Key shifts in the financial services industry assessing the Impact of Covid-19

As some experts claim, the pandemic marks the shift from digital transformation to digital acceleration within the finance industry. While this poses some immediate challenges, the pandemic may also open up space for new opportunities and innovation.

To help businesses within the financial services industry make use of this unique backdrop for opportunities, we decided to assess how the industry addresses the shift from “respond” to “recover” and embraces the tremendous growth of digital.

Using a set of SEMrush tools, we have analyzed around 1,000 websites and billions of keywords (US data only for both) in fields ranging from banking, investment, and insurance to credit cards, audit and consulting, and financial advisors, as well as to get insights on:

The immediate effects of the pandemic on the financial services market in the US; and

Changes in consumer behavior, preferences, and demand patterns.

Slow But Steady: Growing Consumer Interest Market Leaders, Established Players and Game-Changers Top banks* Which Companies Are Leading the Digital Transformation? Top financial services companies* Impact on Ad Spend Landscape Top online advertisers Digital Advertising Patterns in Online Banking Most expensive keywords in online banking Impact on Consumer Interest and Demand The Portrait of a Typical Financial Services Online Consumer Shifts in Consumer Attitude Towards Owing Money Most searched types of loans during the pandemic Demand for Credit Cards Most searched credit cards during the pandemic Consumer Attitude Towards Mortgages How the ‘New Consumer’ Perceives Money-Saving and Investments Peaking Interest in Stocks It’s Not Just About the Stock Market Replotting the Post-Pandemic Digital StrategiesSlow But Steady: Growing Consumer Interest

With banks and other financial institutions closing up branches and consumers trying to comply with social distancing and stay-at-home orders, online has become the last resort for many, if not all, consumers seeking financial services.

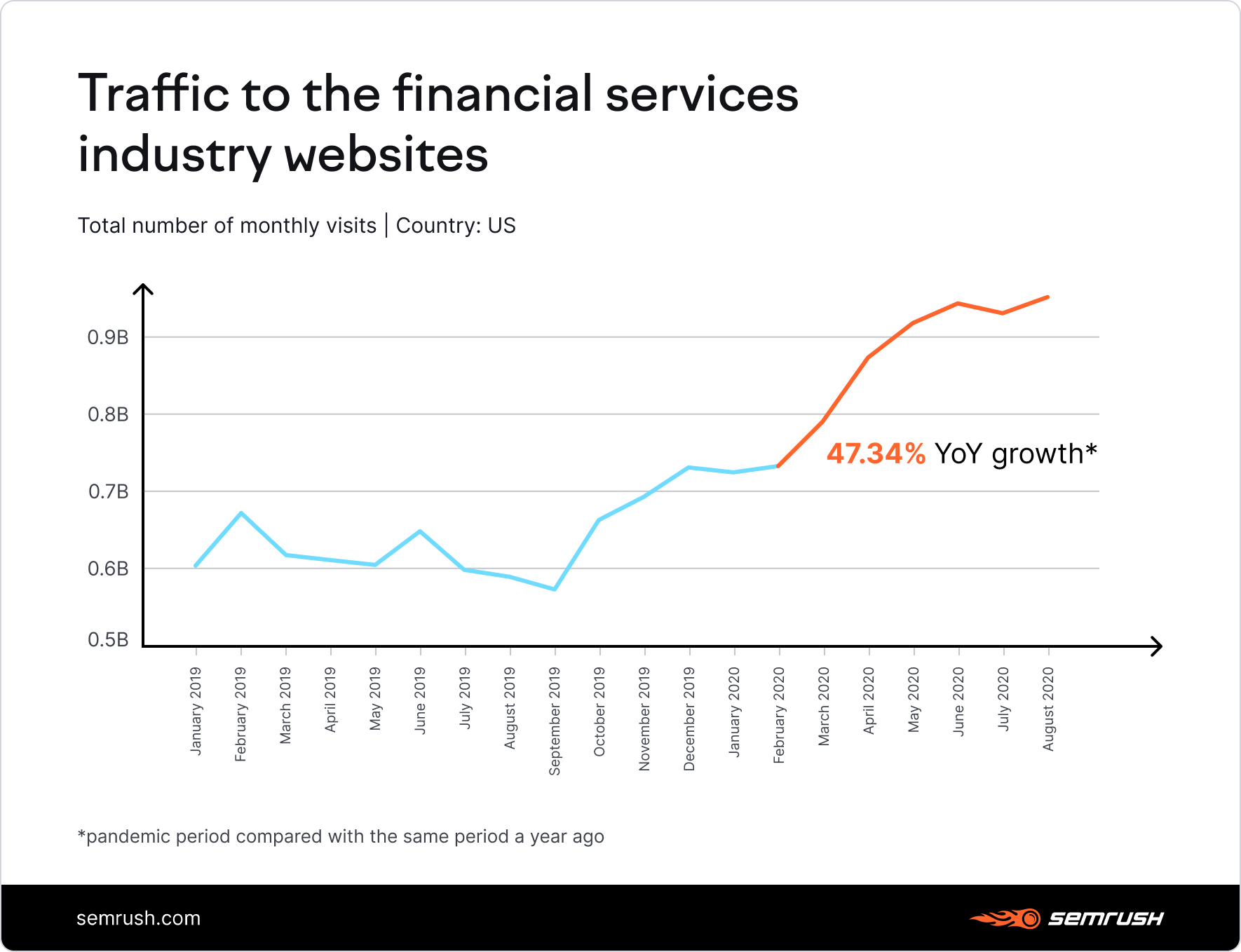

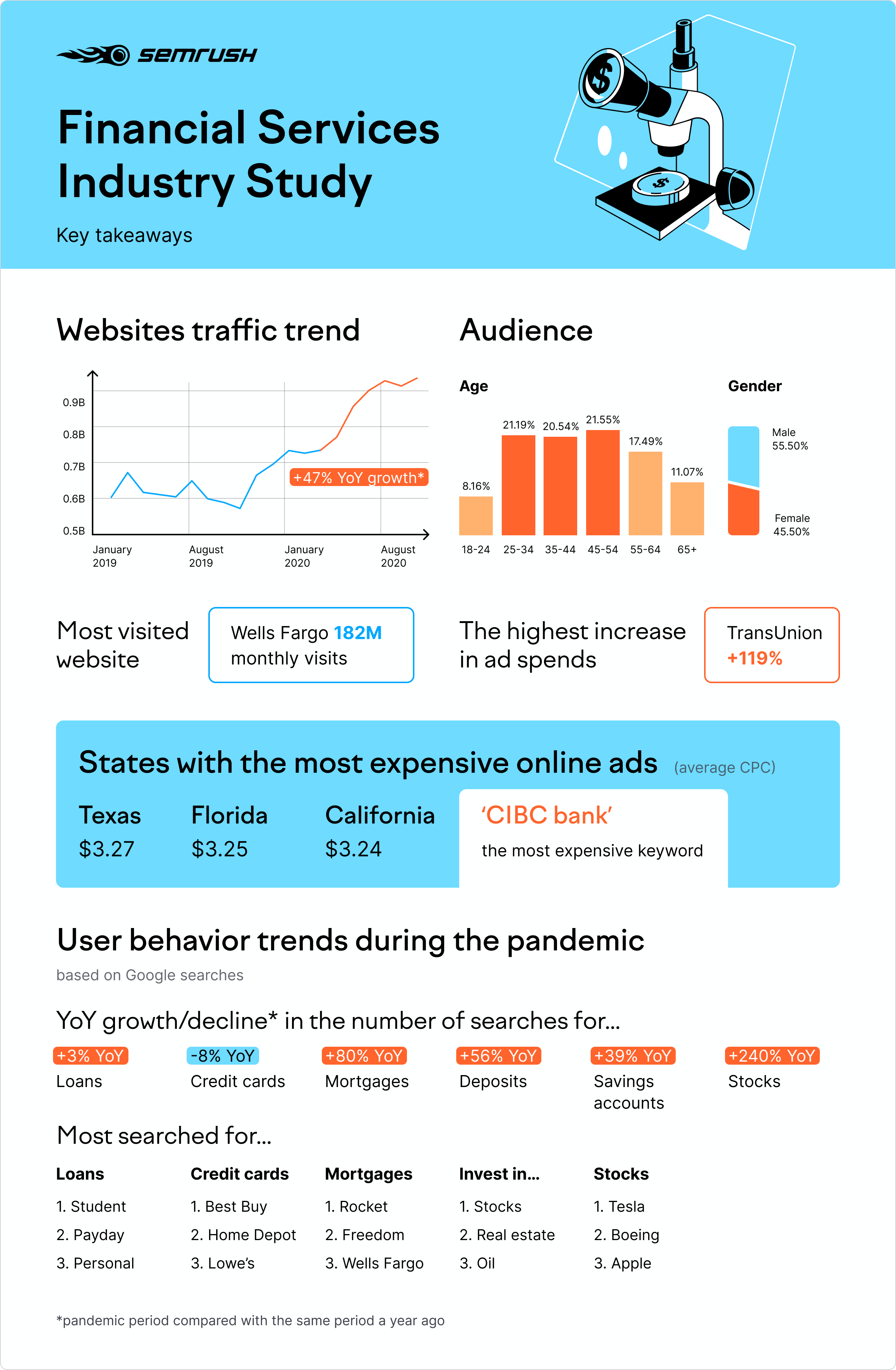

We are seeing a slow yet steady growth of online searches for financial service companies six months into the pandemic, with the average growth volume at 47%. The ongoing reopening of offline services and less talk about the second wave of the pandemic across the US have not slowed down the increase.

