This pandemic-stricken year has reshuffled the cards across pretty much every touchpoint in every industry. From unprecedented stock market highs to bricks-and-mortar lows across the globe, any trend we might have leaned on before to inform our strategies must now be reframed in the context of COVID-19.

In 2020, with people spending more time staying safe at home than anyone could have anticipated, Internet usage gained some remarkable traction:

Overall search traffic grew by a whopping 22% throughout 2020 alone; Average daily time spent on the Internet reached historic highs: 155 mins on mobile, which is over four times the duration spent on desktop (37 mins).In light of this accelerated online usage, we wanted to understand how it affected user demand throughout 2020 and capture what that meant for some of the world’s leading websites.

We turned to our Traffic Rank tool and compared January 2020 to January 2021 in terms of traffic stats for US domains to see which ones grew the most.

Traffic Growth Trends: Which Industries Gained Traction?

A single site’s growth can be influenced by smart marketing tactics and strategy, while overall category growth can imply a more general market trend. So, before we deep-dive into specific websites that gained digital footfall, let’s see which site categories grew the most:

Top 10 Site Categories for Traffic Growth

Category

Average traffic growth

Law & Government

4,300%

People & Society

2,700%

Sports

2,200%

Games

1,400%

Internet & Telecom

680%

Finance

630%

Books & Literature

610%

Arts & Entertainment

610%

Online Communities

570%

Home & Garden

510%

Law & Government sector’s traffic skyrocketed by 4,300%, making it the category with the greatest growth. With everyone’s gaze turned to sites like the CDC or those featuring local COVID-19 updates, this comes as little surprise.

The US Websites with the Greatest Traffic Growth

Now that we have a general understanding of the latest traffic growth trends across the US, let’s look at the specific websites that benefited from this influx of online activity.

