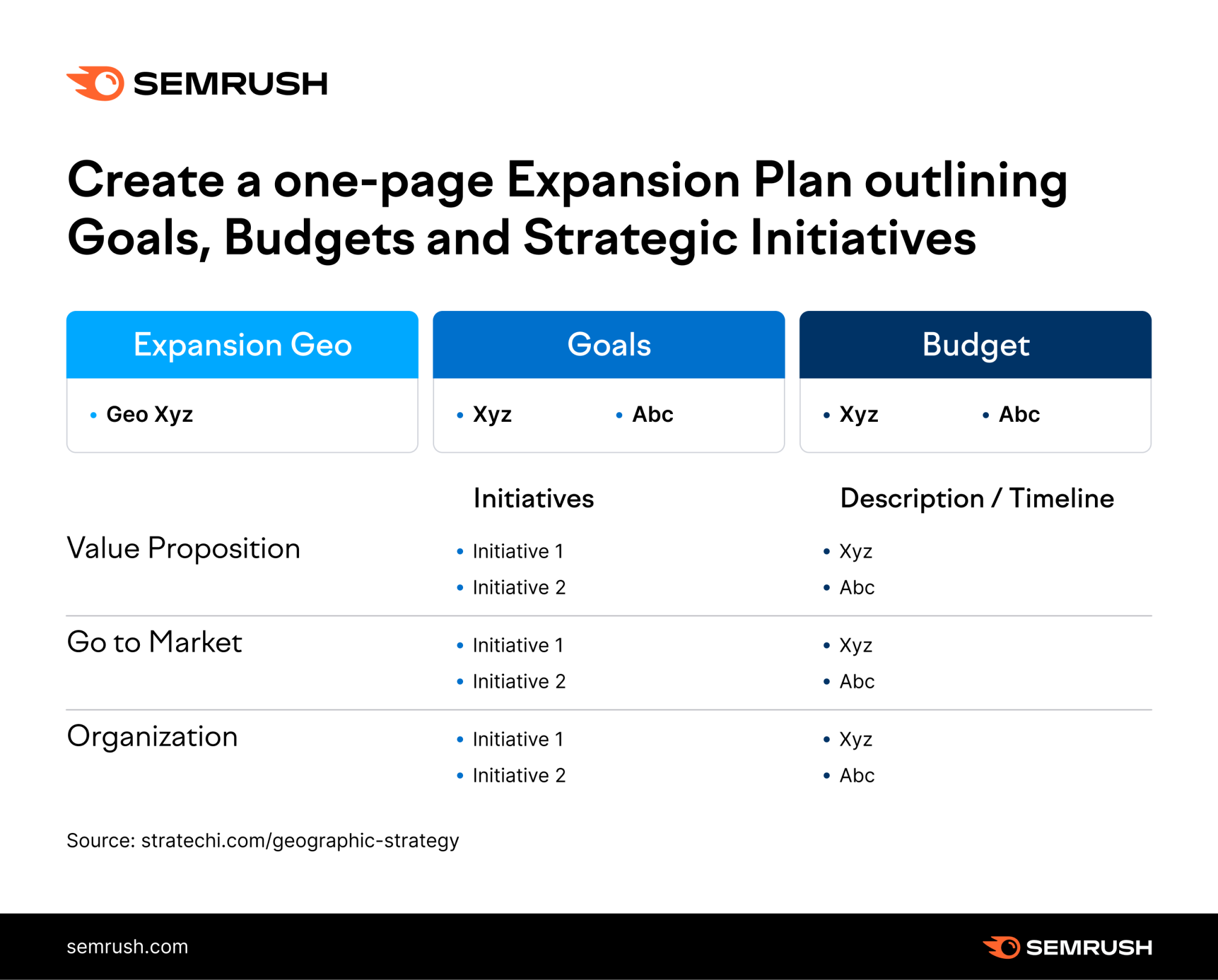

Create a One-Page Go-to-Market Plan

Now you can draw up a one-page action plan for market expansion.

You can develop your own go-to-market strategy template or use something like the one we’ve put together. No matter the format, make sure it includes:

Expansion GEO Goals Budget Your value proposition Go-to-market OrganizationBy organizing your approach in a one-page document, you can visualize initiatives and see timeline detailing at a glance.

How Can Data Help You Build a Stronger Market Strategy?

Your go-to-market strategy will take time to create. It requires plenty of research and digging to avoid the types of errors that have hit big brands such as Uber and Coke.

As you move forward with your plans to grow globally, make sure your decision is well-calibrated and data-driven. Assess the market you’re considering thoroughly, and don’t leave anything to chance. And use the elements mentioned in this article as a new market entry checklist to guide your expansion.

Are you ready to dive into the research necessary to develop a market expansion strategy? Learn more about how to estimate market potential through competitive landscape analysis.

Innovative SEO services

SEO is a patience game; no secret there. We`ll work with you to develop a Search strategy focused on producing increased traffic rankings in as early as 3-months.

A proven Allinclusive. SEO services for measuring, executing, and optimizing for Search Engine success. We say what we do and do what we say.

Our company as Semrush Agency Partner has designed a search engine optimization service that is both ethical and result-driven. We use the latest tools, strategies, and trends to help you move up in the search engines for the right keywords to get noticed by the right audience.

Today, you can schedule a Discovery call with us about your company needs.

Source:

![How to Build an Impeccable Go-to-Market Strategy [Checklist]](https://allinclusive.agency/uploads/images/how-to-build-an-impeccable-go-to-market-strategy-checklist.svg)