Market Leaders, Established Players and Game-Changers

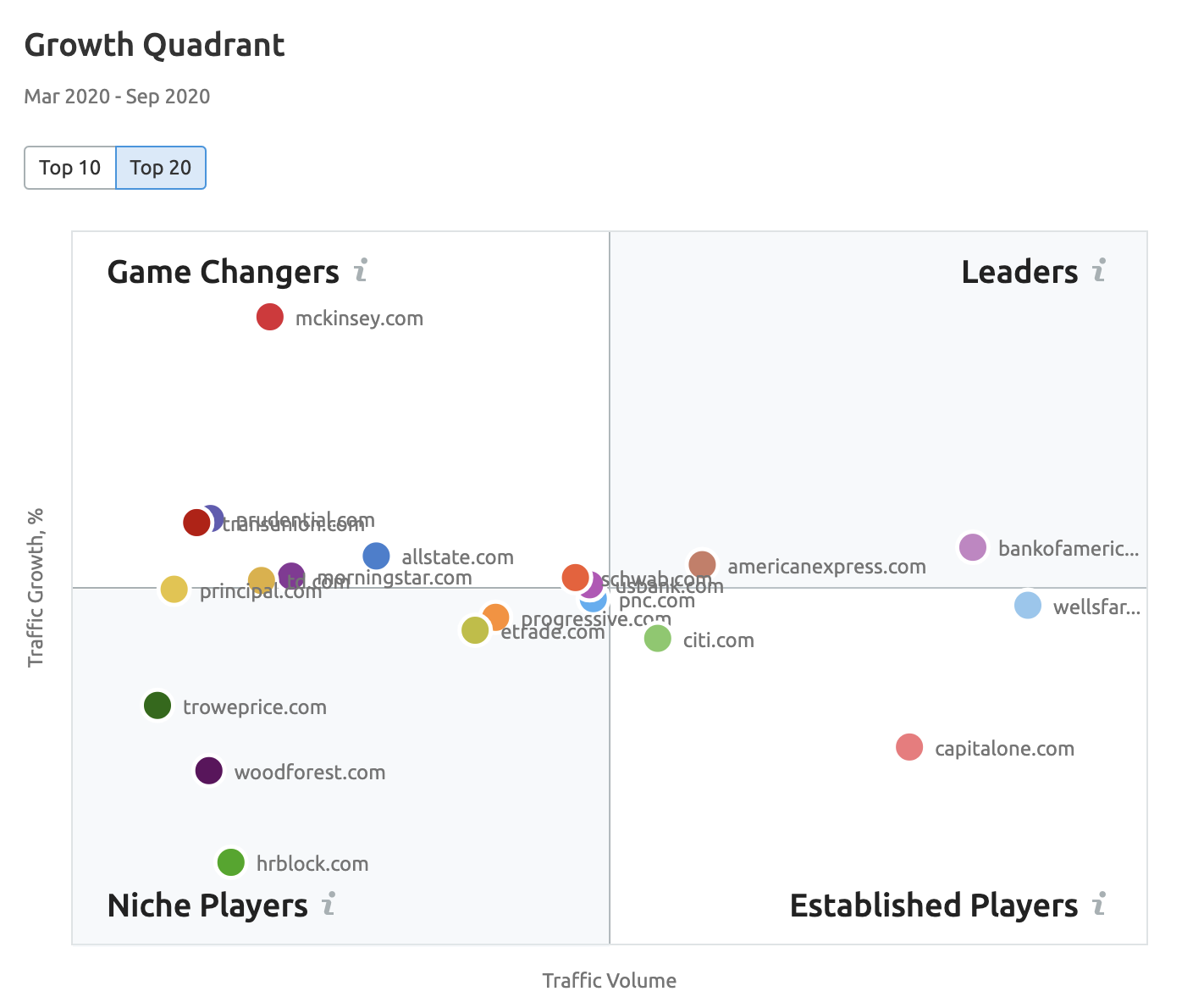

Using our Market Explorer tool, we looked at the general digital market landscape within the American financial industry to get an idea of how industry players stand against each other in the digital realm:

The leaders’ niche is taken by the established US banking brands, members of the banking Big Four - JPMorgan Chase, Wells Fargo, Citi, and Bank of America.

Inherently, digital, review and comparison platforms like Bankrate and Wallethub are, of course, leading the digital transformation in the financial services market, being the top industry game-changers.

Top banks*

Website traffic

1

wellsfargo.com

182,287,395

2

bankofamerica.com

156,391,674

3

capitalone.com

128,507,034

4

americanexpress.com

65,552,730

5

citi.com

44,092,837

6

usbank.com

39,329,326

7

pnc.com

38,757,002

8

td.com

11,024,355

9

woodforest.com

7,191,563

10

merrickbank.com

4,455,499

11

hsbc.com

3,837,733

12

scotiabank.com

3,823,464

13

jpmorgan.com

3,003,137

*by traffic received

Which Companies Are Leading the Digital Transformation?

Generally, when looking at the list of financial service companies that are hitting the highest numbers for consumer interest online, established banks like Wells Fargo, Bank of America, and Capital One are ahead of any competition. Yet, despite low consumer confidence and high financial stress and sensitivity, investing and trading services are managing to attract relatively high consumer interest during the pandemic.

Top financial services companies*

Website traffic

1

wellsfargo.com

182,287,395

2

bankofamerica.com

156,391,674

3

capitalone.com

128,507,034

4

americanexpress.com

65,552,730

5

citi.com

44,092,837

6

schwab.com

41,899,083

7

usbank.com

39,329,326

8

pnc.com

38,757,002

9

etrade.com

28,802,470

10

progressive.com

28,385,846

11

allstate.com

17,387,398

12

td.com

11,024,355

13

morningstar.com

10,356,010

14

mckinsey.com

9,437,388

15

hrblock.com

9,023,341

16

prudential.com

7,235,844

17

woodforest.com

7,191,563

18

transunion.com

5,787,128

19

principal.com

5,719,069

20

troweprice.com

5,178,855

21

morganstanley.com

4,652,405

22

metlife.com

4,641,433

23

merrickbank.com

4,455,499

24

aflac.com

4,262,862

25

travelers.com

4,257,217

26

cmegroup.com

4,172,019

27

ubs.com

4,025,288

28

ameriprise.com

3,872,162

29

hsbc.com

3,837,733

30

scotiabank.com

3,823,464

*by traffic received

Impact on Ad Spend Landscape

Top online advertisers

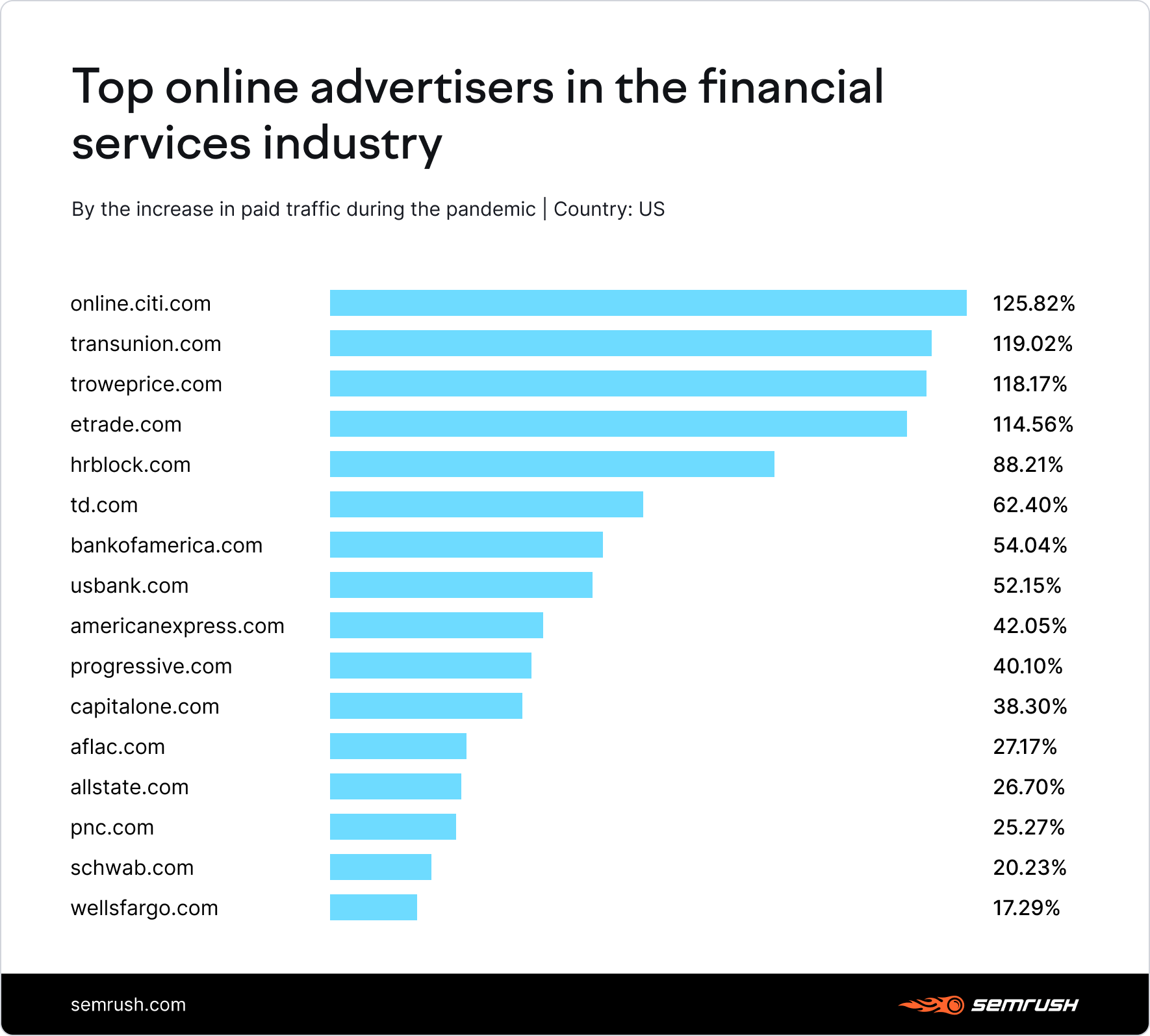

As Covid-19 has pushed many consumers to reassess the way they approach their personal finances and how they bank, industry players are spending big and continuing to increase the number of ad dollars spent, despite the overall decline in digital ad spend during the pandemic.

Without a physical location to visit, consumers became increasingly interested in online banking. And we expected to see big banking names among the top brands that increased their digital ad budgets.

However, it is mainly the credit score checking, investment, and trading firms that started to spend more on digital ads during the Covid-19 pandemic, with some companies like TransUnion and T. Rowe Price doubling their digital ad expenditures.