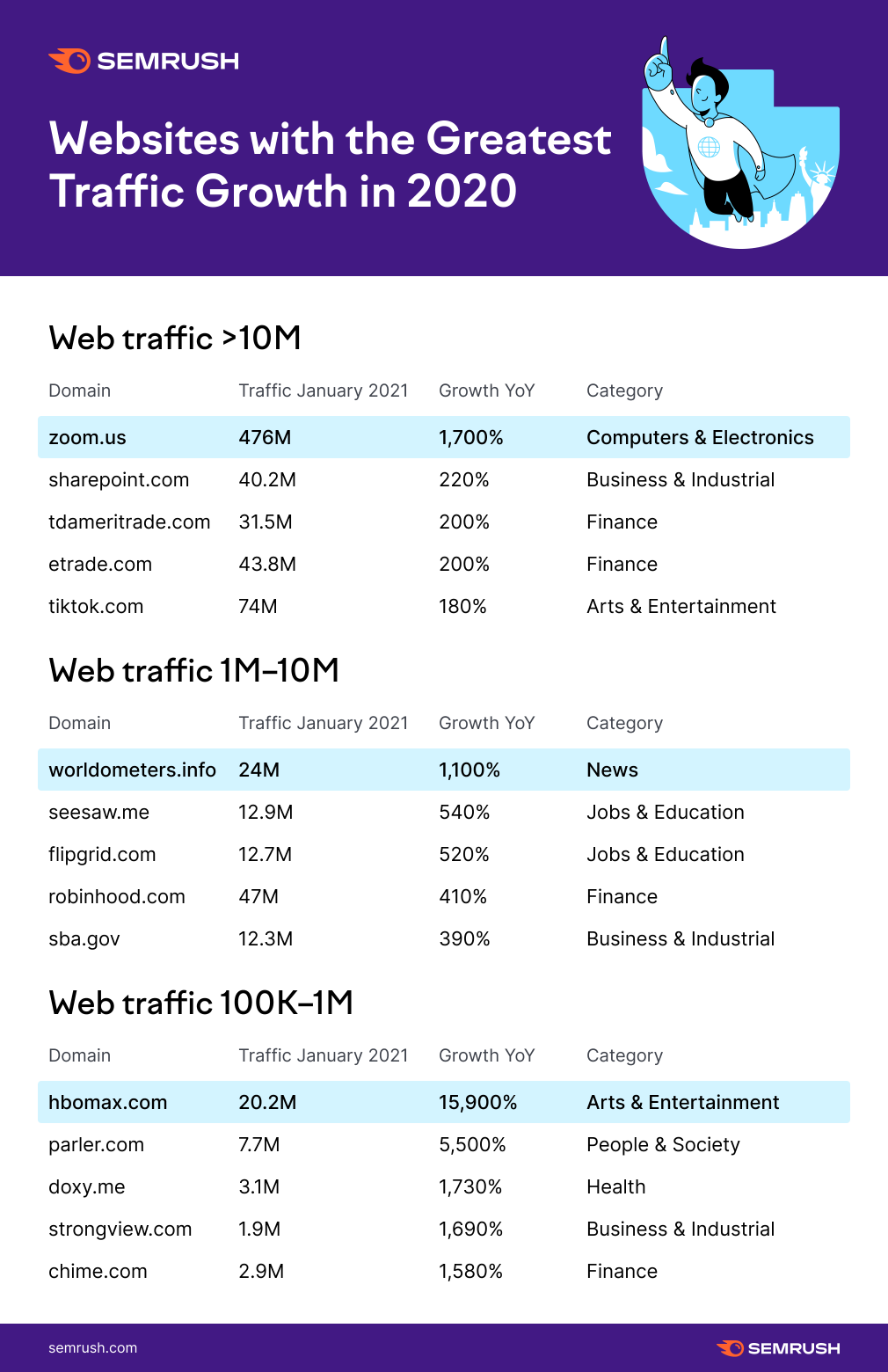

To analyze this fairly, we separated our 500K sample into four categories, breaking them down by the range of their monthly visits – 10M+, 1M-10M, 100K-1M, and fewer than 100K.

Game-Changers Among the Largest US Domains

Top 20 US Websites for Traffic Growth (10M+ Visitors)

Domain

Traffic January

2020

Traffic January

2021

Growth

Category

zoom.us

26.5 M

475.9 M

1,700%

Electronics

sharepoint.com

12.7 M

40.1 M

220%

Business & Industrial

tdameritrade.com

10.5 M

31.5 M

200%

Finance

etrade.com

14.7 M

43.8 M

200%

Finance

tiktok.com

26.4 M

73.9 M

180%

Arts & Entertainmentschoology.com

25.7 M

66.3 M

160%

Jobs & Education

michigan.gov

14 M

35.5 M

150%

Government

roll20.net

11.9 M

29.7 M

150%

Games

coinbase.com

14.9 M

35.6 M

140%

Finance

speedtest.net

10.2 M

24.1 M

140%

Electronics

verizon.com

23.6 M

55.6 M

140%

Telecom

onlyfans.com

42 M

97.2 M

130%

People & Society

manganelo.com

14.9 M

34.2 M

130%

Arts & Entertainmenttwitch.tv

102.2 M

230.7 M

130%

Arts & Entertainmentinstructure.com

89.6 M

201.6 M

130%

Jobs & Education

roblox.com

44.5 M

99.7 M

120%

Games

schwab.com

15.2 M

36.1 M

120%

Finance

slack.com

13.8 M

30.8 M

120%

Electronics

op.gg

11.3 M

24.4 M

120%

Games

doordash.com

24.8 M

52.8 M

110%

Food & Drink

Within the top 10 US sites with large visitor counts, remote teamwork and student software—clearly, a pandemic-inspired growth—experienced the largest spike:

The video conferencing service, Zoom, grew the most, with an astonishing traffic increase of almost 1,700%; As schools and colleges were largely closed, distance learning software was also on the rise: Schoology and Instructure more than doubled their visitor counts with 160% and 130% increases respectively.The economic uncertainty and generous relief packages that resulted in what CNN called a stock "market mania” made their mark in the top 20 as well. Large online trading sites like TD Ameritrade and eTrade grew their online user bases by 200%. Thanks to a sudden revival of Bitcoin, Coinbase (+140%) also received an extra share of visitors.