Digital Advertising Patterns in Online Banking

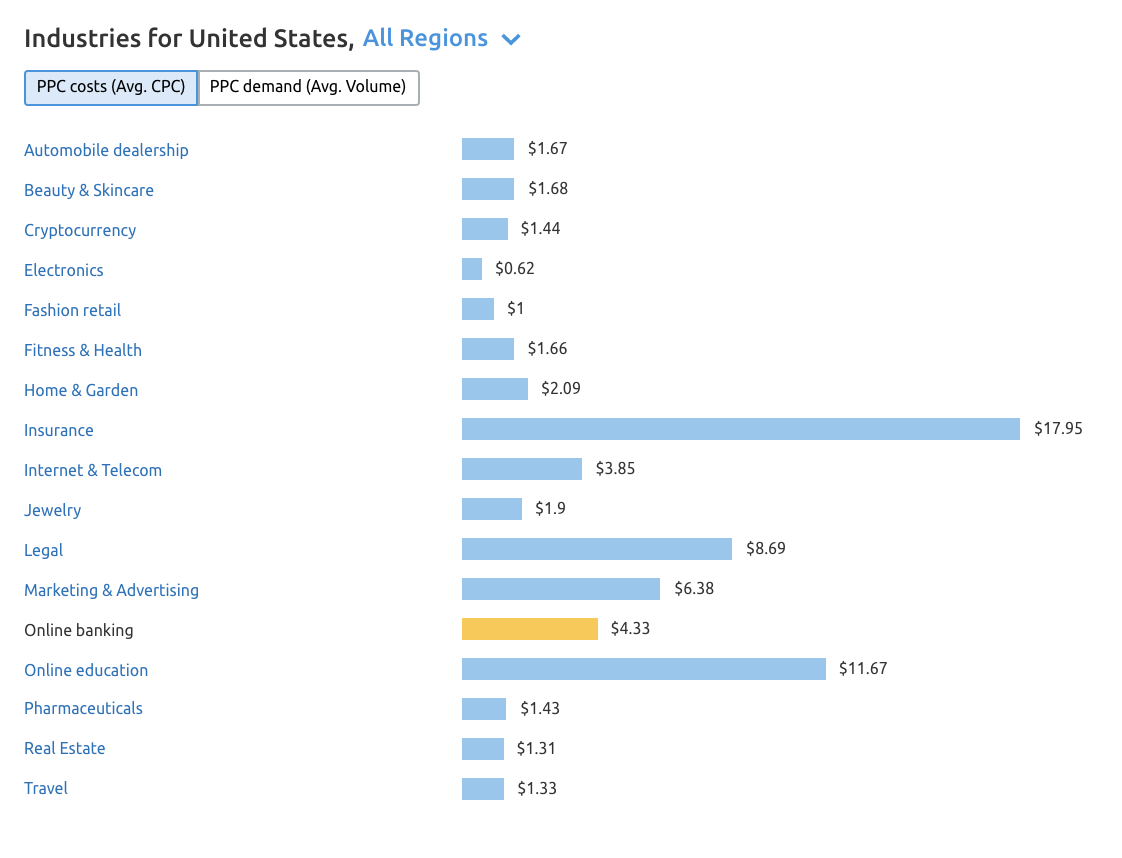

One of the possible reasons why we didn’t see dramatic spikes in ad spend from banks is that banking is one of the most competitive and expensive industries for online advertising.

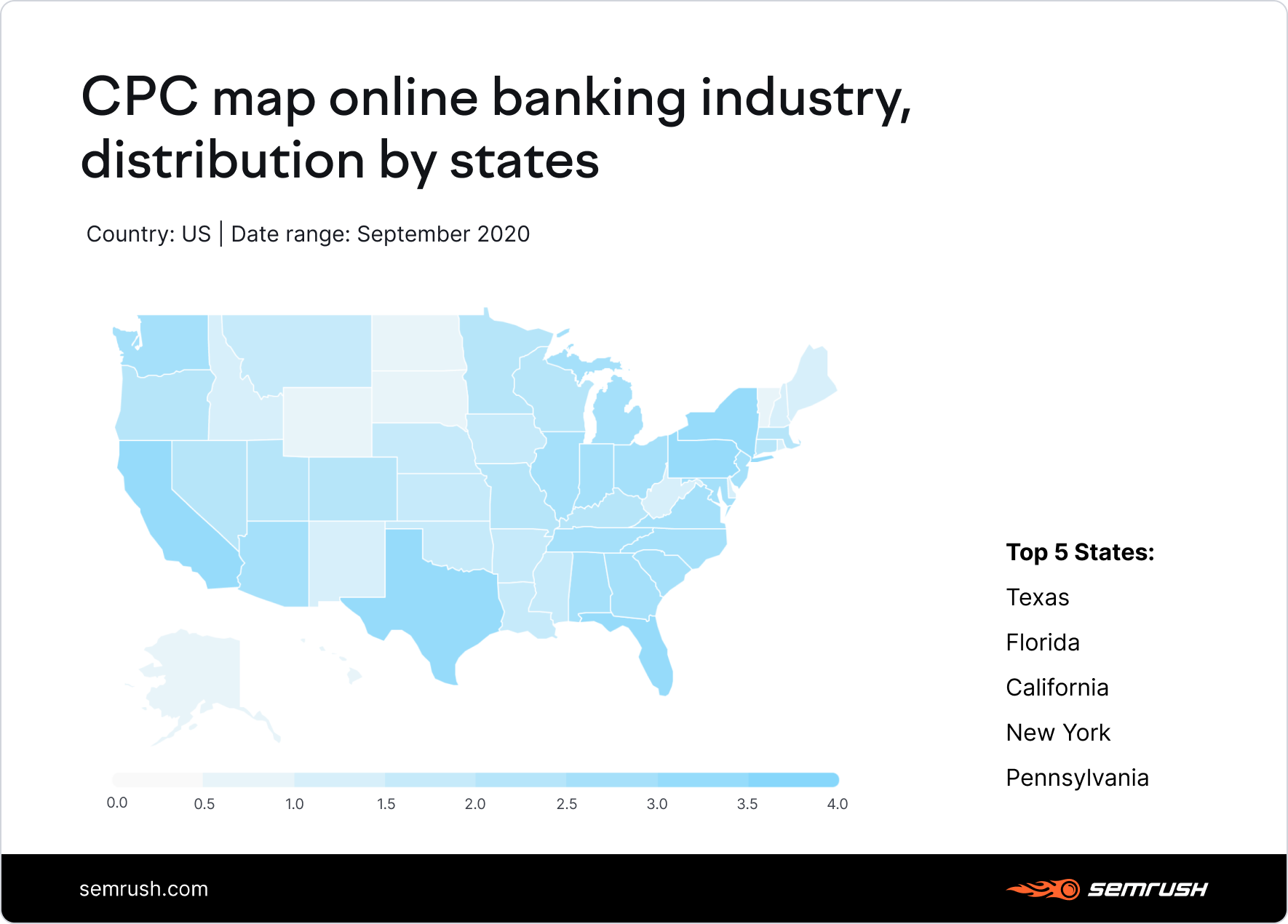

Looking at SEMrush’s CPC Map, we see that advertisers within the online banking niche would need to allocate larger ad budgets to reach users living in the wealthiest Southern states (Texas, Florida, and California), as well as East Coast states like New York and Pennsylvania.

However, comparing YoY CPC data, we can see that advertising costs across most states (27 out of 51) have decreased since the beginning of the pandemic, with an average decline of 15%.

The full CPC breakdown by US states can be found in the image below, but just notice the range here: if Texas’s average CPC within online banking is at a whopping $3.27, targeting a South Dakota resident will already cost 80% less.

US

Region's

avg CPC (USD)

Texas

3.27

Florida

3.25

California

3.24

New York

3.14

Pennsylvania

3.00

South Carolina

2.92

North Carolina

2.91

Maryland

2.88

Illinois

2.84

Michigan

2.80

States that saw the most dramatic CPC costs decrease are South and North Dakota (-52% and -44%), Georgia (-38%), and Texas (-36%).

Ad costs are also determined by what keywords the advertiser is competing for. And, once again, when it comes to keyword costs, online banking shows some overwhelming numbers.

Most expensive keywords in online banking

Top words

CPC (USD)

Volume

cibc bank

138.87

8100

cibc online banking

27.45

6600

apply for checking account online

23.80

1300

open checking account online

23.58

12100

bank account online application

22.11

90

get a bank account online

20.31

880

online checking account

19.96

9900

sign up for bank account online

19.70

1000

apply for bank account online

19.37

1600

checking account application

18.95

110

To our surprise, the most expensive keywords within the online banking niche across the US are related to a Canadian bank, CIBC. CIBC's branded keyword hits a whopping $139 mark.

The next high-cost set of keywords are all about checking accounts, which signals the rising popularity of digital banking.

Impact on Consumer Interest and Demand

Most of the market changes we spotted above have to do with shifts in consumer interests and demand. The post-pandemic ‘new consumer’* defines the new market realities, and businesses have to understand this ‘new consumer’ before attempting to adapt to the ‘new normal’.

* With widespread talks about the ‘new customer’ or ‘new consumer’, we decided to look into the exact features of online behavior to uncover what’s actually so ‘new’ about the financial services’ target persona. Our findings are reflected below.

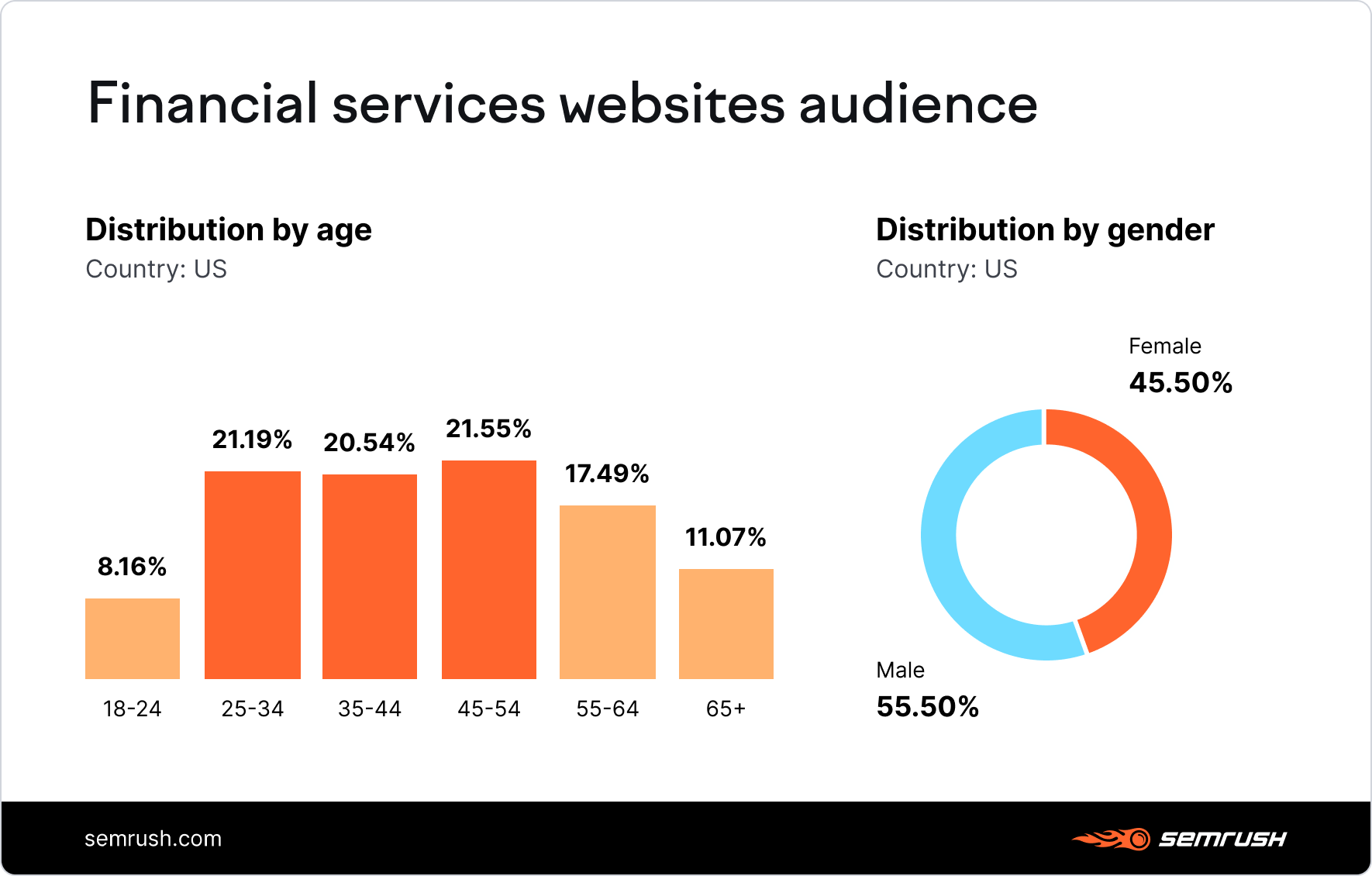

The Portrait of a Typical Financial Services Online Consumer

Before evaluating what changed within consumer preferences in regard to financial services, let’s look at what the typical online user seeking financial services might look like:

Most likely, financial service companies are supposed to appeal to a 25-54-year-old male.

Shifts in Consumer Attitude Towards Owing Money

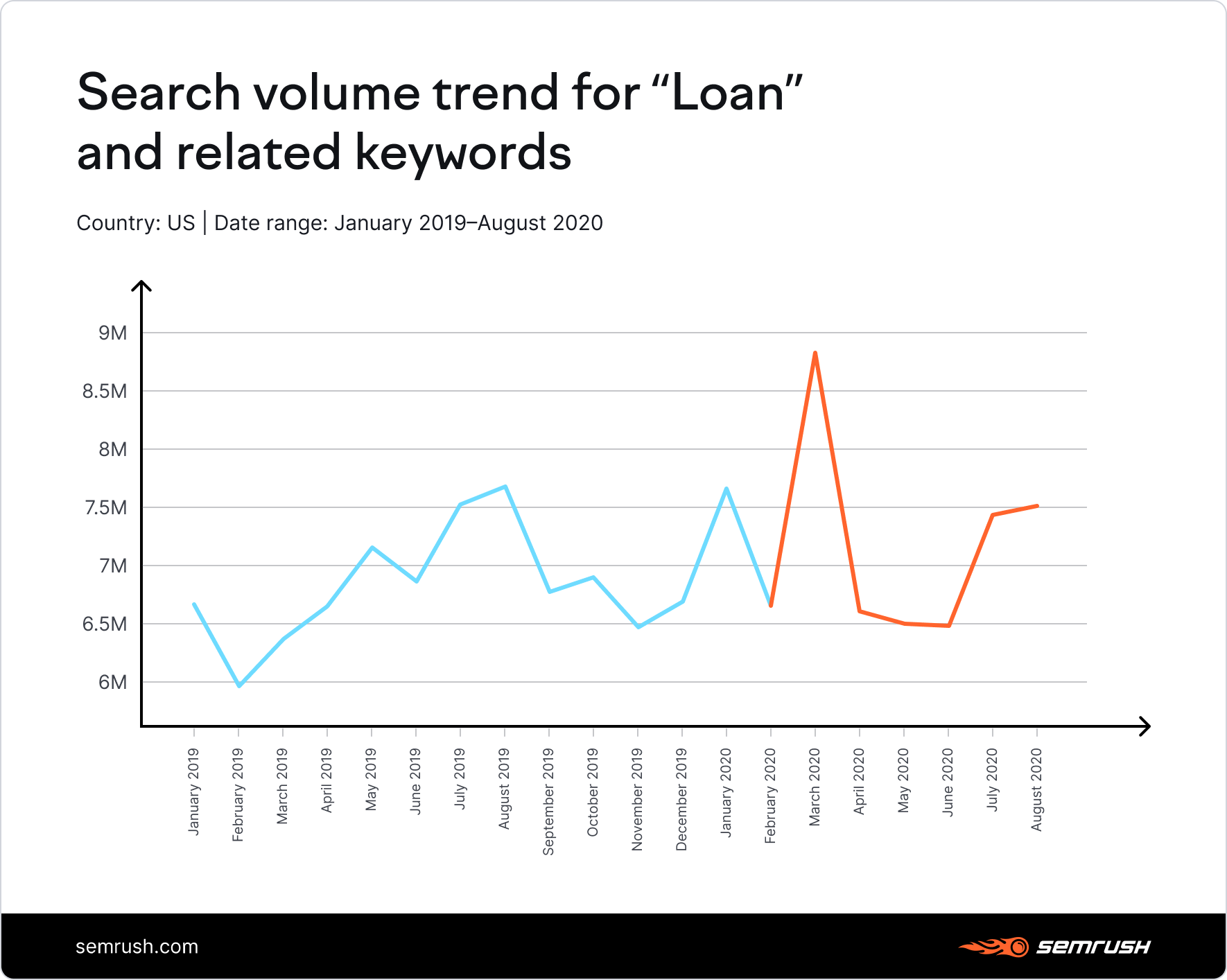

Surprisingly, since the beginning of the coronavirus crisis, the number of searches for loans didn’t peak dramatically. With a slight decrease in searches for loans at the very beginning of the pandemic, the interest in loans stabilized later on at average annual numbers of 7 million searches.

It seems like Government-issue stimulus checks (the most trending search query in the US throughout 2020) have done their part in maintaining consumer financial confidence: we can see a slight increase in searches for loans when talk about the end of stimulus checks flooded the media.

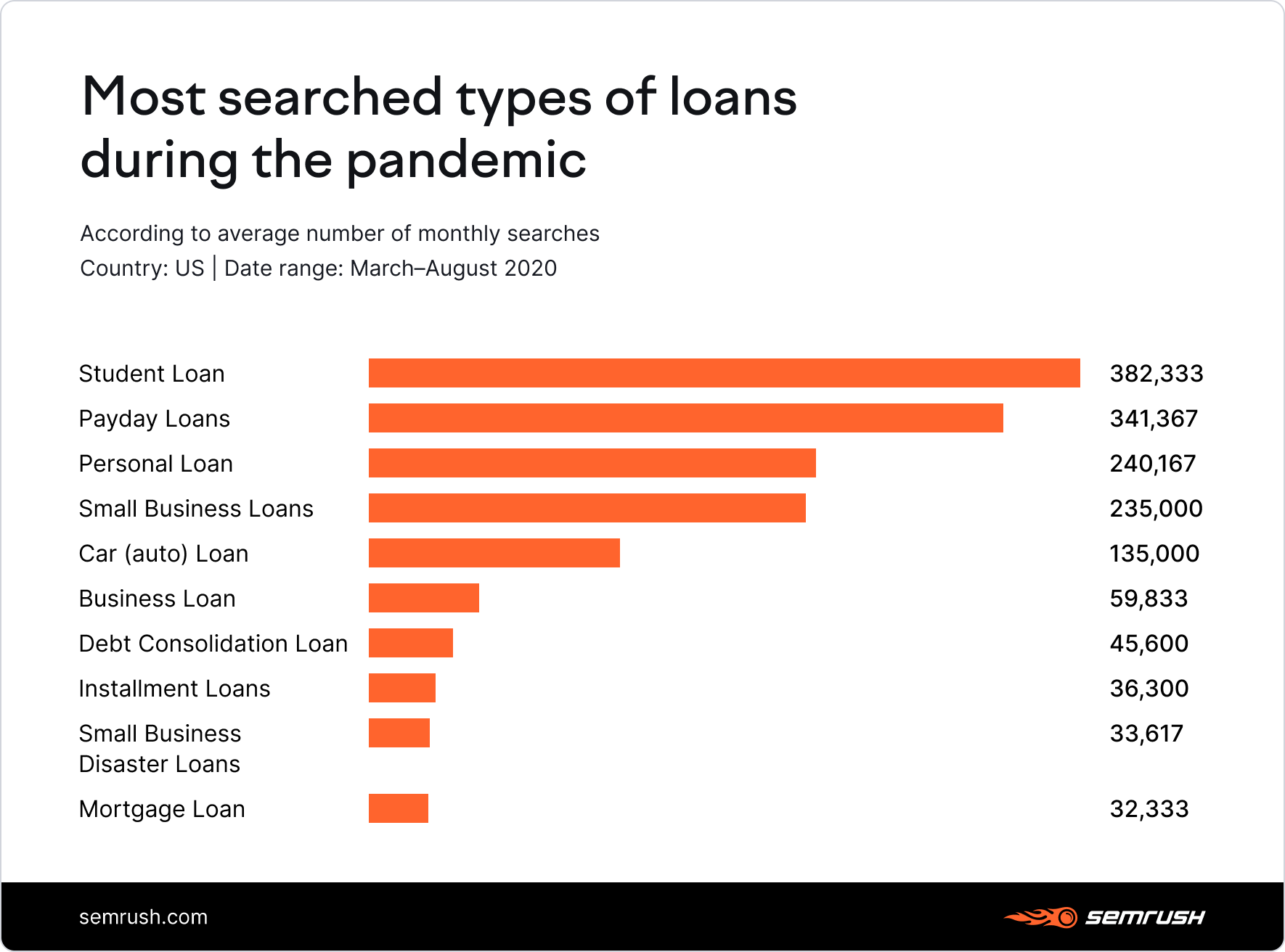

Most searched types of loans during the pandemic

Student loan searches are topping the list of most searched types of loans:

Although payday loans come in as the second most popular searched types of loans, their online demand has actually decreased by around 50%, despite the lockdown and historic low unemployment rates.