With the gaming category experiencing the fourth-greatest growth in traffic, Roll20 and Roblox more than doubled their traffic share throughout 2020.

US Traffic Winners Across 1M-10M-Visitor Domains

Top 20 US Websites for Traffic Growth (1M-10M Visitors)

Domain

Traffic

January 2020

Traffic January 2021

Growth

Category

worldometers.info

1.9 M

23.9 M

1,100%

News

seesaw.me

2 M

12.9 M

540%

Jobs & Education

flipgrid.com

2 M

12.6 M

520%

Jobs & Education

robinhood.com

9.1 M

46 M

410%

Finance

sba.gov

2.5 M

12.3 M

390%

Business & Industrial

chess.com

8.2 M

34.6 M

320%

Games

u.gg

2.6 M

10.2 M

300%

Games

webex.com

9.1 M

33.4 M

270%

Internet & Telecom

tradingview.com

6 M

22 M

270%

Finance

nj.gov

3.6 M

12.9 M

250%

Government

ameritrade.com

9.1 M

31.8 M

250%

Finance

fbdown.net

7 M

23.8 M

240%

Online Communities

wallst.com

3.9 M

12.7 M

220%

Finance

citizensbankonline.com

3.9 M

12.8 M

220%

Finance

myschoolapp.com

3.6 M

10.9 M

200%

Jobs & Education

deviantart.com

5.2 M

15.5 M

190%

Arts & Entertainmentmangadex.org

7.4 M

21.8 M

190%

Arts & Entertainmentpearson.com

7.4 M

21.5 M

190%

Jobs & Education

nearpod.com

4.5 M

13 M

190%

Education

state.mi.us

6.3 M

18 M

190%

Government

Within the upper-middle domains, we see nearly identical trends to the previous category:

Since most of the news throughout this pandemic has concerned COVID-related data and stats, it’s little surprise to see real-time tracking site, Worldometer, grow the most within this category. E-learning software apps — Seesaw (+540%), Flipgrid (+520%), MySchoolApp (+200%), and Pearson (+190%) — saw the greatest influx of visitors of all categories. One more trend we saw is that more websites were giving out official COVID-related updates: Small Business Association’s site attracted four times more traffic, and New Jersey’s official local site tripled its visitor count.The most notorious site across the mid-range category is probably Robinhood, the stock trading app, whose YoY traffic within the US grew by 410% throughout 2020.

Traffic Growth for Mid-Range Websites in the US

Top 20 US Websites for Traffic Growth (100K-1M Visitors)

Domain

Traffic

January 2020

Traffic

January 2021

GrowthCategory

hbomax.com

126 K

20.2 M

15,900%

Arts & Entertainmentparler.com

137 K

7.7 M

5,500%

People & Society

doxy.me

174 K

3.1 M

1,730%

Health

strongview.com

106 K

1.9 M

1,690%

Business & Industrial

chime.com

177 K

2.9 M

1,580%

Finance

facepunch.com

197 K

3.3 M

1,580%

Games

dogecoin.com

113 K

1.8 M

1,570%

Finance

sweepswinner.com

169 K

2.6 M

1,490%

Hobbies & Leisure

webull.com

467 K

7.1 M

1,430%

News

soap2day.to

396 K

6 M

1,430%

Arts & Entertainment10faq.com

828 K

12.3 M

1,390%

Health

numpy.org

124 K

1.8 M

1,370%

Computers & Electronics

iqair.com

188 K

2.6 M

1,290%

People & Society

nowinstock.net

167 K

2.1 M

1,210%

Computers & Electronics

profootballnetwork.com

153 K

1.7 M

1,030%

Sports

bbcollab.com

155 K

1.7 M

1,030%

Jobs & Education

upstore.net

573 K

6.1 M

970%

Telecom

gemini.com

357 K

3.7 M

950%

Finance

azdhs.gov

481 K

5 M

950%

Health

mihoyo.com

275 K

2.8 M

950%

Games

While streaming services were experiencing impressive spikes in their online audiences, HBO Max experienced the most growth. HBO’s move to launch the service early on in the pandemic was rewarded with an impressive traffic jump of almost 15,900%.