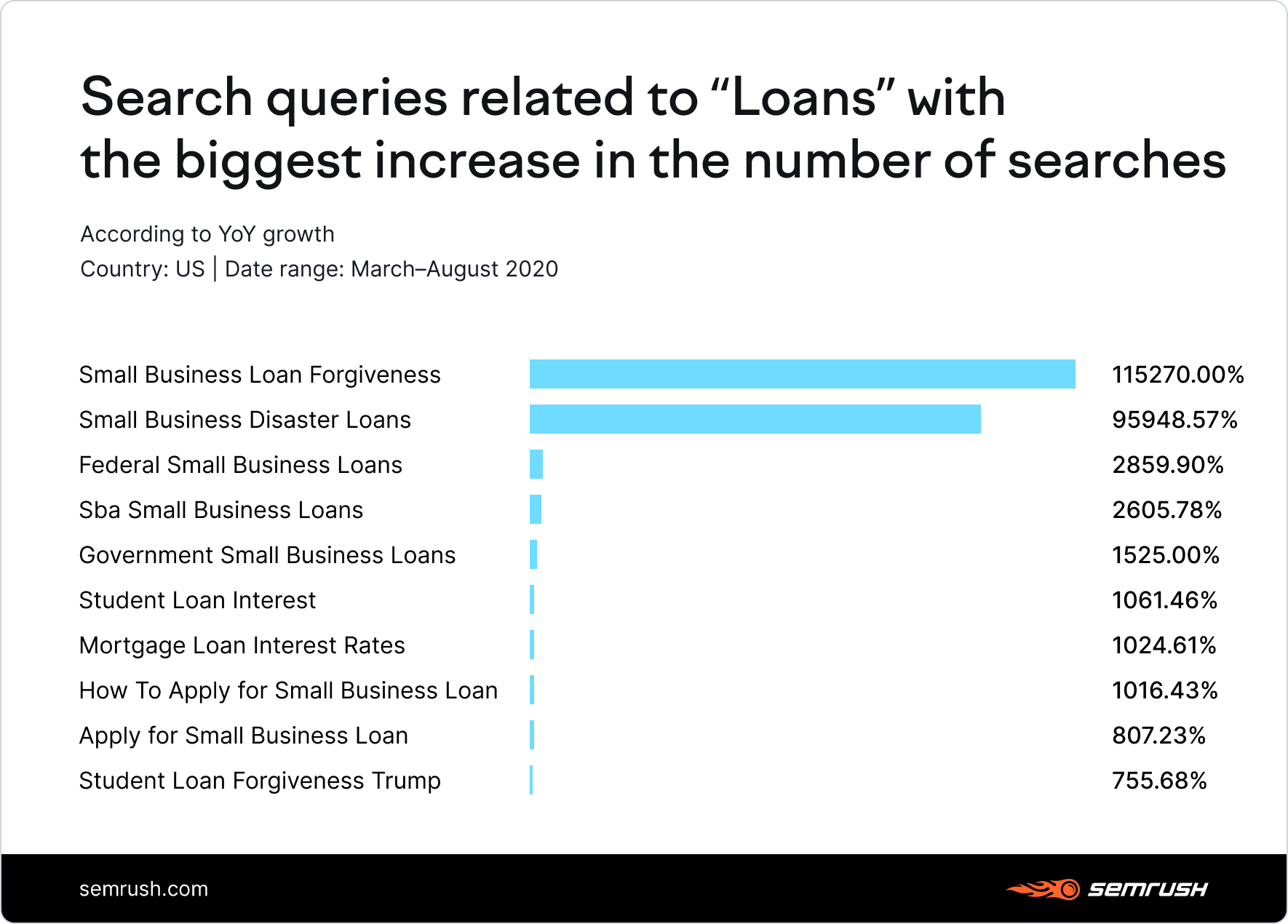

Small business forgiveness loans are getting the biggest spikes in online demand, with online searches growing by a whopping 115,270% at the time of the pandemic.

The biggest increase in searches for the following keywords related to loans:

Yet while some business owners are looking for small business loan forgiveness, others are actively seeking such loans, with an impressive 3,000% rise in searches for federal or other types of small business loans.

Demand for Credit Cards

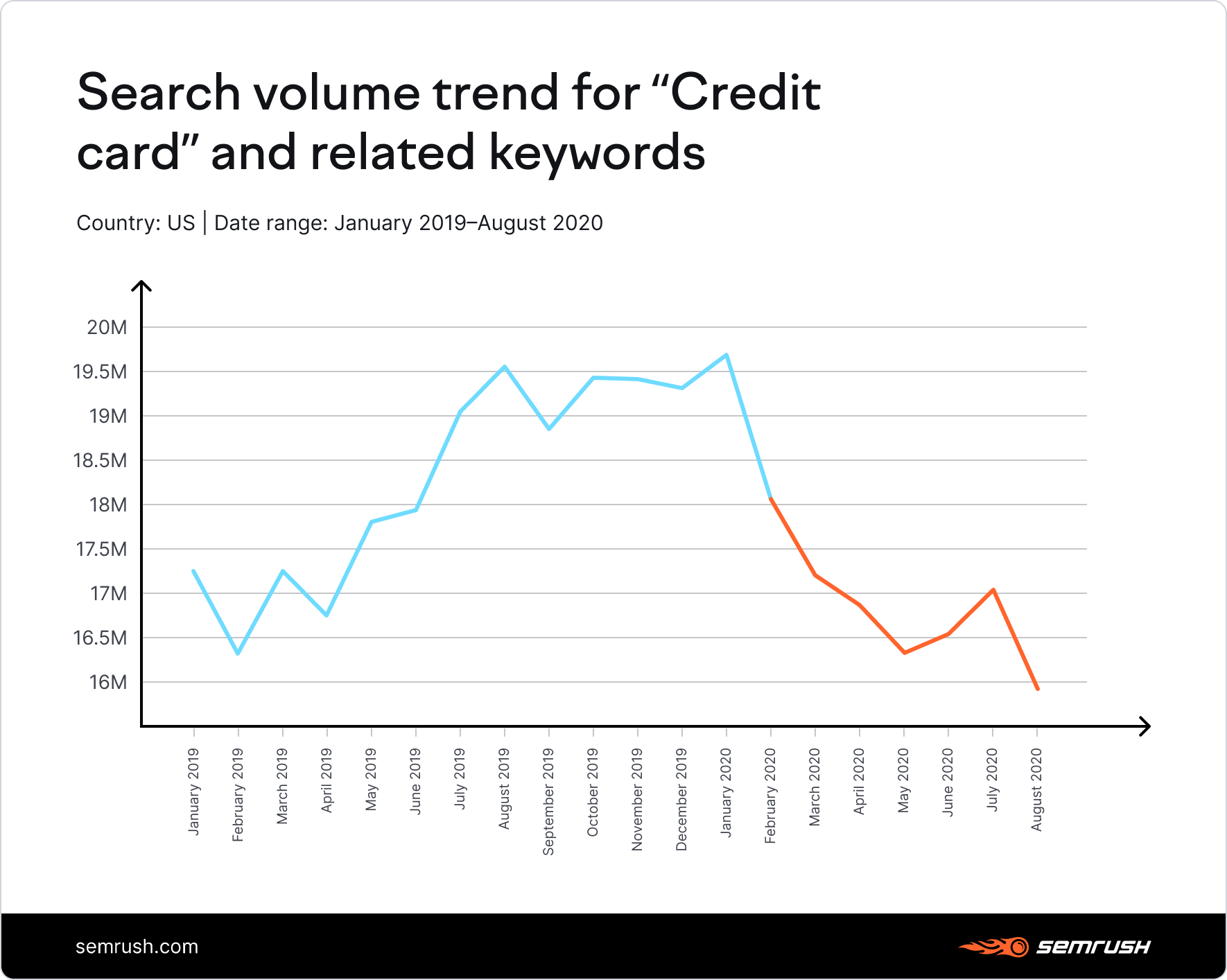

With credit cards comprising a big part of any American’s personal finance, the demand for them hasn’t gone up throughout the pandemic.

In fact, the rise in online searches for credit cards emerging in late 2019 / early 2020 has now slowed down and is back to pre-July 2019 levels.

Most searched credit cards during the pandemic

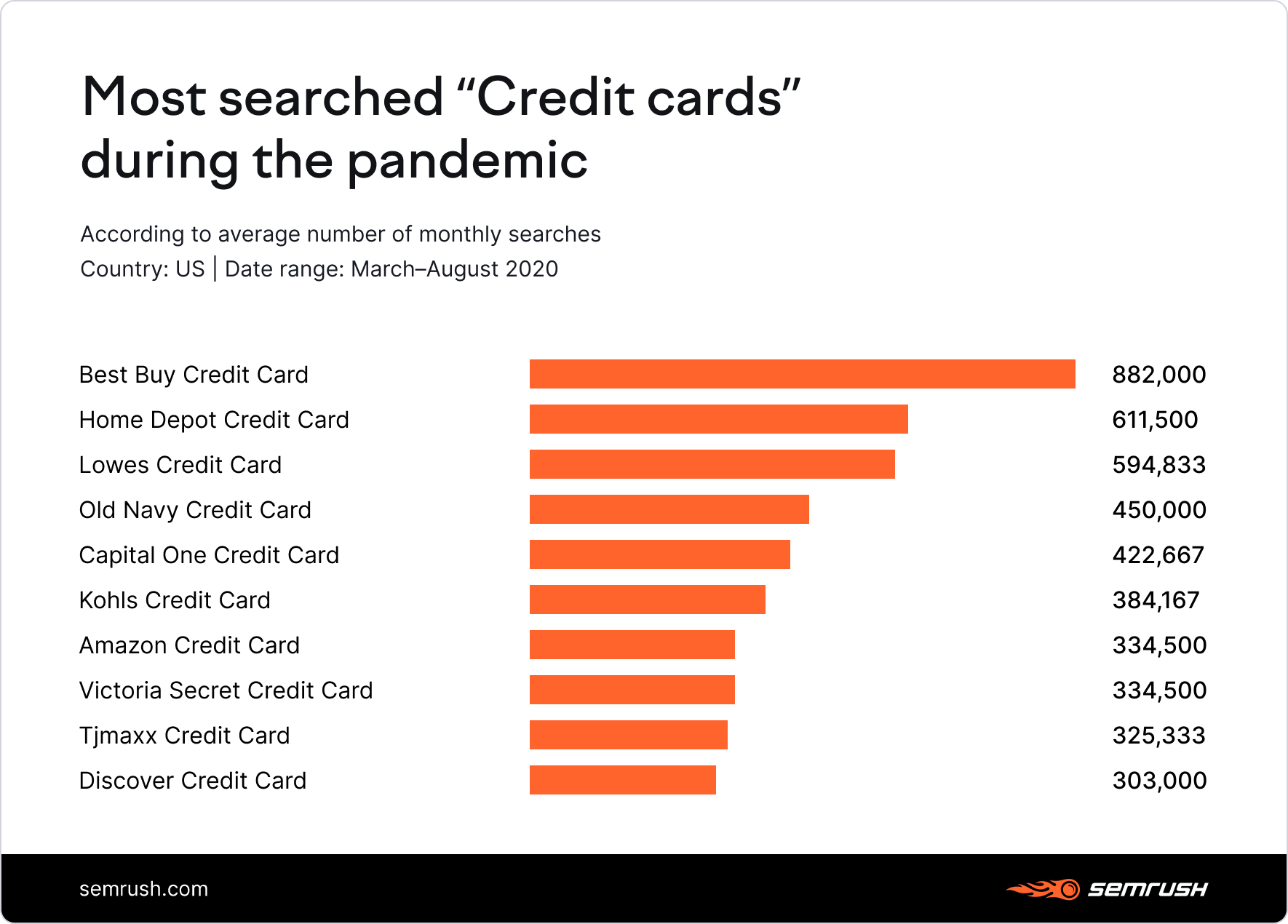

We spotted that, during the pandemic, it is not big bank credit cards that are attracting the most interest of American consumers; it is good old retail credit cards that are leading the way.

BestBuy, Home Depot, and Lowe’s credit cards are the three most searched ones within the entire credit card niche:

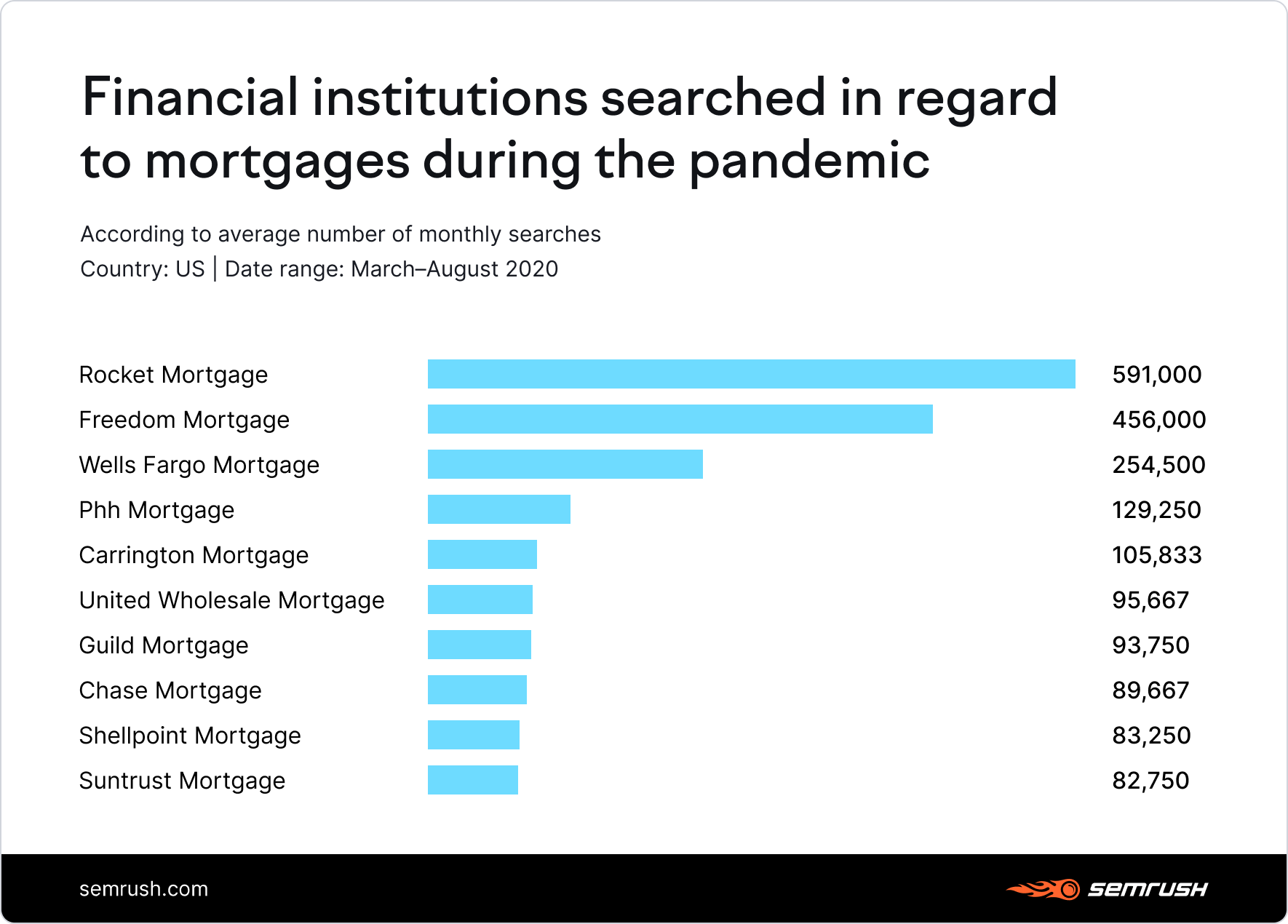

Consumer Attitude Towards Mortgages

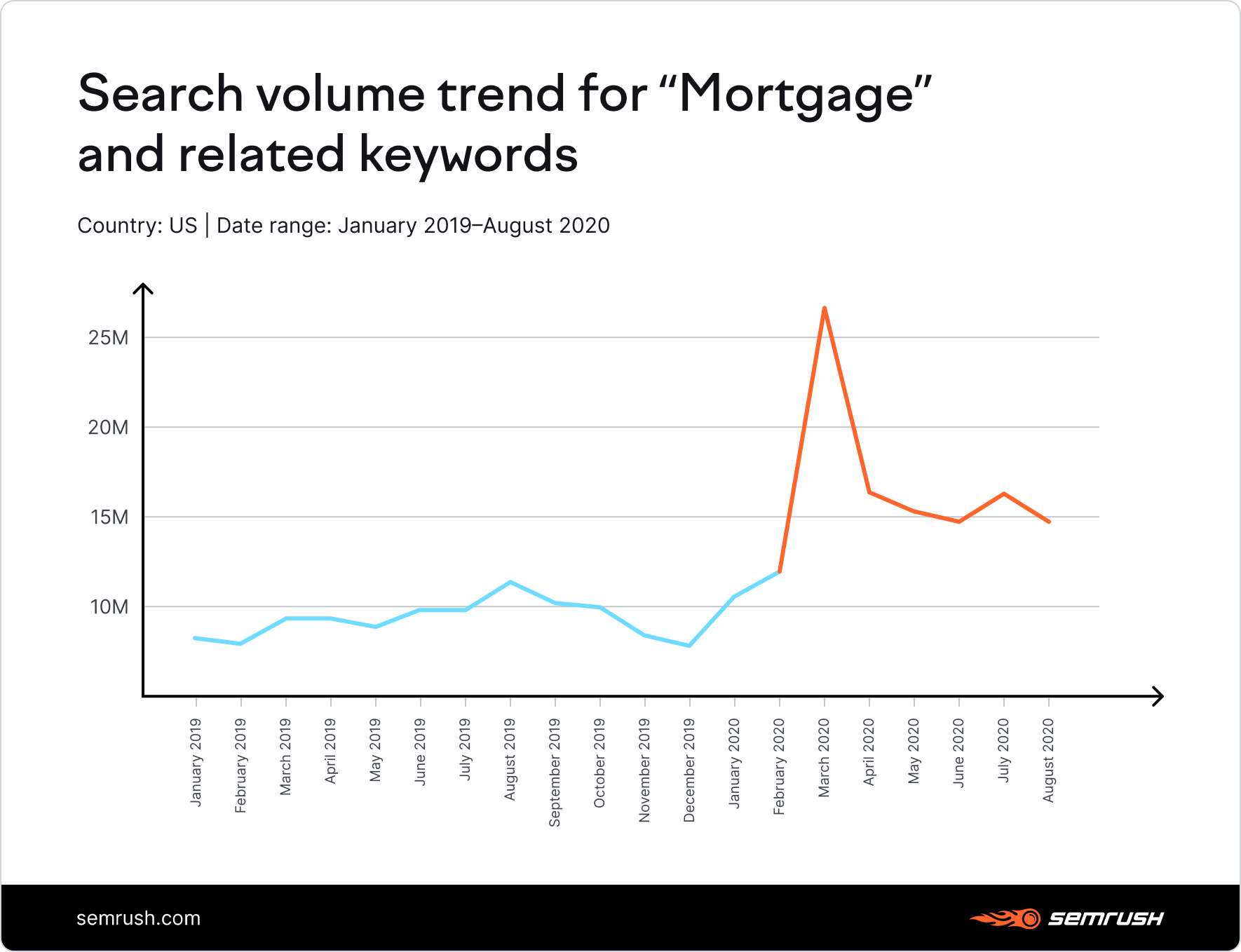

Now, with the incredible housing market boom, the overall YoY increase in online searches for mortgages is at 80%.

Back in March 2020, just at the start of the pandemic, when the Fed announced a dramatic slash of interest rates down to zero, online searches for mortgages grew by 125%.

Below is a list of financial institutions Americans look up online in regard to mortgages:

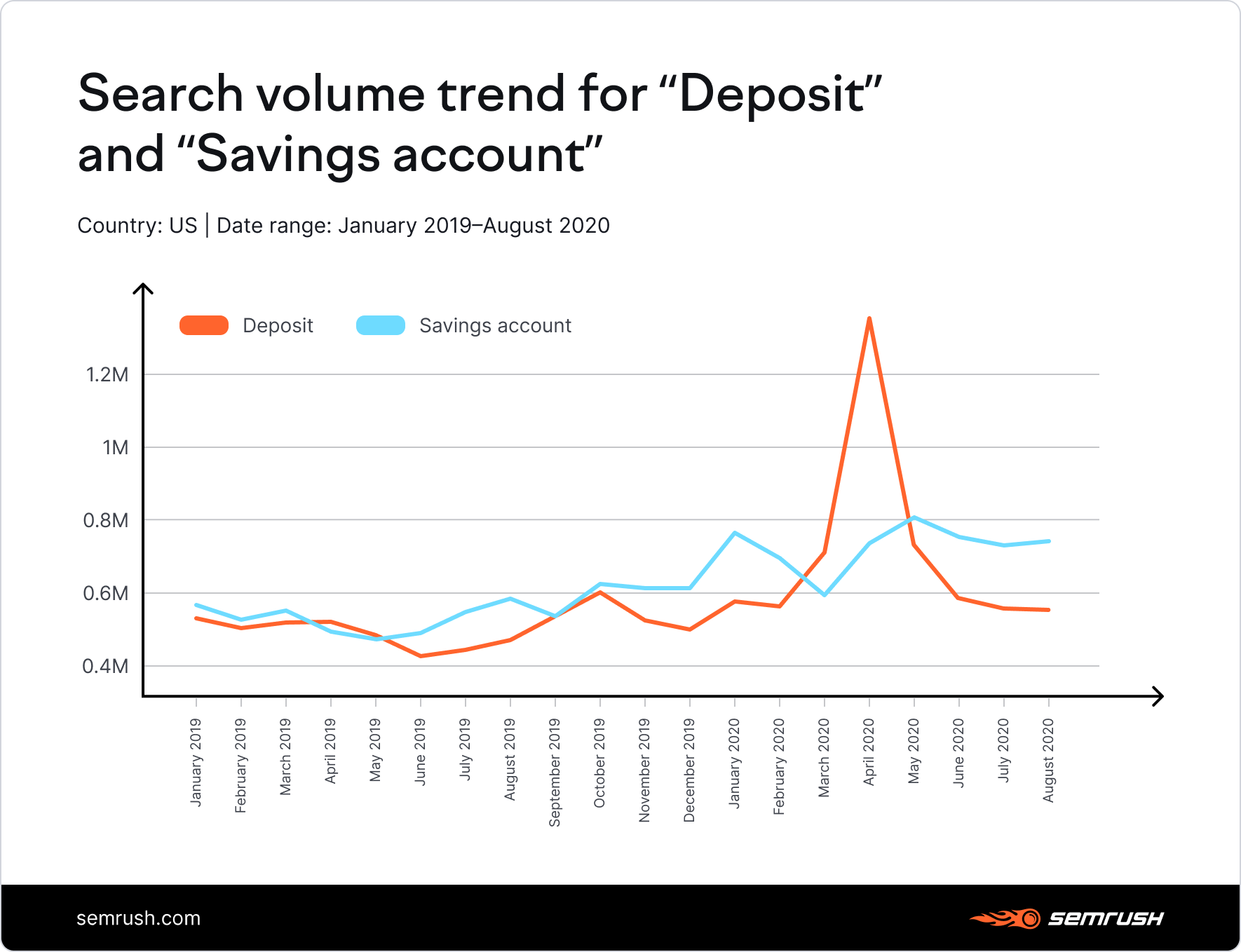

How the ‘New Consumer’ Perceives Money-Saving and Investments

If the ‘spend, spend, spend’ motto has often been perceived as a solution to any economic and financial crisis in the US, the ‘new consumer’ might disagree.

In the midst of the pandemic, the interest in deposits and savings accounts marked by online searches for these terms showed a threefold increase (only in April 2020 for deposits).

However, with the emerging stock market bonanza, consumer interest in stocks has picked up and searches for savings and deposits have decreased.

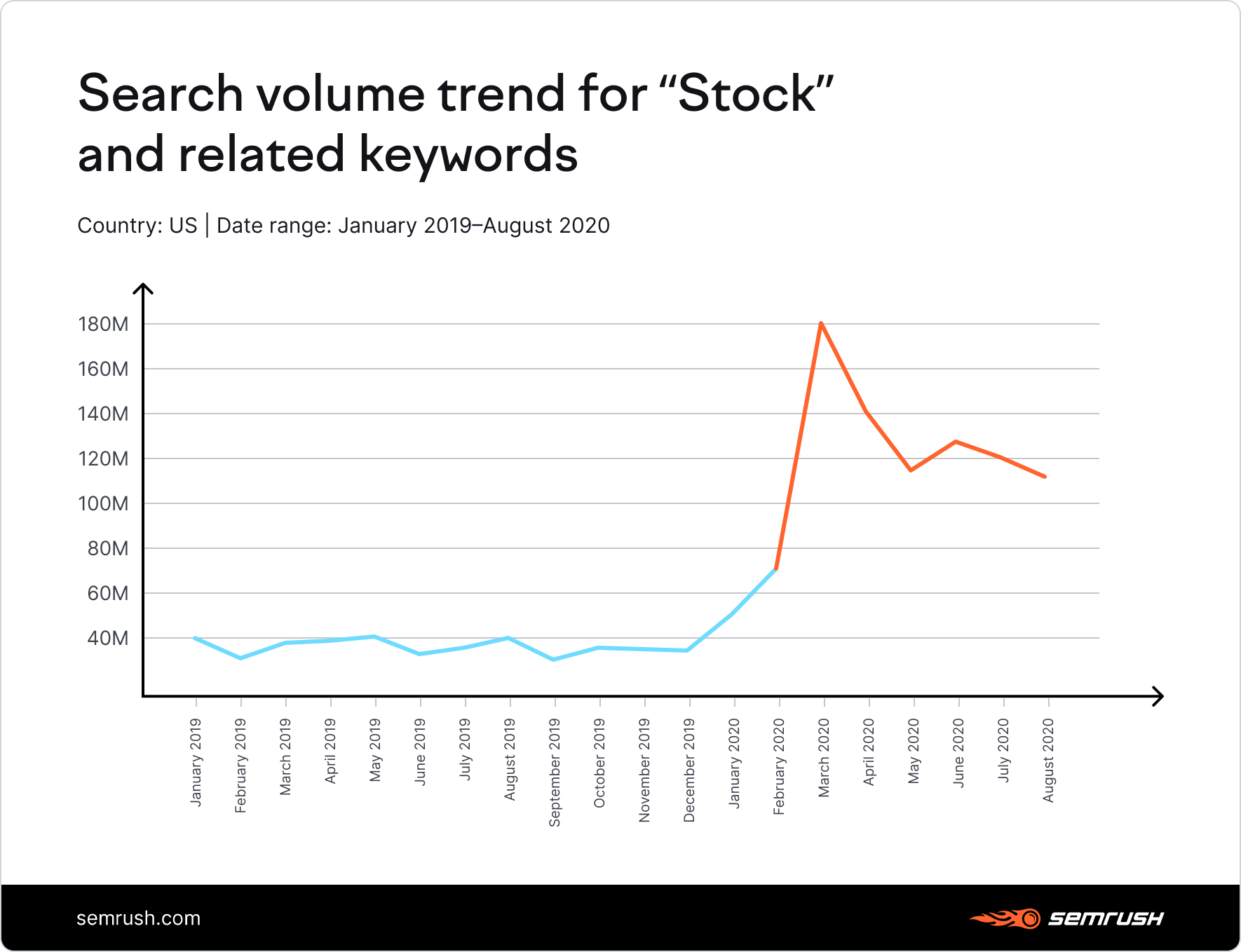

Peaking Interest in Stocks

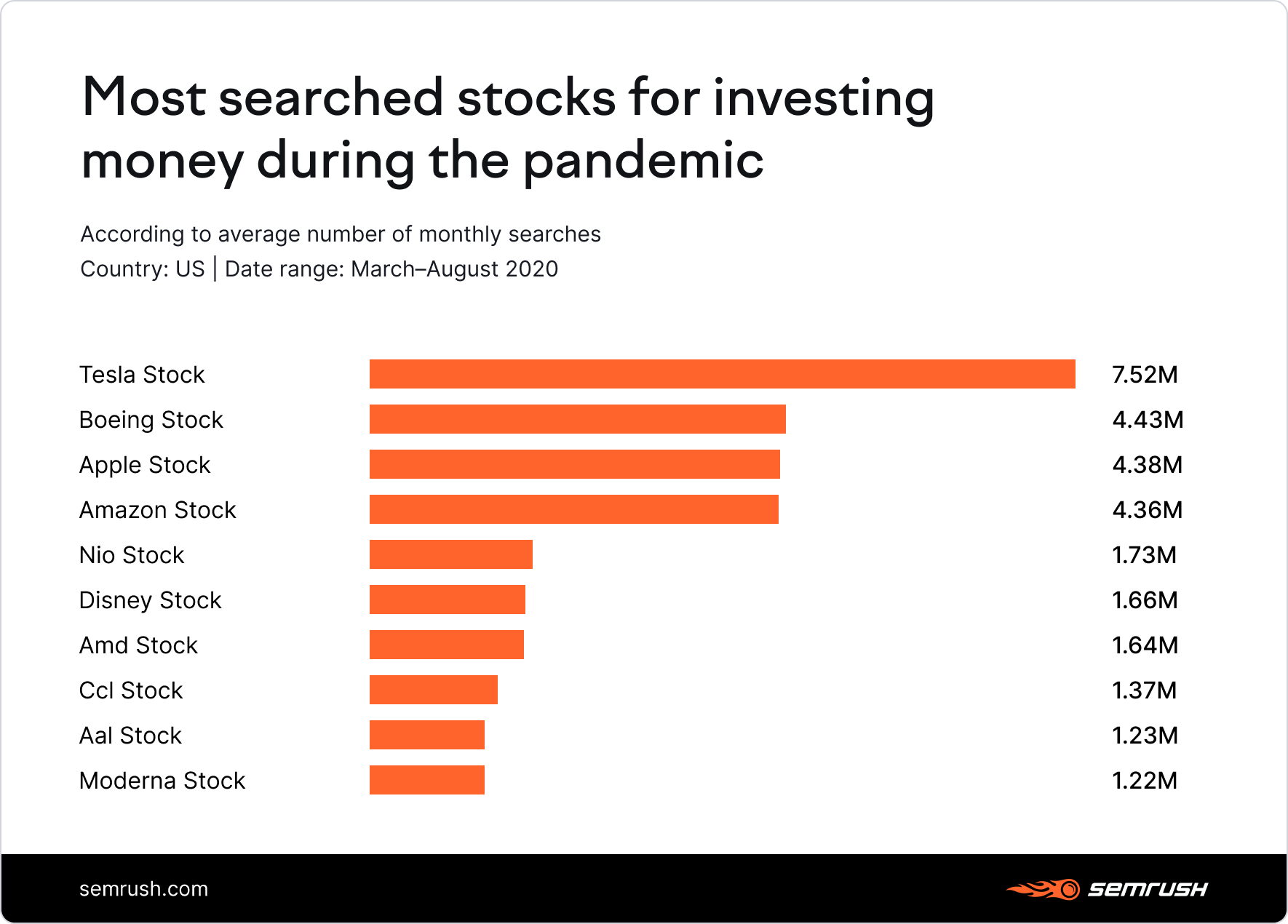

The Coronavirus crisis has given birth to a new generation of first-time investors, and the stock market has been breaking historic highs during the pandemic, with some companies hitting a $1(and even $2) trillion market cap.

While it’s not surprising to see Tesla, Apple, and Amazon among the top 10 most popular stocks for investment, people were also looking into investing in market losers like Boeing and Disney, whose stock prices have dramatically declined.

Vaccine-related pharma companies like Moderna have also sparked attention from users searching for a profitable investment.