The site with the second-most growth within this mid-range category was Parler, a service that achieved infamy in the midst of Donald Trump’s ban from Twitter. Despite Parler’s temporary service suspension, the platform had 5,500% more YoY visitors.

Another sector that received an influx of online users is telemedicine. Doxy.me (+1,720%) made it to the top three websites with the greatest growth in this category.

Smaller US Websites with the Highest Growth Rates

Top 20 US Websites for Traffic Growth (Fewer than 100K Visitors)

Domain

Traffic

January 2020

Traffic

January 2021

GrowthCategory

my2020census.gov

347

1.2 M

363,500%

People & Society

oklahoma.gov

613

1.6 M

263,100%

Government

discord.com

32 K

72 M

226,300%

Games

nbatopshot.com

877

1.7 M

201,000%

Sports

eztv.re

3 K

1.5 M

59,900%

Arts & Entertainmentmeetdapper.com

4 K

1.6 M

42,900%

Finance

educonnector.io

4 K

1.3 M

37,100%

Jobs & Education

0123movie.net

9 K

2.8 M

30,900%

Arts & Entertainmentsafelyonline.tech

6 K

1.6 M

26,600%

Internet & Telecom

internalfb.com

13 K

2.2 M

16,500%

Internet & Telecom

rh.com

7 K

913 K

13,100%

Home & Garden

mobiletracking.ru

26 K

3.4 M

12,900%

Internet & Telecom

bookshop.org

9 K

1.1 M

12,400%

Books & Literature

w2g.tv

10 K

1.2 M

12,100%

Arts & Entertainmenteinthusan.tv

11 K

1.1 M

10,200%

Online Communities

crackstreams.net

28 K

2.5 M

9,000%

Arts & Entertainmentonline.church

7 K

569 K

8,000%

People & Society

zinzino.com

6 K

506 K

7,600%

Health

hopin.com

7 K

466 K

6,300%

Electronics

getgov2go.com

10 K

596 K

5,700%

Government

If we look at the growth dynamics of sites that had fewer than 100K monthly visits back in January 2020, we get a few peculiar sites within the top 20:

Within the lowest traffic category, we spotted a lot of illegal streaming activity, with traffic increasing to sites like 0123movie (+30,900%) and torrent-based EZTV (+59,900%). In the course of only one year, these sites’ visitor bases grew from thousands to millions.With a lot of religious establishments being shut throughout 2020, sites like online.church saw 8,000% more visitors.Over to you

We’ve touched upon the grand changes that took place within the post-pandemic search landscape in the US.

If you’ve been following our studies and general news, the key trends won’t come as much of a surprise, but it’s useful to see them in the context of yearly changes so you can dig deeper into traffic generation strategies and see if there is anything you can learn for your own strategies.

For more granular insights that reveal the growth dynamics within your market and competitive landscape, you can turn to Semrush .Trends — a platform designed to facilitate your market research and competitor analysis efforts:

You can uncover market trends and shifts in the key market players’ growth dynamics with the help of the Market Explorer tool. Once you spot which competitor is causing the biggest threats to your traffic growth, you can deep-dive into their traffic acquisition strategies and tactics with insights from the Traffic Analytics tool.

Innovative SEO services

SEO is a patience game; no secret there. We`ll work with you to develop a Search strategy focused on producing increased traffic rankings in as early as 3-months.

A proven Allinclusive. SEO services for measuring, executing, and optimizing for Search Engine success. We say what we do and do what we say.

Our company as Semrush Agency Partner has designed a search engine optimization service that is both ethical and result-driven. We use the latest tools, strategies, and trends to help you move up in the search engines for the right keywords to get noticed by the right audience.

Today, you can schedule a Discovery call with us about your company needs.

Source:

![Traffic Growth Rankings for US Websites [Study]](https://new.allinclusive.agency/uploads/images/traffic-growth-rankings-for-us-websites-study.svg)