It’s Not Just About the Stock Market

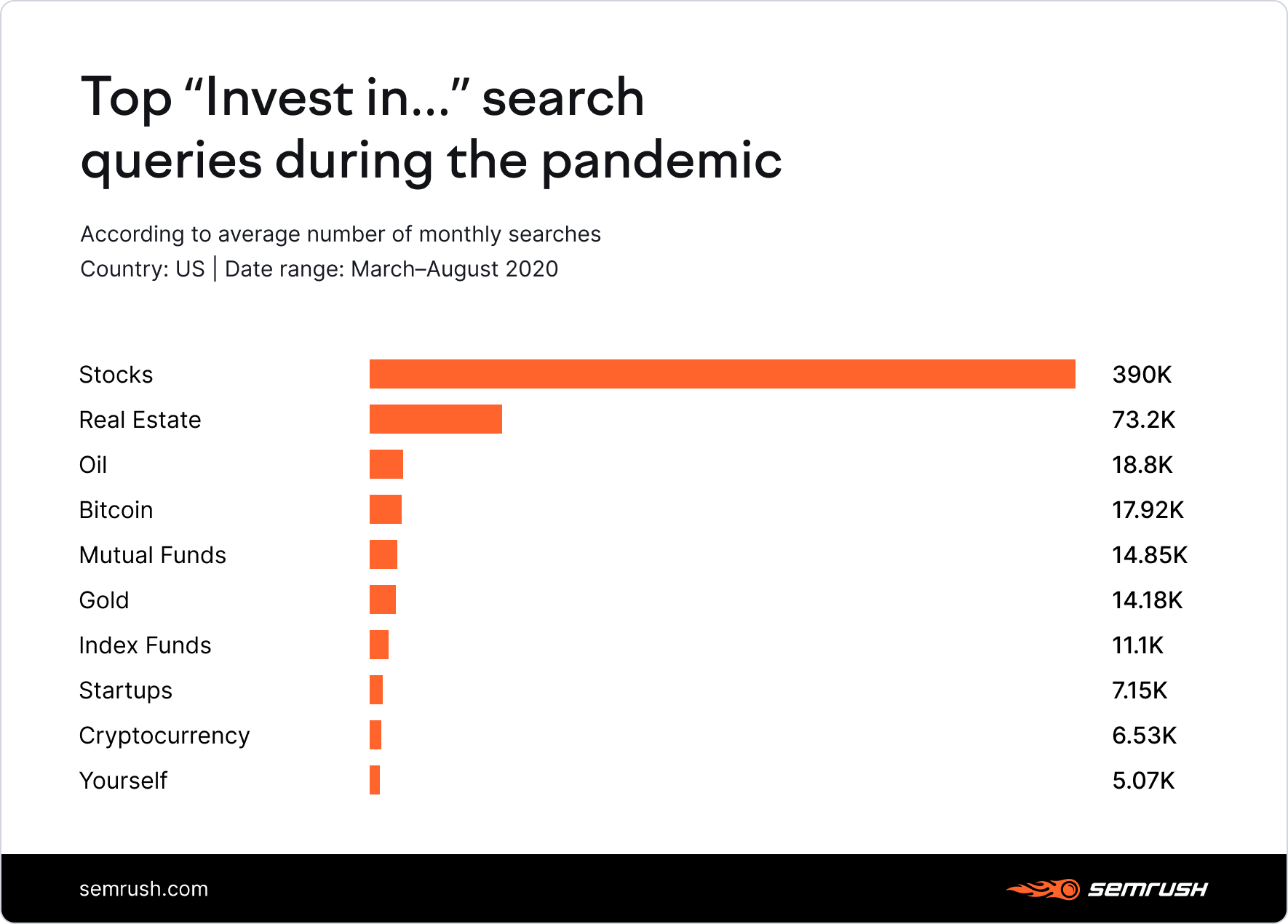

Some consumers might have been cautious about the stock market bonanza, but this doesn’t mean they weren’t looking for investment opportunities.

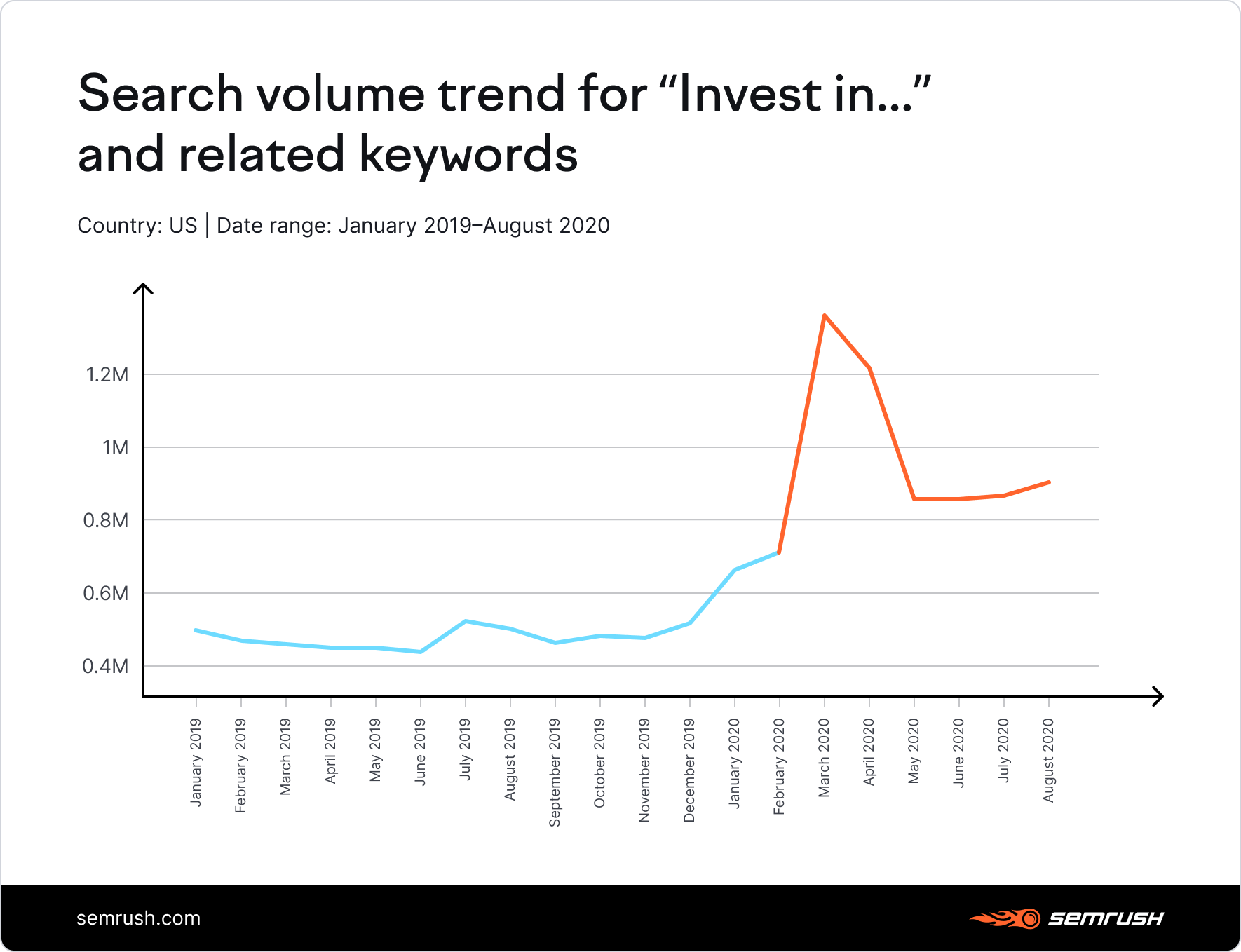

Online searches starting with the query “invest in…” have shown a threefold increase in the midst of the pandemic:

If not stocks, people were also searching for investing in real estate (hence, the housing boom), oil (thanks to the plummeting oil prices), and alternative currency like gold and bitcoin.

Based on these insights, we can start portraying the new face of an American consumer:

Someone who likes to stay within budget and treats personal finance as a long-term financial strategy rather than listening to the good old “higher consumption will save our economy”;

Someone who prefers to make investments that will bring benefit in the long run, with education, stock market, and housing leading the way;

Someone who keeps an eye on the larger market developments and follows the news, be it Government-issued initiatives like stimulus checks and unemployment benefits or news about the new pharmaceutical company working on the Covid-19 vaccine.

Replotting the Post-Pandemic Digital Strategies

Taking into account the upcoming market trends and behavioral patterns of the ‘new consumer’, financial service companies are subjected to a huge digital shift.

The overwhelming proliferation of online technologies - from launching online products to creating winning digital marketing strategies - can be a matter of great distress, but barely a matter of choice for businesses.

Get to know your ‘new’ audience and chase all fluctuations in user behavior, or in other words, customer needs. One of the easy ways to do this is by following the search trends. Before taking a mortgage people are likely to check the rates and the conditions by searching online for it. The decrease in searches for loans can direct you to switch your ad strategy to relocating the budget or offering the products which see an increase in demand, e.g. growing trend for deposits shown in this study.

Constantly explore the competitive landscape within the market as well as the actions of your competitors to see strengths and weaknesses. If you see your competitor’s website traffic is growing, you can deeply analyze the sources of its traffic growth and the reasons behind it. Adapt your online strategy avoiding the worst and implementing the best practices of your competitors.

These 2 simple steps described above can help you succeed in rethinking business, product and marketing strategies, particularly:

Adapting to the ‘new consumer’: Changes in consumer behavior and demand are long-lasting; and they will impact users’ communication channel preferences, product relevance, and companies they trust and choose.

Reinforcing brand loyalty: With more companies moving to digital, market payers should expect stiffer competition and more innovation with customer interaction strategies, user acquisition tactics, and more. Thus, brand loyalty ensuing from building a stronger societal relevance can be the winning feature for businesses operating in the post-pandemic environment.

Growing the audience beyond the core: While adapting to customers who are expecting more individualized offerings, wider product and pricing plans is a challenge, this may be the only way to grow audience size in the market with an increasing number of players and disruptors.

Re-validating business and marketing assumptions: From business model to marketing strategies, long-held assumptions may be subject to reconsideration. Is it smart to offer quick loans? Or should your business expand into trading services and investment advice? Reexamining value and profit drivers is essential to keep playing in the field.

These points will take time to implement, but moving into digital and seeing big wins early is possible. A success story from Argentina's biggest financial service provider, Naranja, is a great example of how an established market player managed to grow online sales from 0 to 70% in the course of three years by implementing a well thought-out digital marketing strategy.

Innovative SEO services

SEO is a patience game; no secret there. We`ll work with you to develop a Search strategy focused on producing increased traffic rankings in as early as 3-months.

A proven Allinclusive. SEO services for measuring, executing, and optimizing for Search Engine success. We say what we do and do what we say.

Our company as Semrush Agency Partner has designed a search engine optimization service that is both ethical and result-driven. We use the latest tools, strategies, and trends to help you move up in the search engines for the right keywords to get noticed by the right audience.

Today, you can schedule a Discovery call with us about your company needs.

Source: